Why Your ESG Peer Benchmarking Group is Different than Your Competitive Peer Set. And Why You Need Both.

Many IROs feel their ESG ratings would be higher if they were based on their competitive peer set rather than the benchmarking group used by the ratings agencies. After all, companies are used to picking peers for valuation reasons or as part of the executive compensation table graph. And these lists are often customized to make a specific case, maybe how undervalued the company is, or how its compensation practices fall in the middle of its peers.

While cherry-picking for these purposes is perfectly acceptable, it cannot be done for ESG ratings. The ratings agencies base your company’s benchmarking group on your GICS code. And for better or worse, that code can’t be changed, at least not without making significant alterations to your business.

ESG ratings peer groups – a necessary starting point.

If you are doing internal benchmarking specifically with the goal of improving your ratings, it’s important to look at the peers in your GICS code. However, there are several pitfalls to this approach.

On one hand, you could end up with a false sense emergency if your peers are big players with large budgets and extensive corporate buy-in. On the other hand, you could develop a false sense of security if your group is made up of organizations that are much smaller than you or if it includes many laggards. It’s important to keep in mind that many companies are moving fast on improving ESG disclosures because of board or investor pressure. Even if peers’ scores are lower than yours today, they might not be for long.

For ratings purposes, try to concentrate specifically on your like-sized GICS-code peers with the highest ratings. Emulating the best practices of this subgroup will likely have the greatest impact on your scores.

How to make internal benchmarking more meaningful.

When it comes to ESG disclosure, handpicked peers can still serve as a valuable benchmark for aspirational and best practice purposes, especially if you identify peers by material ESG topic area. When you benchmark against companies who have the same ESG priorities as you do (because they matter to your shareholders or because they are closely tied to either success or risk in your business model), then your internal benchmarking efforts will deliver much more useful information. In this case, you want to look beyond specific ratings to uncover disclosure trends and practices that are becoming the standard within your group.

Some questions to ask of this group include:

- What frameworks do the majority of these materiality-based peers use? Often times, this comes down to industry. Retailers, for example, tend to favor GRI. Companies of all types, however, are rapidly adopting environmental frameworks. If many of your peers are already aligned with TCFD, and you have not yet taken that step, you may need to act quickly, especially given the forthcoming disclosure rules expected from the SEC by year end.

- Do these peers set E or S targets, or both? Often companies will do great in one area but not the other. Take best practices from leaders in both areas to ensure all bases are covered.

- How are these peers disclosing information? Websites, Corporate Social Responsibility/Sustainability Reports, proxy statements, and 10K expanded disclosures are all common vehicles. It’s worthwhile seeing which materials your peers are using most.

- Who is heading up ESG initiatives? Some companies will have a head a sustainability, a steering committee, or a named individual in charge of the effort. How does this compare with how your organization is handling or dividing up the work?

Be sure to leverage the flexibility of SASB.

When it comes to disclosure practices, perhaps no other reporting framework offers as much flexibility as SASB. The SASB framework is unique in its focus on industry-based standards. Even more unique is the fact that companies are free to choose, and report aligned with, the industries and reporting requirements they feel fit their companies best. This makes it possible to customize a peer group for external benchmarking purposes.

One company that does this well is ITT. In its 2019 Sustainability report, ITT reported under two SASB standards: Industrial Machinery and Auto Parts. The company includes the metrics within those two standards that it found applicable to its business and for which it tracks data, and ITT noted that it will include more data in the future when it becomes available.

Another example is PayPal Holdings. PayPal’s SASB Index maps disclosures from its 2020 Global Impact Report to the SASB framework to disclose information on relevant key topics from the Software & IT Services and Consumer Finance industry standards. The company’s index consists of a greater number of metrics from the Software & IT Services standard, with PayPal only disclosing four metrics for the Consumer Finance standards, illustrating the extreme flexibility of the framework and how it can help a company voluntarily report on issues that it finds most pertinent.

Keep your focus on frameworks and metrics rather than point-to-point comparisons with peers.

While you can’t do anything to alter your ESG Peer Benchmarking Group for ratings purposes, you can and should use a variety of both preestablished and handpicked peer groups to improve your overall ESG efforts. However, instead of direct comparisons, be prepared to discuss your roadmap to better disclosure best practices, especially as it relates to your industry and to companies that identify with similar material ESG topics. This will ensure your messages resonate better with your stakeholders. And as your disclosures improve, your ratings will likely follow suit.

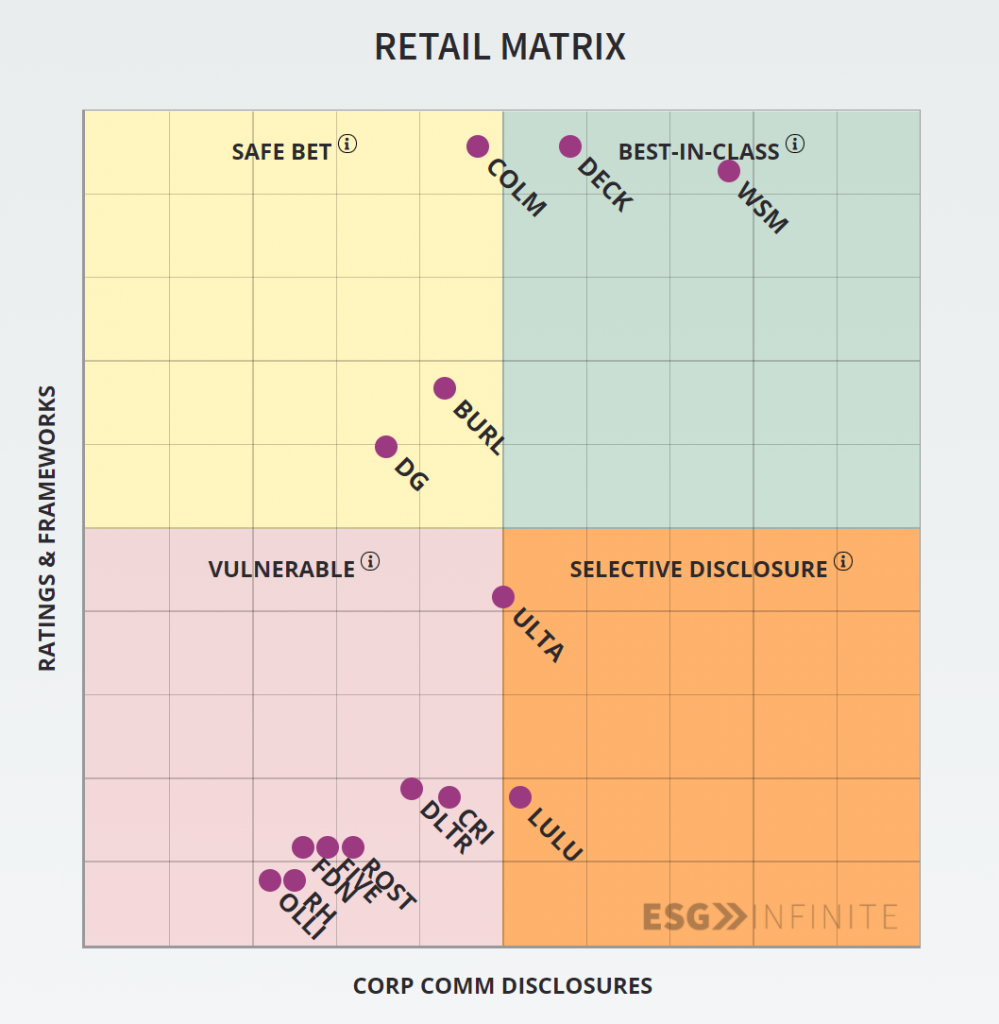

Let the ESG Infinite Matrix do the benchmarking for you.

With ESG Infinite, you can choose your peers and see how your ESG disclosures compare to the companies within your GICS-code and the additional companies whose websites you view frequently. Then, let ESG Infinite do the research for you – all of your peers’ ESG disclosures are in one centralized location. By using the data behind each company, you can answer the essential benchmarking questions listed above. If you are interested in learning more about how ESG Infinite can guide your ESG strategy, contact us today.