Why Required Climate Disclosures Are Still Not Here (Newsletter 2/11/22)

Sign up for The Infinite Minute to receive the top news impacting corporate ESG reporting.

Regulatory News

SEC Delays Climate Rule, Again

According to Bloomberg, the timeline for climate-related disclosure mandates has shifted to March or later (previously February). The leading cause for yet another setback is based on the amount of information the agency can require companies to share without losing a legal battle from the opposition. SEC Chair Gary Gensler warned the staff that materiality must uphold to the Supreme Court’s interpretation of the term for the climate proposal to go through. In turn, it’s likely companies would not need to report Scope 3 greenhouse gas (GHG) emissions – which many corporations have argued are not part of their primary business operations. A second point under consideration is whether auditors should be held accountable for reviewing the disclosures, as done with financial statements.

Investor Updates

BlackRock Leans into the Net Zero Transition

In a letter sent to clients, BlackRock outlined the investment strategies and tools it is developing to aid clients in the transition to net zero. For starters, BlackRock will utilize Aladdin, its risk management system, to create a map of the probable unfolding of the transition across different regions, technologies, and sectors. Additionally, the institutional giant has plans to develop the BlackRock Transition Scenario, which would enable clients and portfolio managers to use analytical and modeling tools to guide them through the transition. Finally, BlackRock has committed to continue developing additional strategies that facilitate the greening of portfolios.

New York Pension Fund to Divest Oil and Gas Holdings

New York’s state pension fund will divest more than $238 million in shares and bonds of oil and gas companies following an internal review that determined these companies failed to demonstrate viable net zero transition plans. Some of the companies being dropped by the fund include Pioneer Natural Resources Co., Hess Corp., and Diamondback Energy. Despite oil and gas’s recent outperformance, the fund sees long-term risks for investors in the space, stating that “the shale oil and gas industry faces numerous obstacles going forward that pose risks to its financial performance.” The fund divested from 10 firms, all of which were in the oil and gas sector.

UN PRI Highlights Equity & Inclusion as Key Action Areas for Investors

The UN PRI has released a new paper on the importance of championing equity and inclusion alongside diversity. The presence of diverse employees is not enough, the paper argues, and efforts to improve equity and inclusion are necessary for ensuring equal opportunities and outcomes for employees and applicants. Investors can benefit from improved DEI practices through reduced exposure to legal and reputational risk, increased innovation, and reduced turnover. The paper proposes a variety of ways investors can promote DEI, such as screening investments for DEI performance and engaging with companies and regulators on company practices and disclosures.

ESG Ratings & Reporting

Glass Lewis Launches ESG Scores for Investor Engagement and Voting

Glass Lewis announced new ESG scores and data in proxy voting reports. The “ESG Profile” will cover roughly 1,800 global, large-cap companies during the 2022 proxy season, applying only to U.S. S&P 500 companies this year. The ESG Profile and the scores and data will provide investors with an evaluation of companies’ ESG policies, performance, and disclosures close to the company’s annual general meeting date to provide investors with timely insights ahead of proxy voting. The score summary includes a Board Accountability Score, an ESG Transparency Score, an ESG Targets and Alignments Score, and, for certain companies, a Climate Risk Mitigation Score. Covered public companies will have the opportunity to verify their ESG data through Glass Lewis’ Issuer Data Report program.

Science Based Targets Under Scrutiny for Potential Conflicts of Interest

The Science Based Targets initiative (SBTi) has come under fire for its use of fees and the potential conflicts of interest that they may create. The fees range from $1,000 for SMEs net zero target submissions to $14,500 for larger companies to package both near-term targets and net zero targets for first-time submissions. Previously, SBTi has stated the fees are priced to be accessible for all companies interested in setting net zero targets. Critics argue that forcing companies to pay to be assessed combined with the lack of third-party verification could give SBTi too much power over companies’ scores. In response to the criticism, SBTi is creating a technical board to review standard setting practices and ensure independence in the scoring process.

VRF Gives Boards a Guide to Address ESG

The Value Reporting Foundation, which acquired SASB, released a Directors’ Guide to the SASB Standards, providing boardrooms with industry-level guidance to enhance their discussions with management teams. Under each industry, the guide offers questions to better assess risks, improve strategic planning, and prepare for shareholder engagement. For example, a few questions for the Software & IT Services industry are as follows:

- How does the company integrate environmental considerations into its strategic planning for data centers?

- How does the company respond to requests for customer information from governments or law enforcement?

- What is the company’s exposure to labor shortages from having a lack of access to qualified technical STEM candidates?

Companies Feeling the Heat

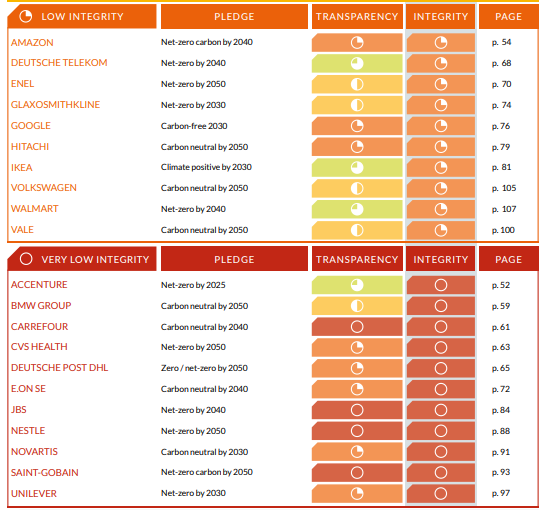

Controversy over Net Zero Plans by World’s Largest Companies

A recent report by the NGOs Carbon Market Watch and the New Climate Institute calls into question the integrity of net zero plans from some of the largest companies in the world, including Accenture and Unilever, among others. Significantly, the report showcases the complexity behind emissions reductions targets, as 18 of the 25 corporate plans analyzed have backing from the Science Based Target initiative, the gold standard for target setting. Despite these stamps of approval, by the report’s review, 21 of the 25 companies assessed have reduction plans with low or very low integrity, calling to attention differences in methodology and potential loopholes in certification processes.

Company Spotlight

Salesforce Adds ESG Measures to Executive Compensation

Salesforce announced it is including ESG goals as part of its executive compensation programs, and a portion of pay for the Executive Vice President level and above will be determined by ESG measures. This year, the indicators are centered around equality – increasing representation of gender and ethnically diverse employees globally, and sustainability – reducing air travel emissions and spending more with suppliers that have signed a contract to reduce their carbon footprint.

More to Know…

While net zero targets seem to be ubiquitous, most companies have not set reduction targets.

The 2022 proxy season is ripe for activism, especially for these ESG topics.

Duke Energy plans to exit coal by 2035 and set Scope 2 and some Scope 3 emissions targets.

News Bites