Why Board Oversight Matters (Newsletter 7/1)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

JPMorgan Buys ESG Investment Startup

This week, JPMorgan entered into an agreement to acquire OpenInvest, which allows financial advisors to build, manage, and report on customized ESG portfolios. The demand comes from clients’ desire to understand the ESG impact of their portfolios, and to better align with ESG goals.

Nasdaq Launches ESG Data Screening Tool

Nasdaq announced the launch of its ESG Data Hub. This is a tool for institutional investors to screen ESG data sets across a wide spectrum of areas, including gender diversity, carbon emissions, and climate risk. If companies do not disclose this information, they will be screened out by users.

BNP Paribas Creates New Low Carbon ETF

The new ETF, BNP Paribas Easy Low Carbon 300 World PAB UCITS ETF, gives investors equity exposure to global companies that have been chosen and weighted to gain compliance with the Paris Agreement climate change goals and tracks the Euronext Low Carbon 300 World PAB NTR Index.

Regulatory Updates

EU Climate Law Adopted

The EU Council adopted a climate law, setting carbon neutrality by 2050 into legislation. As part of the European Green Deal, the new law sets a target to reduce greenhouse gas emissions in the EU 55% by 2030 from a 1990 baseline. The law places a cap on carbon capture reliance, emphasizing the goal of reducing emissions through initiatives, such as renewable energy, efficient electricity, cleaner transportation, greener farming, circular economy, protecting ecosystems, and investing in innovation and research.

SEC Encourages Board Oversight of ESG

In a speech at the Society for Corporate Governance National Conference, Commissioner Allison Herren Lee discussed the importance of board oversight of ESG issues. Citing investor support this proxy season for environmental and social proposals, and the impact ESG has on investment decision making at the largest funds, Lee said it is increasingly clear boards need to step up. She called out TCFD’s request for disclosure of board oversight on climate-related risks and opportunities, ISS’ and Glass Lewis’ voting policies that attribute ESG governance failures to directors, and BlackRock and State Street CEO statements on ESG accountability at the Board level. Her three recommendations for companies are to enhance board diversity, increase board expertise on climate and ESG risks, and inspire management success through executive compensation.

Proxy Season Briefing

Microsoft Under Fire for Reusability

The tech giant is facing a shareholder proposal filed by As You Sow for its failure to support device repairability, which ultimately seems to undermine the company’s sustainability commitments. However, according to an article by The Wall Street Journal on the push to repair and reuse hardware, Microsoft is actively working to improve the repairability of its devices. This comes as Apple has started to promote the repair of products out-of-warranty by equipping independent repair businesses with parts, tools, training, and guidelines needed to fix devices and extend lifetime.

Kroger Plastic Pollution Resolution Fails to Achieve Majority Support

A shareholder proposal requesting Kroger create a report on the estimated amount of plastics discharged into the environment received 45% of support, falling short of the majority necessary for the approval of the resolution. According to Proxy Insight, proposals with similar requests won 81.2% and 35.5% support at DuPont de Nemours and Amazon, respectively.

Constellation Shareholders Request Board Diversity Policy

A shareholder resolution filed by the New York City Employees’ Retirement System, New York City Teachers’ Retirement System, and the Board of Education Retirement System requests Constellation adopt a board diversity policy for its external hires, where qualified female and racially/ethnically diverse candidates are to be included in the initial slate of candidates for roles including external directors or CEOs.

Company Spotlight

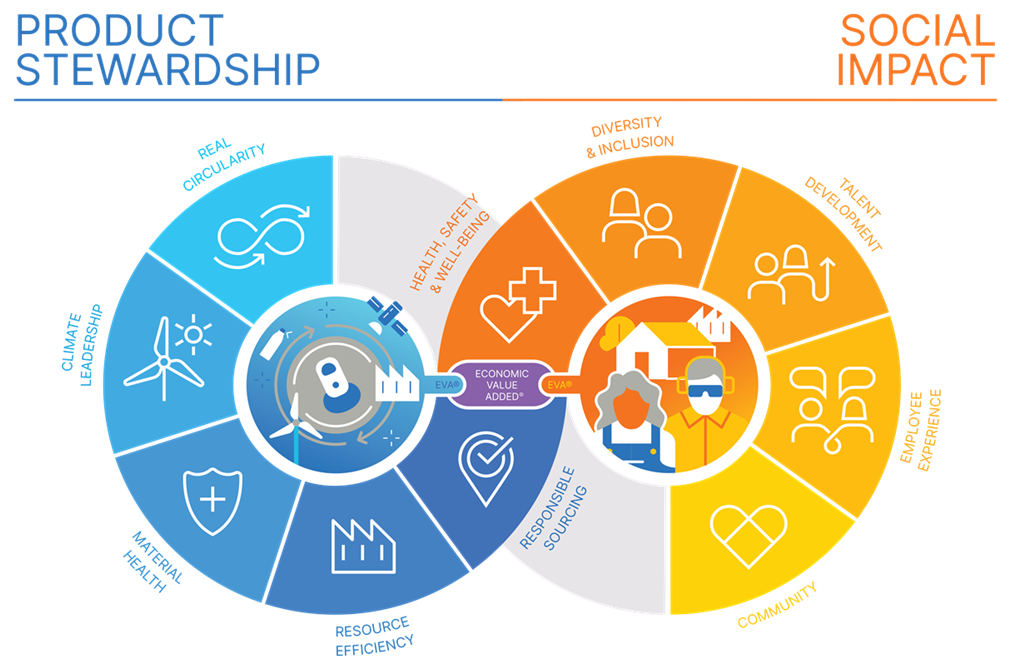

Ball Corporation Announces Sustainability Goals

Ball Corporation released its 2030 Sustainability Goals, with the overarching foci being product stewardship and social impact, as shown in the sustainability visual which can be leveraged across the company’s corporate and investor communications materials. Each topic is tied to one or more applicable UN SDGs. Specific goals shared by Ball Corporation include:

- Decreasing absolute Scope 1 and 2 GHG emissions 55% and absolute Scope 3 emissions 16% from 2017 levels by 2030, which are science-based targets

- Achieving 100% renewable electricity internationally by 2030, with an interim target of 75% by 2025

- In Beverage Packaging North & Central America, expanding female representation from 10% to 18% by 2025 and increasing racial/ethnic diversity from 18% to 28% by 2025

Additionally, Ball released Towards a Perfect Circle, its vision for a circular economy.

How to Weave ESG into Your Investment Proposition

Many companies believe they are effectively telling an ESG story and conveying an enterprise-wide “commitment” to ESG because they have an ESG slide in their pitch deck. You know the one, it has those pretty green leaf icons and it is buried somewhere in the appendix. The problem with this approach – which can be found in the overwhelming majority of investor-facing presentations – is that it positions ESG as a standalone issue. This is a major disservice to a topic that investors increasingly care about.

A 2020 CFA Institute Survey found that 85% of investors consider some form of ESG factors in their investment evaluation process. According to the survey respondents, the main reason for factoring in ESG is to reduce investment risk. And, it’s working. A Morningstar analysis found that three out of four sustainable funds outperformed their peer benchmarks in 2020.

But, if you struggle with how to integrate the concept into your overall narrative, our 12-question framework can help. Fit ESG into your investment proposition by making it front and center in your internal strategy discussions. This can be achieved simply by asking the right questions when designing a communication strategy. While each company has a unique story to tell, the six main building blocks of those stories are rather universal, and each offers an opportunity to give ESG a starring role in your narrative. You can thread ESG into all the key facets of your investment proposition by talking through the following 12 questions and using them to supplement your existing narrative. Continue reading the article here.

News Bites

- SEC: Comments on Climate Change Disclosures

- Twilio, Asana to List on Long-Term Stock Exchange as ESG Push Continues

- Investor protests at US executive pay hit record high

- Companies Spend Big on ESG Investments, Hoping for Long-Term Payoff

- Investors Urge Hannaford Supermarkets to Protect Dairy Workers in its Supply Chain

- CFOs must show ambition in sustainable ESG goals amid SFDR