Why Are CEOs Not Concerned About Setting Net Zero Targets? (Newsletter 10/1)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Regulatory News

SEC Proposes Changes to How Funds Disclose Proxy Voting

The SEC proposed new rules aiming to change how funds disclose proxy voting. Asset managers may be required to use standardized language and categories to help investors identify issues in proxy votes and compare voting patterns across funds. The new categories cover emissions, diversity, equity, and inclusion (DEI), share buybacks, and other items. Additionally, the proposed rulings would require more disclosure on securities lending by funds, which restricts the funds’ ability to cast votes on those companies at the annual meeting.

Investor Updates

Invesco Builds Its ESG Team

Invesco, the second-largest provider of ESG ETFs in the U.S. and a key provider of ESG mutual funds, has made 8 new ESG hires across the U.S., London, and Hong Kong. Invesco says it reviews the potential impacts of environmental, social, and governance issues to the performance of every investment, and it intends to have all teams be fully integrated by the end of 2023. As of June 30, 2021, Invesco has $52.7 billion ESG AUM and recently joined the Net Zero Asset Managers initiative.

JPMorgan to Cut Emissions in Lending Portfolios

JPMorgan pledged to reduce operational carbon intensity (the carbon in emissions from industrial activity) by 35% for its oil and gas portfolio by 2030. Similar targets were set for energy and manufacturing portfolios. Marisa Buchanan, Global Head of Sustainability, said the bank may adjust the financing provided to companies depending on if it believes companies are on the right path towards reducing emissions.

Movement Away from Fossil Fuels Expands

Harvard’s announcement a few weeks back that it would fully divest from fossil fuels, including in its indirect investments, is followed by divestment decisions from both MacArthur Foundation and Boston University. The MacArthur Foundation, with assets totaling $8.2 billion, announced plans to change its equity indexes to indexes that exclude companies with fossil fuel reserves. This builds upon a previous commitment to stop new investment in private funds investing in oil and gas exploration. Boston University, which has an over $3 billion endowment, has committed to divesting from direct investments in oil and natural gas extraction companies and will work toward phasing out indirect investments in fossil fuels.

Climate Change ETFs Sabotaging Climate Efforts

An academic study from Edhec, a French business school, found that by frequently participating in greenwashing, climate-related investment funds are sabotaging climate efforts. ETFS that track “climate change”, “Paris-aligned”, or “low carbon” indices do not allocate much of their money to the greenest companies and tend to raise the weighting of companies with declining environmental performance. This misalignment between ETFs’ marketing and their impact can be at least partially attributed to the fact that climate data drives at most 12% of a stock’s weight in an ETF, while the rest is determined by market capitalization. Most notably, these ETFs are problematic because they redirect funding that could be going to sectors most essential to a cleaner economy.

Company Spotlight

Are Net Zero Pledges Agreed to Because They Aren’t Even Next Management’s Problem?

Net zero targets are often created with long deadlines that allow companies time to put new processes in place and gradually adjust their technologies and programs. However, research done by Lex, a financial commentary service of the Financial Times, suggests that executives may be agreeing to targets with long deadlines because they will not be in charge of the company when the deadline arrives. In fact, this research shows that for most businesses a minimum of four chief executives may manage the company before the net zero deadline occurs. According to the article, companies in highly polluting industries such as oil, cement, and aviation have adopted net zero by 2050, an easier target, while businesses with lower carbon footprints may set bolder, more near-term targets. The below graphic illustrates the number of CEOs that might hold the title before a company’s net zero target year is reached, depending on the length of past CEO stints.

Laying Out an ESG Roadmap

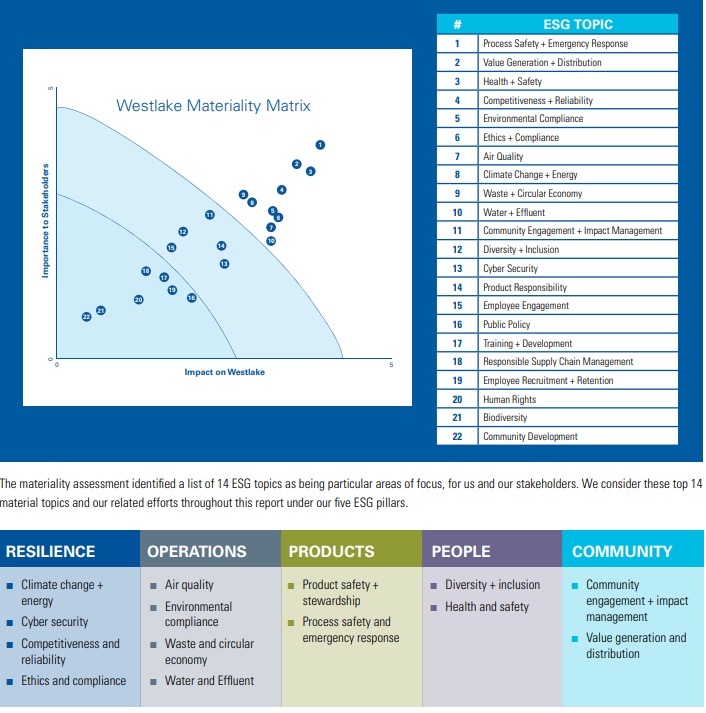

Westlake’s 2020 ESG Report shared the results of the chemical company’s first materiality assessment, which identified 14 ESG topics to prioritize that the it broke down into 5 ESG buckets – resilience, operations, products, people, and community. It also mapped the 14 ESG topics to the SASB Chemicals Standards. As for oversight, Westlake upped its internal ESG responsibilities by expanding an existing charter to the Corporate Risk and Sustainability Committee on the Board in addition to creating a VP – Sustainability role within its executive leadership team, who will report directly to the CFO and take charge of progressing Westlake’s ESG efforts. While the company’s disclosures are informed by ESG frameworks, it states a goal of more completely reporting in alignment with SASB, TCFD, and GRI, starting in 2022.

Unilever Encourages Suppliers to Set Targets to Halve Absolute GHG Emissions by 2030

As part of the company’s commitment to achieving net zero emissions across the value chain by 2039, Unilever has created Unilever Climate Promise. This initiative invites suppliers to demonstrate their shared values and commitment to GHG reductions in partnership with Unilever. The promise is optional but encouraged. Suppliers who participate promise to:

- Publicly disclose a climate target to reduce absolute GHG emissions by half by 2030,

- Report publicly on progress towards achieving this goal, and

- Provide Unilever with GHG emissions / footprint data.

Fifth Third Appoints CRO

This week Fifth Third announced the appointment of its first Climate Risk Officer, Michele Mullins. Her role now spans her previous responsibility of enterprise risk governance and business support and the newly added component of managing the bank’s effort to mitigate climate risk. Initial priorities will include benchmarking against peers to ensure the company does not fall behind peers in its ESG disclosures and strategy and to publish a TCFD report.

In Case You Missed It…

Last week the SEC issued sample climate change comment letters to select public companies. You can find the sample letter here.

Featured Article: How to Prioritize Corporate ESG Ratings

How many ESG scores does your company have? Chances are, a lot – and that number is growing. The SustainAbility Institute identified over 600 ESG raters and rankings globally. If you’re in an investor relations or sustainability role, you’ve likely been inundated with engagement and survey requests, or questions internally about various ESG scores. Since responding or proactively trying to improve all scores is probably not feasible, how do you know which ESG score to prioritize?

Click here to continue reading and learn more about the 3 ESG ratings you should focus on first.

News Bites

- Ford to Lead America’s Shift to Electric Vehicles with New Mega Campus in Tennessee

- A Massive Shift in the ESG Landscape Is Coming with Mandatory Disclosure Regulations

- BHP Shareholders Urged to Vote Against Climate Plan

- Energy Recovery Hosts ESG-Focused Webinar with Company Leaders

- DuPont Joins RE100 Global Initiative

- Video: Rolls-Royce Going Full EV by 2030

- Boeing’s MAX Woes Reach the Boardroom

- Airbus Gears up for Hydrogen Jet as Fuel of Future Edges Closer to Reality