When to Expect Mandatory Climate Risk Reporting (Newsletter 7/30)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Regulatory Updates

SEC Wants Climate Requirements by Year-End

In a speech to Principles for Responsible Investments on Wednesday, SEC Chair Gary Gensler said that he asked the staff to have proposed rulings for mandatory climate risk reporting in place by the end of 2021, potentially within the 10-K. He noted the rules would provide consistency and comparability of information from companies, particularly for investors to have “decision-useful” quantitative and qualitative data.

FCA Recommends Diversity Requirements for Listing Companies

Last week, the FCA issued guidance for UK investors. This week the organization announced recommendations for company disclosures. The FCA proposed listed companies disclose metrics, such as 40% of the board is comprised of women, at least one of the senior board members is a woman, and at least one member of the board has a non-white ethnic minority background. If a company does not meet the stated metrics, then it must provide an explanation.

Investor Updates

Fidelity’s New Sustainable Investing Guidelines on Diversity & Climate

Fidelity International, a global asset manager with $3.9 trillion AUM, has released new sustainable investing proxy voting guidelines, which increase expectations around climate and diversity. Key updates include:

- At a minimum, companies should disclose a climate change policy and emissions data, as well as illustrate climate change discussion and oversight by the Board.

- Additionally, Fidelity expects companies to have GHG emissions reductions targets for Scope 1, 2, and 3 emissions that align with the Paris Agreement.

- Starting in 2022, Fidelity may oppose directors for failure to demonstrate adequate climate risk oversight or failure to disclose risk management processes and emissions reductions targets.

- In the US, EU, UK, and Australia, Fidelity will vote against the election of directors for boards that do not have at a minimum 30% female representation.

- In all other markets, Fidelity will vote against the election of directors where boards do not have at least 15% female representation.

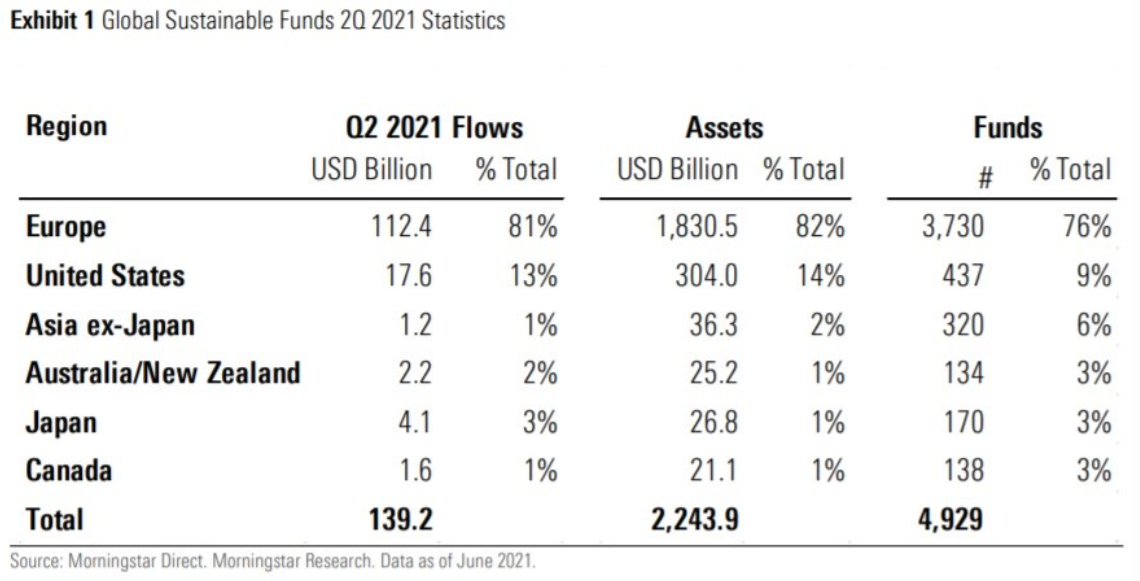

Q2 Sustainable Fund Inflows Slow

While the popularity of sustainable investments remains at a high with flows above 2020 levels, the flows into sustainable funds were down 24% in the second quarter of 2021 compared to the first quarter, according to data from Morningstar. The decline was primarily driven by Europe, which has more than five times the amount of ESG AUM’s as the rest of the world combined, where new “greenwashing” regulations stripped many ESG funds of their ability to use that title anymore. Sustainable fund flows are still a very large part of overall fund flows at 42.7%, or $112.4 billion, of total fund flows, which hit $263 billion in the second quarter.

ESG Activist Engagement: Impactive Capital

In an interview with CNBC, Lauren Taylor Wolfe, Co-Founder and Managing Partner of Impactive Capital, emphasized how DEI can contribute to the bottom line. As an example, she referred to Impactive Capital’s engagement with Asbury Automotive. Parts and service is the company’s most profitable business segment, but the industry is dealing with an issue of mechanics retiring faster than they are able to hire new talent. During her engagement with the company, she recommended Asbury target women, stating only 2% of all mechanics are women, yet women account for over $200 billion of auto service and retail spend. She outlined that developing pro-women policies and recruiting and retaining female mechanics could increase profits and add long-term value to the company. Additional engagements by Impactive Capital were with Crown Holdings – focusing on the circular economy, Wyndham Resorts – cutting down energy usage, and KBR – supporting a transition to a more hydrogen-based economy from a GHG-dependent economy.

As You Sow Turns up the Heat with Sustainability Scorecards

As You Sow, a shareholder advocate and activist non-profit that engages heavily in shareholder proposals, has unveiled sustainability scorecards for company 401(k) plans. These scorecards compare a company’s 401(k) plan investments to their corporate sustainability goals, enabling employees and other stakeholders to identify misalignment. Currently, As You Sow offers sustainability scorecards for Amazon and Comcast, but has plans to expand this offering to include additional S&P 500 companies.

Company Spotlight

ESG Transparency in Earnings Calls Linked to Lower Volatility

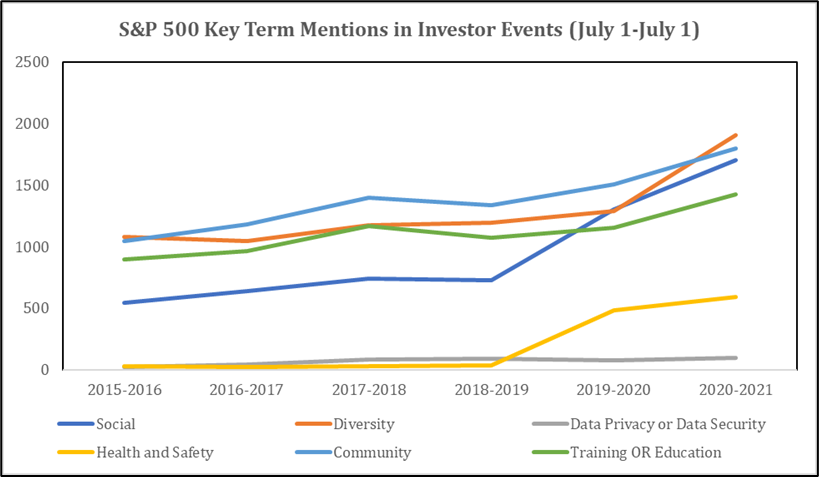

Nasdaq research found S&P 500 and MSCI USA Leaders constituents that talked about ESG topics were linked to lower volatility. By using sentiment or the tone of the earnings call, companies can be issued scores to determine if the calls are more positive or negative. Interestingly, the companies in both indices that addressed ESG topics had higher, or more positive, sentiment scores than those that did not mention ESG. Specifically, companies in the S&P 500 that mentioned company culture had an average sentiment score that was more than 9% higher than the companies that did not mention culture, and those that talked about training and development averaged over 7% higher sentiment scores. Finally, the research showed the annualized volatility of a stock 30 days after an earnings release was correlated to the frequency of ESG mentions. Meaning, companies that discussed ESG topics the most were less volatile in the days after earnings results were announced. The findings were true for both constituents of the S&P 500 and MSCI USA Leaders (Navigating ESG: ESG Discussion in Earnings becomes a Strategic Imperative).

Norfolk Southern Uses Efficient Technologies for Science-Based Targets

Norfolk Southern, one of the nation’s leading railway corporations, announced its adoption of a science-based target that would see the railway company reducing its scope 1 and 2 GHG emissions intensity by 42% using a 2019 baseline. To reduce its emissions, Norfolk Southern will leverage smart energy management technologies, fuel-efficient locomotives, hybrid and electric overhead cranes, alongside other actions.

Home Depot Amps Up Climate-Related Commitments

Within its 2021 ESG Report, retail giant Home Depot announced a new set of sustainability goals, focusing on renewable energy and emissions reduction. Two of the most notable commitments are that Home Depot will transition all of its stores, warehouses, and other facilities to 100% renewable electricity by 2030 and will set science-based targets by 2023 to reduce Scope 1, Scope 2, and Scope 3 emissions. These science-based targets signal an expansion of Home Depot’s GHG reduction efforts, as the company had already set science-based goals to reduce Scope 1 and 2 CO2 emissions 40% by 2030 and 50% by 2035. Other key disclosures included in Home Depot’s ESG report are the report’s alignment with TCFD, SASB, GRI, CDP, and the UN SDGs and the inclusion of the company’s progress on its ESG goals.

Ratings & Frameworks

Sustainalytics Announces Product Enhancements

Earlier this week, Sustainalytics announced upcoming product updates to expect this year. A few highlights are as follows:

- For investors, the rater will add Morningstar’s iconic Company Globes to ESG Risk Ratings in November 2021, measuring portfolio vulnerability to ESG factors

- In December 2021, the Impact Metrics will expand to include:

- Four pollution-related metrics (total NOx, NOx intensity, total SOx, and SOx intensity) and

- 17 theme and Sustainable Development Goal (SDG) level product revenue metrics

- Enhancements were made to the scoring criteria for the following indicators: diversity programs, oil spill disclosure & performance, the scope of GHG reporting, risk management, and reduction programs, and renewable energy programs.

Featured Article: Your Social Communications Are Missing the Mark: A Framework for Speaking Investors’ Language

If you spent more time talking about social issues in 2020 than ever before, you’re not alone. In the wake of unfortunate societal events like the death of George Floyd, Facebook’s data privacy violations, and Foxconn’s abhorrent working conditions, 2020 became a landmark year for corporate ESG communications, and the “S” factor in particular.

Not surprisingly, there has been a major uptick in the mention of social keywords by corporate issuers at investor events. But, new research seems to show that investors aren’t happy with what they’re hearing. According to an EY study, 98% of investors review companies’ nonfinancial disclosures; and roughly two out five of them say that these disclosures are simply not enough to adequately understand disclosing the social risks of their businesses.

Click here to continue reading for a simple framework that addresses the three main areas of risk – strategy, execution, and outcome.

News Bites

- 2 ETFs Investing in The ESG Leaders of Today and Tomorrow

- Two new mega-funds pile into climate-focused fund frenzy

- How to achieve supplier diversity: 4 experts explain

- Boeing Releases First Sustainability Report, Charting Path to Sustainable Aerospace

- Activision CEO Apologizes After Employees Threaten to Walk Out

- Parker Hannifin Commits to Achieving Carbon Neutral Operations by 2040, Advances Technologies That Enable a Sustainable Future