U.S. Sustainable Investments Jump to $17 Trillion (Newsletter 7/23)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

BlackRock Releases 2020 – 2021 Stewardship Highlights

In its 2021 Voting Spotlight Report, BlackRock reveals that its specialist stewardship team consists of about 70 analysts that conduct engagement with thousands of companies across 55 markets. The team focused on 5 key engagement priorities over the past year, which are comprised of climate and natural capital (2,330 engagements), strategy, purpose, and financial resilience (2,200 engagements), board quality and effectiveness (2,150 engagements), company impacts on people (1,350 engagements), and incentives aligned with value creation (1,240 engagements). Additional highlights of the report are that BlackRock:

- Supported 35% of shareholder proposals, compared to 17% last year,

- Backed 64% of environmental resolutions, 35% of social resolutions, and 32% of governance resolutions,

- Voted against management at 42% of shareholder meetings, slightly up from 39% last year

- Voted against 255 directors and 319 companies for climate-related reasons,

- Voted against the re-election of 1,862 directors at 975 companies due to lack of board diversity and against 2,222 directors for lack of independence, and

- Withdrew support for 758 directors at 639 companies for over-boarding.

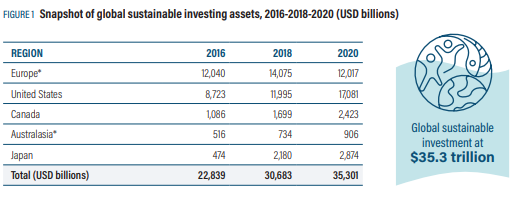

Europe’s ESG Assets Shrink by $2 Trillion, While the U.S. Jumps Ahead

Europe’s sustainable investments drop by $2 trillion from $14 trillion in 2018 to $12 trillion in 2020. This follows the announcement of stronger ESG disclosure rules, such as the Sustainable Finance Disclosure Regulation (SFDR) for EU financial market participants and advisors aimed at minimizing potential greenwashing. Additionally, earlier this week, the Financial Conduct Authority (FCA) released a letter issuing guiding principles for UK funds making ESG-related claims. Globally, sustainable investments reached $35 trillion in 2020, which totals 36% of all professionally managed assets. The U.S. accounts for $17 trillion of the global sustainable investments, surpassing Europe for the first time.

The Latest Institutions to Release Sustainable Funds

Aberdeen Standard Investments launched three new climate-focused funds to support its commitment to net zero global emissions and the goals of the Paris Agreement.

- ASI Global Climate and Environment Equity Fund invests in companies that develop or use products and services to enhance resource efficiency, support the transition to a low-carbon economy, and address broader environmental issues. In addition to ASI’s proprietary research and ESG analysis, the managers will incorporate MSCI ESG reports, MSCI ESG Key climate and environmental scores, Trucost carbon emissions data, CDP, and BloombergNEF.

- Aberdeen Standard SICAV I – Climate Transition Bond Fund invests in leading emissions reducers and adaptors and solutions for physical risks related to climate change.

- Aberdeen Standard SICAV II – Multi-Asset Climate Opportunities Fund focuses on generating long-term growth (5+ years) by investing in equities and corporate bonds issued by companies whose businesses support the transition to a sustainable low-carbon economy.

In addition, John Hancock Investment Management, a Manulife Investment Management company, announced the launch of the John Hancock Global Environmental Opportunities Fund, sub-advised by Pictet Asset Management. The fund looks for investment opportunities in environmental companies which operate within the Planetary Boundaries framework and whose businesses pursue positive impacts on the environment. The fund is managed by Luciano Diana and Gabriel Micheli, CFA, senior investment managers, and Yi Du, investment manager.

ESG Managers Need Stronger Data Points

Index Industry Association, an independent non-profit organization representing the global index industry, conducted a survey of 300 CFOs, CIOs, and portfolio managers in asset management firms in France, Germany, the UK, and the U.S. illustrating both the rising importance of ESG and the need for greater transparency in corporate ESG data and metrics. Key insights from the survey include:

- 94% of U.S. fund managers and 85% of fund management firms surveyed globally say ESG is a high priority.

- Managers expect their ESG portfolio allocation to increase from 26.7% of assets in their portfolios within the next year to 43.6% within five years.

- 64% of investment managers worry about lacking transparency or insufficient corporate disclosure of ESG activities.

Company Spotlight

IBM Sets 21 Environmental Goals

In the newly released 2020 IBM and the Environment Report, IBM sets 21 environmental goals, touching on topics ranging from water conservation to renewable energy and sustainable supply chain. These goals follow IBM’s February 2021 commitment to achieve net zero greenhouse gas (GHG) emissions by 2030 and illustrate the company’s continued dedication to sustainability. A few of IBM’s environmental goals include:

- Procuring 75% of the electricity IBM consumes globally from renewable sources by 2025, and 90% by 2030,

- Cutting IBM’s GHG emissions 65% by 2025 from a 2010 base year, and

- Completing 3,000 energy conservation projects at a minimum in order to avoid 275,000 MWh of energy consumption between 2021 and 2025.

Gerber to Go Completely Carbon Neutral by 2035

Nestlé’s Gerber announced Climate Forward Nutrition Ambition, its new sustainability initiative that will ultimately lead the company to be carbon neutral by 2035 across its products. As a first step toward carbon neutrality, Gerber outlines its goal of making all Gerber Organic and Natural pouches and jars carbon neutral by 2022. Further, Gerber’s new ambition and action plan outlines the different actions the company is taking to turn its commitments into a reality. These actions range from researching and investing in regenerative agriculture to decrease water use and boost biodiversity to switching to renewables. Earlier this year, Nestlé made a similar announcement about KitKat, which pledged to become carbon neutral by 2025. The statements reveal that the food and beverage conglomerate is taking a brand-by-brand approach to set environmental initiatives.

American Airlines to Set Science Based Targets

American Airlines has announced its decision to set a science based target for reducing GHG emissions by 2035, which aligns with its prior commitment to achieve net-zero emissions by 2050. As part of this announcement, American Airlines becomes the first North American airline to pursue validation of its targets from the Science Based Target initiative and joins the Business Ambition for 1.5°C campaign, which is a coalition of businesses who have committed to setting a net zero target that aligns with a 1.5°C future.

Ratings & Frameworks

Morningstar Finalizes Sustainalytics Integration

On the one-year anniversary of Morningstar’s acquisition of Sustainalytics, the combined entity announced Sustainalytics ratings and methodology have been incorporated into Morningstar’s equity and fund research. Michael Jantzi, Founder and CEO of Sustainalytics, is now transitioning to the Managing Director of ESG Strategy for Morningstar to lead the adoption of sustainable investing throughout the company’s primary audiences and to support Morningstar CEO Kunal Kapoor’s goal to strengthen the company’s position as an ESG industry leader. Jantzi also sits on the boards of PRI and Value Reporting Foundation (SASB).

News Bites

- Demand for ESG Investments Soars Emerging from COVID-19 Pandemic

- How to Incorporate a Best-in-Class Investment Proposition on Your IR Website

- Fund Companies Are Paying More Attention to ESG Matters, Survey Shows

- ESG Claims in an Era of Heightened Regulatory and Litigation Risks

- Carlyle Launches Renewable-Energy Infrastructure Unit