The End of GRI? ESG Frameworks Consolidate (Newsletter 11/5)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

ESG Ratings & Reporting

The Launch of the International Sustainability Standards Board

In an important turning point this week, the IFRS Foundation announced the consolidation of the International Sustainability Standards Board with the Climate Disclosure Standards Board and Value Reporting Foundation. The new consolidated body, which will be known as the International Sustainability Standards Board (ISSB), is set to develop a comprehensive set of global sustainability disclosures to meet investors’ information needs. Important to note, while SASB and CDP are included in this consolidation, GRI is missing entirely, and the Task Force on Climate-related Financial Disclosures (TCFD) is a participating member of the working group. As the new ISSB seeks to become the premiere global sustainability disclosure standard for financial markets, it remains to be seen how investors and regulators respond. The TCFD framework, to date, has become the most trusted climate risk framework by financial markets, asset managers, and regulators – here in the U.S. and abroad.

ISS ESG’s Net Zero Products Account for Interim Targets and Decarbonization Strategies

ISS ESG, Institutional Shareholder Services, Inc.’s responsible investment arm, is launching a new series of Net Zero Solutions, including automated reporting for portfolios in Q1 2022, that will enable investors to ensure their portfolios align to net zero. The new tool allows investors to identify the most suitable data and KPIs needed to transition and adjust their portfolio holdings to align with public commitments and net zero initiatives. More specifically, investors can use the Issuer Level Net Zero Alignment Data to identify positive and negative performing companies against a range of individual climate related metrics. Lastly, the automated reporting component known as “Net Zero Portfolio Report” creates an aggregated view of a portfolio’s readiness for Net Zero (based on current and potential future emissions disclosure performance, fossil fuel exposure, climate mitigating revenue, and target setting). This provides investors with a comprehensive and data-driven snapshot of its portfolio holdings and alignment with Net Zero targets.

COP26

COP26 Victories Thus Far: Global Methane Deal and Deforestation Agreement

Over 100 countries, including China, Brazil, and the U.S., have committed to a deal which plans to halt and reverse deforestation by dedicating almost $20 billion of both public and private funds to preserve and rebuild forests. While specifics around enforcement and execution for this deal have yet to be hammered out, the agreement is noteworthy in illustrating common ground between developed and developing countries.

Additionally, more than 100 countries have agreed to a global emissions reduction pledge, led by the EU and the U.S., that commits countries to cut methane emissions by 30% by 2030. While an important step in climate policy, a number of key emitters, including China, Russia, and India, have not agreed to the pledge. This agreement has coincided with the U.S. Environmental Protection Agency (EPA) proposing plans that would tighten methane regulations on the U.S. oil and gas industry. Larger producers, who are facing investor pressure to better their environmental practices, have voiced their support for such regulations, but smaller producers have criticized such regulations as having the potential to put them out of business.

Regulatory News

HCM and Climate Shareholder Proposals Will Not be Excluded

On Wednesday, Corp Fin issued Staff Legal Bulletin No. 14L on shareholder proposals, stating that proposals raising human capital management issues and requests for timelines or targets to address climate change are no longer excludable. Further, the Staff is taking a step back on their approach to micromanagement. The bulletin mentions that a proposal requesting a timeframe or method for implementing the proposal may not be considered micromanagement. Overall, this change means we can expect to see an even larger rise in environmental and social shareholder proposals on company proxies. For additional takeaways from the announcement, click here.

Investor Updates

EY Finds Investors May Divest from Poor ESG Performance

In the 2021 EY Global Institutional Investor Survey, EY collected viewpoints from 320 institutional investors from 19 countries on ESG investing. Key findings are as follows:

- 74% of the institutional investors surveyed responded they are more likely to divest from companies with peer ESG performance than prior to the onset of COVID-19

- 86% of investors said they were more likely to hold a stock based on strong ESG performance than prior to the pandemic

- 77% of respondents said over the next 2 years they plan to improve their analysis of physical risks (described as climate change impacts on a business’ ability to improve its products and services)

- 76% of investors believe a shortage in green investments and overpaying for green assets could lead to risk of a market bubble

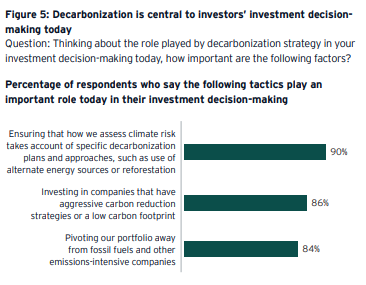

- As shown in the image below, decarbonization is currently a key part of investors’ investment decision-making

CEO of Ariel Investments Talks Diversity

In an interview with Mellody Hobson, co-chief executive of Arial Investments, Barron’s dives into the topic of diversity. As an early adopter of ESG factors and a minority and female board member of JPMorgan Chase and Starbucks, she shares a fact that companies with diverse boards outperform companies with non-diverse boards over time. Within Ariel’s holdings, she noted the firm engages with companies no matter what, and Ariel plans to own these companies for a long time. She mentioned over 50 companies within Ariel’s portfolio have added a minority board member following engagement with Ariel investors. “If a board isn’t diverse, it doesn’t mean we can’t buy the stock, but if the board lacks female and minority representation, we will vote against the board,” stated Hobson indicating where she believes the responsibility lies. Fun fact: Mellody Hobson is married to George Lucas, the creator of Star Wars.

Company Spotlight

Moderna Commits to Net Zero Carbon Emissions by 2030

Alongside the occurrence of COP26, Moderna has announced its decision to work toward achieving net zero carbon emission by 2030. In addition to announcing its new commitment, Moderna shares the company’s initiatives in process for reducing its environmental impact. These include:

- Setting baseline energy, waste, and water metrics

- Evaluating Moderna Technology Center’s utilities infrastructure to create a timeline for cutting down its carbon footprint

- Beginning to use renewable energy at US facilities and to offset non-renewable electricity consumption

JPMorgan Chase Reports Racial Equity Progress on 2020 Commitment

Since June 2020, a plethora of different companies announced commitments to racial equity and anti-racism but taking action and reporting back on progress and impact are considered best practice. A year after JPMorgan Chase announced its $30 Billion Racial Equity Commitment, the firm reported back on the company’s progress. Highlights of the progress update include:

- Invested over $100 million of equity in 14 diverse-owned or -led minority depository institutions and community development financial institutions

- Increased recruiting partnerships with historically black colleges and universities from 3 to 17

- Developed governance and reporting process for tracking of the Commitment

- Funded over $6 billion in loans to preserve over 60,000 affordable housing and rental housing units around the country

Featured Article: Off-Season is the New On-Season for ESG Engagement

Proxy season is no longer the only or even the best time to talk ESG with your passive institutional investors. Indeed, the fourth and first quarters, when the ESG stewardship and compliance officers from institutions have significantly less on their plates, can be the perfect time for you to share the details of your environmental and social journeys and showcase your best-in-class governance practices.

Hot issues such as climate change, diversity, and corporate responsibility are top of mind for your investors and they want to hear from you what your plans are to address these issues. To learn the significance of hosting off-season meetings and how to make the most of the meetings, click here to continue reading.

News Bites

- The Management Systems Underlying ESG Reports

- Kimberly Evans Named Northern Trust’s Head of Corporate Sustainability, Inclusion and Social Impact

- How Chipotle Will Reduce its Carbon Emissions 50% by 2030

- ESG’s Unintended Consequence – Lawsuits

- 3M’s Four Business Groups Set New Equity Commitments

- Enbridge ESG Forum: CEO Presentation (Video)

- Corporate Climate Pledges Often Ignore a Key Component: Supply Chains

- Tariffs to Tackle Climate Change Gain Momentum. The Idea Could Reshape Industries.