Sustainable Investing Hits New Record in 2021 (Newsletter 2/4/22)

Sign up for The Infinite Minute to receive the top news impacting corporate ESG reporting.

Regulatory News

California Senate Passes Bill Requiring Companies to Disclose Emissions

The California State Senate passed the Climate Corporate Accountability Act (CCAA) requiring companies with gross annual revenues of over $1 billion to disclose their Scope 1, 2, and 3 emissions data. Next, the bill will go to the Assembly and then to the governor who could turn the bill into law. If passed, this would be the first ruling within the U.S. to require companies to disclose all greenhouse gas (GHG) emissions, and it would impact most of the largest companies in the country.

EU Categorizes Nuclear Power and Natural Gas as Green Investments

Despite backlash from some EU member countries, pro-environmental groups, and investors, the European Commission said it would move forward with its plan to label certain nuclear energy and natural gas investments as sustainable as part of the EU Taxonomy. The plan is under review for 6 months, and then member countries and the European Parliament will vote on it. Austria and Luxembourg have already stated that they may take legal action against the European Commission. Most critics of the plan say the move is a form of greenwashing and poses a threat to the EU’s credibility of addressing climate change. Others see it as an opportunity for categorizing investments.

Investor Updates

U.S. Sustainable Fund Flows Dip, Yet Hit a New High in 2021

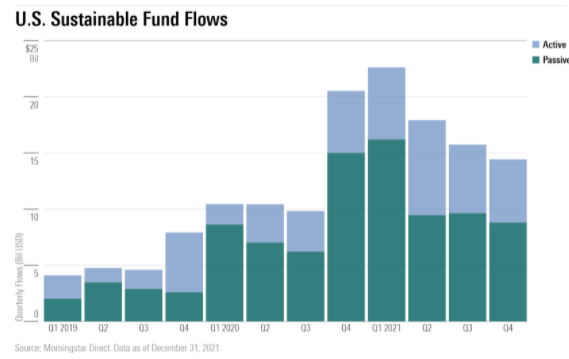

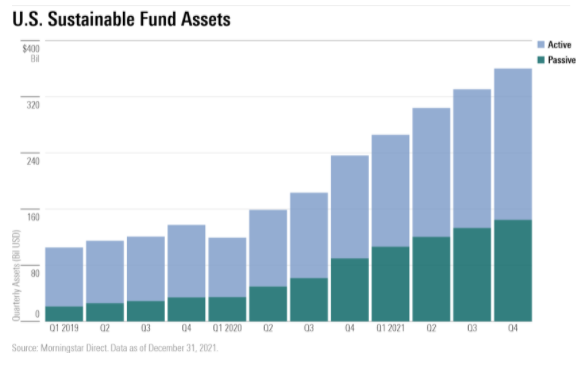

According to Morningstar, in the fourth quarter of 2021, sustainable fund flows in the U.S. dipped to the lowest point of the year at $14 billion. Sustainable funds attracted $17.3 billion in net flows each quarter on average, well above the $12.8 billion average in 2020. As seen in the chart below, sustainable passive funds are still surpassing their active cohorts, and saw inflows of $8.8 billion for the quarter.

Further, in the U.S., sustainable funds held a total of $457 billion in assets, as of December 2021, tripling from three years prior. While active funds have the majority of sustainable assets (about 60%), passive funds are quickly climbing.

Lastly, the fourth quarter saw the highest number of sustainable fund launches in the U.S. at 45 new funds – 35 were equity funds and 26 were ETFs. This beats the previous record of 38 new funds.

William Blair Investment Management Rebrands U.S. All-Cap Fund for Sustainability Focus

William Blair Investment Management has changed the name of its U.S. all-cap growth fund to the US Equity Sustainability SICAV, reflecting the firm’s push towards a sustainable investment strategy. The strategy will invest in companies focusing on themes such as decarbonization, health and well-being, and the circular economy, while filtering out companies that go against these principles.

Company Spotlight

Exxon Restructures and Elevates Energy Transition Business

Less than a year after losing 3 seats on its Board of Directors, Exxon is taking a number of significant actions to restructure operations and cut costs, including merging its chemicals and refining businesses and having a centralized technology and engineering department. Beginning April 1, Exxon will have the following business line organizations: upstream oil and gas production, chemicals and downstream refining, and Low Carbon Solutions, the company’s new business focused on the energy transition. The creation of Low Carbon Solutions, which will direct its efforts initially to carbon capture and storage, is a key move by the oil and gas giant to begin elevating an energy transition business and address concerns of activists like Engine No. 1.

T-Mobile Achieved 100% Renewable Energy in 2021

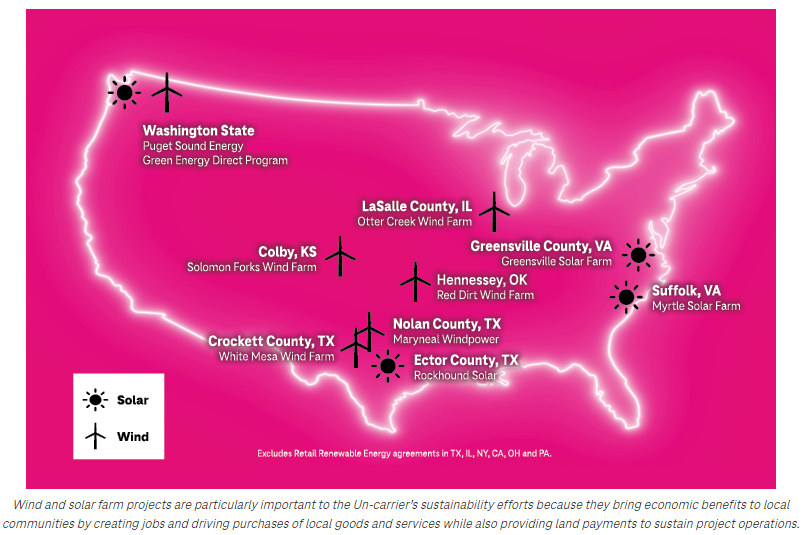

T-Mobile announced that it has achieved 100% renewable power usage, a first for the wireless telecom industry. The firm had previously committed to do so by 2021 and is a member of the RE100. T-Mobile met this goal through a combination of renewable energy investments, primarily contracting the production of enough wind and solar energy to cover the entire usage of the company. In addition to purchasing green energy, T-Mobile is striving to reduce its power usage through improved efficiencies and equipment. The company plans to continue to match any future increases in electricity usage and has said it will announce further decarbonization plans later this year.

ESG Ratings & Reporting

ISS ESG Launches Data Tool in Bid to Tackle ESG Labelling Issues

ISS is releasing a new tool for investors to simplify the language and disclosures of sustainable investing. The ISS ESG Labels & Standards Solutions platform, launching this February, will leverage ISS’s data to streamline ESG data review, verification, disclosure, and reporting. ISS claims the tool will standardize ESG language and reporting requirements and keep investors up to date on the necessary concepts.

Proxy Season Briefing

Meta Pushes Back Against Human Rights-related Shareholder Proposals

According to Proxy Insight, Meta Platforms seeks to omit five resolutions from its proxy statement dealing with human rights disclosures. The resolutions cover topics that range from reporting on why Meta’s community standards enforcement has failed to effectively control hate speech to reporting on potential harms of the metaverse project. In the past five years, three similar proposals have been submitted around misuse of the company’s platform, with each respective proposal gaining greater support. Though the latest proposal in 2021 only received about 20% support. The company is asking the SEC to exclude the proposals on the grounds that a number have been covered in years past and/or because they are related to ordinary business matters.

Featured Article: 3 Ways to Strengthen Your Cybersecurity Program

In a world where work is increasingly done remotely, retail shopping is driven by e-commerce, and entertainment, marketing, and even real estate are expanding into the “metaverse,” cybersecurity is of utmost concern for companies looking to capitalize on the new digital landscape. More reliance on digital channels comes with heightened cybersecurity risk as both revenues and reputations are on the line.

The burning question on company’s minds is, what can my company do to protect itself? In this article, we provide 3 steps to create or strengthen cybersecurity program – read more here.

News Bites

- Investors Escalate Pressure on Companies to Adopt Paid Sick Leave Policies

- The Wall Street Journal is Wrong About ESG

- BlackRock pledges to help clients navigate, shape net-zero transition

- Honeywell To Help Walmart Reduce Its Carbon Footprint Across North American Stores

- Ulta Beauty Announces 2022 Diversity, Equity and Inclusion Commitments

- EU Markets Regulator Kicks Off Process to Regulate ESG Ratings