SEC Sends Companies Letters Seeking More Climate Disclosures (Newsletter 9/24)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Regulatory News

SEC Requests More Climate Disclosures from Companies

The SEC sent letters to dozens of companies requesting they provide more information to investors about how climate change may impact their financial earnings or business operations. Specifically, the SEC asked for more information on risks to companies for potential litigation, increased compliance costs, capital expenditures for climate-related projects, possible lower demand for goods and services that produce large amounts of greenhouse-gas (GHG) emissions, the effects of severe weather on operations, among other items. The SEC is also asking companies why they report climate change information in corporate sustainability/social responsibility reports instead of SEC filings, as it expects the disclosures to primarily live within the MD&A and risk factors. While the companies weren’t revealed, the Wall Street Journal uncovered that the letters were sent to companies in the agriculture, banking, oil and gas, real estate, and trucking industries. For more information, view the sample letter posted by the SEC.

Vanguard Scrutinized for Lack of Action on Climate

According to a report by Universal Owner, Vanguard could lose $3 trillion by 2050 for not taking meaningful action on climate change through its investments. The report specifically calls the institution out for having one employee to monitor 300 portfolio companies’ climate issues, not sharing a policy to divest from coal producers within its portfolio, and lending large sums of money to tar sand companies. A spokesperson responded saying “We have and will continue to outline our expectations for companies where climate change is a material risk, and it will further disclose engagements with companies on climate and rationale for votes on environmental shareholder proposals.

Investors with $46 Trillion in Assets Call on Governments to Increase Climate Ambitions

In the last few months before the 26th United Nations Climate Change Conference of the Parties (COP26), a group of nearly 600 investors with $46 trillion in assets is calling for governments internationally to increase their climate ambitions and better their policies. Specifically, the group is calling on governments to:

- Strengthen their Nationally Determined Contributions for 2030 before COP26

- Agree to a domestic mid-century net zero emissions target and outline a decarbonization pathway

- Create domestic policies that facilitate achievement of these goals

- Make sure COVID-19 recovery plans facilitate the transition to net zero emissions

- Agree to implement mandatory climate risk disclosure requirements aligned with TCFD

Proxy Season in Review

Insightia Announces Key E & S Takeaways from 2021 Proxy Season

Insightia, a company providing corporate governance, shareholder activism, and shareholder voting data, has released its 2021 Proxy Voting Season Snapshot. The report covers about 25 million votes from institutional investors globally during the 2021 proxy season. Key findings of the report include:

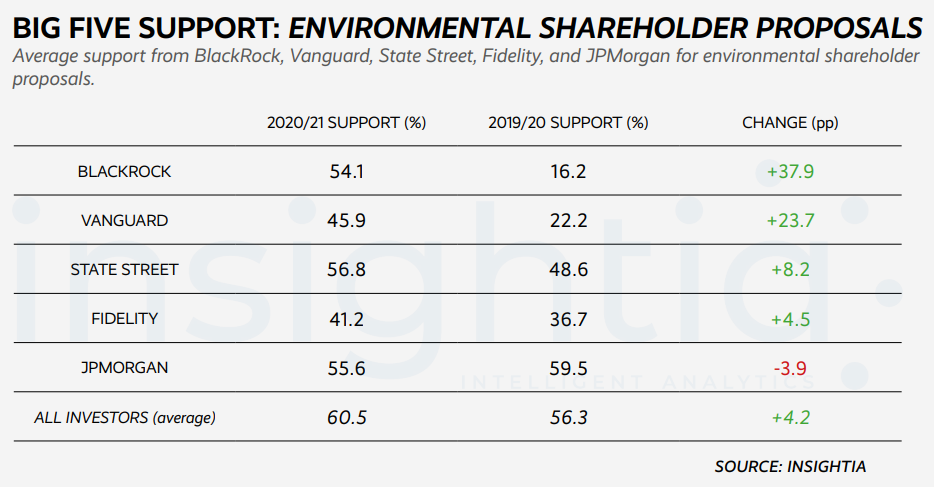

- The five biggest institutional investors upped their support of environmental shareholder proposals by 13 percentage points on average between the 2020 and 2021 proxy seasons, compared with a 4 percentage point increase for all investors

- The top five investors backed 100% of climate transition plans that companies asked for votes on, but only Fidelity supported a majority of shareholder proposals to adopt annual “say on climate” proposals at Canadian and U.S. companies

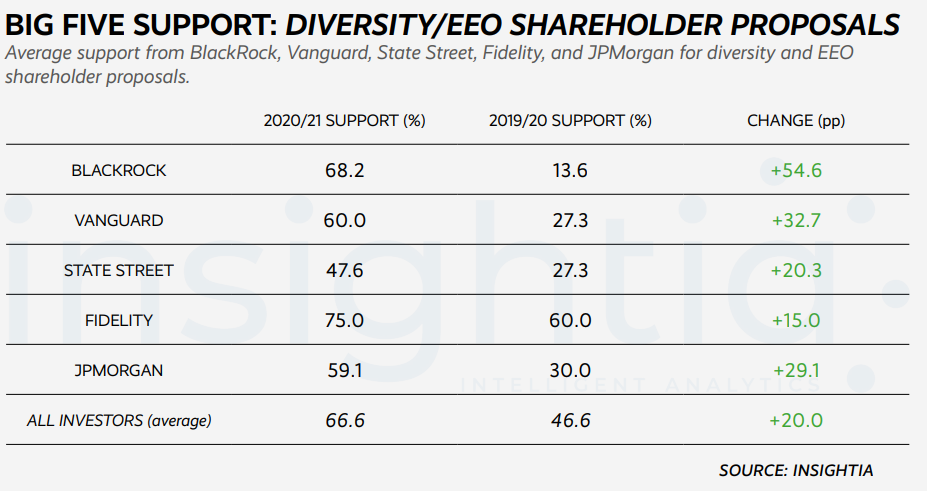

- Diversity proposal support from the five investors rose by 30 percentage points on average

Company Spotlight

ServiceNow Sets New, More Ambitious Net Zero GHG Reduction Goals

ServiceNow, a digital workflow company that had previously set a goal to achieve net-zero GHG emissions before 2050 has moved its goal forward to 2030. After having Watershed, a third-party provider, assess the company’s carbon footprint, ServiceNow found that 93% of its footprint is from Scope 3 emissions (its value chain). With this information, ServiceNow is focusing on internal reductions programs and supplier engagement, in order to achieve net zero by 2030.

Goldman Sachs Introduces the First ESG-linked Demand Deposit Account with Xylem

Goldman Sachs has announced a new Transaction Banking (TxB) product, which connects clients’ achievement of their ESG goals with the yields on their deposits. Clients that are focused on ESG will be likely to earn higher yields with this account. Xylem, a water technology company, is Goldman’s anchor client for this new offering.

86 New Companies Join Climate Pledge to Achieve Net Zero by 2040

More than 200 organizations globally have now signed The Climate Pledge, an initiative created by Amazon and Global Optimism. The newest 86 signatories include Nespresso, Procter & Gamble, HP, ASOS, and Salesforce, amongst others. As part of The Climate Pledge, signatories commit to:

- Measure and disclose greenhouse gas emissions regularly

- Implement decarbonization strategies in line with Paris Agreement, including through efficiency improvements, materials reductions, and renewable energy

- Counterbalance any remaining emissions with quantifiable, socially beneficial, permanent offsets to achieve net-zero annual carbon emissions by 2040

ESG Ratings & Reporting

Over Half of the S&P Global 1200 Reports Use SASB

The Value Reporting Foundation announced that over half of the companies in the S&P Global 1200 index, precisely 608 out of 1201, use SASB standards in their investor communications. SASB adoption has grown significantly – 215% from 2020 to 2021 – with about 1,300 businesses using the SASB standards to report.

SBTi Finds Companies with Climate Targets in G20 Don’t Align with Climate Science

A report from the Science-Based Targets initiative (SBTi) found that most companies do not report climate targets in alignment with climate science. In the U.S., of the 843 companies that disclose climate-related targets through CDP, only 159, or 19%, are science-based targets. Click here to see which companies have set science-based targets, and click here to learn more about setting science-based targets for your sector.

Featured Article: Hit the Materiality Assessment Easy Button: A Primer for Conducting Your Inaugural Assessment with Less Pain and More Gain

Best-in-class examples are great, especially when it comes to conducting a materiality assessment, but unfortunately, they’re often not the right fit for everyone. In general, they are a lot of work and take a good amount of time. We have found that this can be a big turnoff for executives, especially in companies that just aren’t ready (yet) to put their ESG strategy in stone.

The good news is, materiality assessments don’t have to be all-or-nothing endeavors. Conducting a “starter” assessment is a perfectly acceptable way to get your feet wet, gain invaluable insight, and score points with stakeholders, all without a significant investment of resources on your part. In our most recent blog post, we share the steps to building an effective starter materiality assessment.

Click here to continuing reading the 3 keys to an effective “starter” materiality assessment.

News Bites

- Newton IM expands responsible investment team

- Biden pledges to double U.S. climate change aid; some activists unimpressed

- Value Reporting Foundation: Transition to Integrated Reporting: A Guide to Getting Started

- More CFOs Add Sustainability Targets to Corporate Loans

- Shell signs agreement to sell Permian interest for $9.5 billion to ConocoPhillips