Over 50% of the S&P 500 Use ESG Metrics in Exec Comp (Newsletter 3/12)

Sign up for the ESG Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Regulatory News

SEC Announces ESG Task Force

The SEC created a new Climate and ESG Task Force in its Division of Enforcement. The ESG Task Force will develop initiatives to proactively identify ESG-related misconduct, focusing initially on identifying material gaps or misstatements in issuers’ disclosure of climate risks. The group will also analyze disclosure and compliance issues relating to investment advisers’ and funds’ ESG strategies and pursue tips, referrals, and whistleblower complaints on ESG-related issues.

Ditching Trump-Era ESG Regulation

The U.S. Department of Labor will not make it harder for 401(k) plans to offer ESG funds. The Trump administration had previously set rules regulating sustainable investments in corporate 401(k) plans, limiting funds with nonfinancial goals, such as environmental, social, and governance, and curbing proxy voting. The Labor Department is reviewing the rulings and may attempt to suspend them in the future.

EU SFDR Level 1 Effective 3/10

The EU Sustainable Finance Disclosure Regulation (SFDR) is a pending European regulation mostly requiring ESG disclosure from EU-based investment managers at a firm level and on individual products. Once this regulation is in force, EU investment managers may expect or require portfolio companies to disclose this information. Level 1, which went into effect on March 10th, does not give precise disclosures, but largely requires investment managers to disclose if they consider sustainability risks in their investment process and the policies they use to do so. Many companies have reported receiving emails from MSCI on these new disclosures – but should consider these are for EU-based asset managers, and are pending additional discussions from these firms, many of which find them untenable.

Investor Updates

CalSTRS Calls the Start of an “Active Stewardship” related to ESG

The country’s second largest pension fund with nearly $300 billion in assets has actively signaled it took a page from the activism playbook to increase portfolio returns. Two portfolio managers from the Sustainable Investment and Stewardship Strategies unit published an interview in the Harvard Business Journal and said traditional engagement is too ineffective, and takes too long to deliver returns, while activist tactics, specifically the replacement of directors, will effect the kind of change that drives returns. They remind us that divestment is not an attractive option for passive investors, and that companies uninterested in meaningful engagement with shareholders, or “Corporate Castles” as they term these companies, should expect CalSTRS own brand of activism.

Investors Commit to Decarbonizing Portfolios

Unlike individual companies, investors have less control and access to data surrounding the total emissions within their portfolios. An investor network, consisting of a group of investors managing a combined $33 trillion, launched the “Net-Zero Climate Framework” to give investors a common approach to reach net-zero portfolios, supporting the Paris Agreement. For an initial list of investors already committed to the framework, including PIMCO and Fidelity, see here.

While that is one way to do it, BBVA took a more drastic approach and said it is eliminating its exposure to coal financing. The bank plans to help clients decarbonize from additional industries including oil, gas, automotive, steel, cement, and transport. Robeco and Deutsche Bank announced similar initiatives in 2020.

Preparing for SFDR

StateStreet released a new ESG Risk Analytics offering supporting TCFD reporting and giving investors access to data for the SFDR. Similarly, MSCI and Sustainalytics are building platforms to cater to investor needs resulting from the regulation. While the PAI indicators are still being determined, companies should consider looking over the proposed list. You can see the details here.

Company Spotlight

Executive Comp & ESG Metrics

Chipotle is the latest company to link ESG goals to executive compensation. The fast-casual chain stated 10% of Chipotle executives’ annual incentives will be tied to their progress toward achieving company goals within the topics of Food & Animals, People, and the Environment. The company moved up the 2025 target for disclosing Scope 3 emissions to this year.

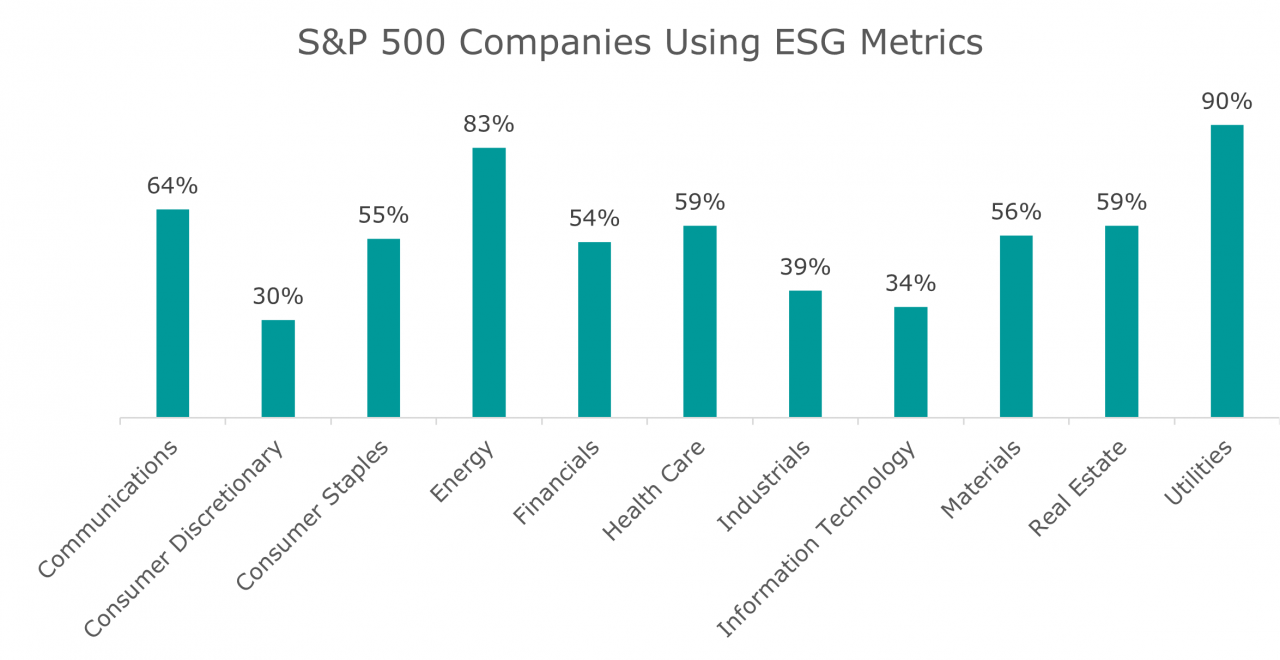

According to Willis Towers Watson, as of 2020, 51% of the S&P 500 use ESG metrics in their compensation plans in some fashion. 50% of the S&P 500 use ESG metrics within their annual bonus, while only 4% use similar metrics within their long-term incentive program. These figures are expected to increase, as the 2020 proxy season saw several companies providing forward looking disclosure of ESG metrics being incorporated into their compensation plans. Below is the percentage of S&P 500 companies using ESG metrics by sector:

Source: Willis Towers Watson

Featured CSR: Square, Inc.

Square’s new, easily digestible CSR, touches on a variety of material topics. At the forefront, the company states its net zero by 2030 commitment and discloses emissions data, 97% of which is attributable to Scope 3 emissions. The company shares a year-by-year graph laying out its plans to achieve carbon neutrality, which includes investments in carbon removal – an increasingly popular and longer-term method. Touching on the social pillar, Square details how it is supporting underserved communities, primarily extending its reach through partnerships, with over 85% of sellers living outside of the 25 most populous cities in the U.S. While Square is still striving to achieve its diversity goals, it outlines the steps it has taken to get there by proactively working with a wide range of organizations tied to underrepresented groups to attract new and diverse talent, adjusting hiring practices, and developed employee resource groups. And lastly, the report highlights 4 out of the 11 Directors are women or ethnically diverse and the Nominating and Governance Committee oversees all ESG matters and risk oversight

SASB Reporters by Industry

As we enter spring, a popular time to release fresh CSRs, companies have either started to report or updated previous SASB tables. Below are the U.S. companies that have published a report in alignment with SASB this year, as of March 11th, 2021.

- Ulta

- Transocean

- BlackRock

- LPL Financial Holdings

- Kroger

- Flowers Foods Inc

- Cardinal Health

- Charles River Laboratories International

- Hologic

- Revance Therapeutics

- Walgreens

- SBA Communications Corp

- New Jersey Resources

- UGI Corp

- Rayonier

- Atkore International

- Tupperware Brands

- Park Hotels and Resorts

- Telephone and Data Systems Inc

- Akamai Technologies Inc

- Intuit

- Xerox

Ratings & Frameworks

The Sell-Side Issues ESG Scores

Equity research reports from Cowen now feature an ESG score designed to help investors quantify differences between corporations around ESG topics. The score is based on how companies report and perform on materiality topics in their industry, as defined by SASB. Then, utilizing AI and media monitoring, companies are assigned risk ratings on risks they view as increasing or decreasing in the industry – on a 0 to 100 scale where 50 is considered a neutral impact, above 50 has a positive indication, and below 50 has a negative indication. The data comes from Truvalue Labs, which was acquired by FactSet last fall.

News bites

- Investors Turning to ETFs to Get Their ESG Fix

- Most Investors Still Fail to Back Climate Resolutions

- Wells Fargo is the last of the Big Six banks to issue a net-zero climate pledge. Now comes the hard part

- Expanding access to 2°C-aligned investment opportunities: Solactive and right. based on science broaden set of options available to the investment community with triple launch

- Greenwashing in finance: Europe’s push to police ESG investing

- Board Practices Quarterly: 2021 Boardroom Agenda