ISSB Announces Proposed Consolidated Reporting Standards (Newsletter 4/1/2022)

Sign up for The Infinite Minute to receive the top news impacting corporate ESG reporting.

ESG Ratings & Reporting

The ISSB Announces Proposed Draft of Standards

Following the lead of the SEC, the International Sustainability Standards Board (ISSB), launched by the International Financial Reporting Standards Foundations (IFRS), released a draft of the consolidated sustainability standards. The goal is to create industry-based, globally consistent standards for environmental disclosure. The proposals build on the TCFD framework and sound eerily similar to the SEC proposed rules, including the following guidelines:

- Companies must disclose information that enables investors to assess the effect of significant sustainability-related risks and opportunities on its enterprise value

- Companies also must disclose climate-related risks and opportunities including Scope 1, 2, and 3 emissions in accordance with the GHG Protocol

- As with the SEC’s recent comment letters, the ISSB has placed an emphasis on the integration of financial statements and sustainability disclosures

- The rules will also build on SASB’s industry-based approach to setting standards

The ISSB is collecting feedback through July 29th and expects to issue standards by the end of the year.

Investor Update

CalSTRS Focuses on Climate Risk and Board Diversity for 2022 Proxy Season

The California State Teachers’ Retirement System (CalSTRS) has announced that it will take an enhanced approach to proxy voting this year, focusing in on board diversity and climate risk. To further corporate action in these two focus areas, CalSTRs has stated that it will:

- Vote against full boards of directors at companies with all-male boards

- Vote against board nominating committees at companies without at least a 30% female board

- Vote against directors of companies that do not disclose scope 1 or 2 emissions

- Vote against directors of the largest 1,900 companies globally that have not published a TCFD-aligned report

- Vote against directors of highest emitters globally, where they have not: 1) published a TCFD-aligned report, 2) disclosed scope 1 and 2 emissions, and 3) set appropriate targets to reduce GHG emissions

Proxy Season Briefing

Investors Convince Dell to Increase Customer Access to Product Repairs

Following Dell’s commitment to improve availability of product repair options, Green Century Capital Management has withdrawn a shareholder proposal it previously filed, which had asked Dell to disclose how it enables the accessibility of product repairs, according to Proxy Insight. This shareholder proposal was particularly timely given an increased focus by legislators on Right to Repair legislation, which enables third-party repair of devices.

Occidental Fights GHG Emissions Reduction Resolution

Follow This, an activist group, and Benta B.V., a Dutch investor, have teamed up in filing a resolution asking Occidental Petroleum to create and disclose short-, medium-, and long-term targets for Scope 1, 2, and 3 emissions that align with the Paris Agreement. The proposal requests that the company disclose its strategy for achieving these goals and report on its progress annually. Occidental has pushed back saying it has already set emissions targets in line with the Paris Agreement but Follow This continues to question these targets and whether they truly are aggressive enough to align with the Paris Agreement.

Regulatory News

Ford, GM, Stellantis Support EPA’s Stricter Tailpipe Emissions Standards

New rules finalized in December that set tougher tailpipe emissions standards have become the center of a legal battle between the EPA and 13 oil-producing states. Opponents to the regulation claim the rules unfairly promote electric vehicles over “superior means of transportation that use abundant fossil fuels,” as Texas Attorney General Ken Paxton stated. The rules have support from the Alliance for Automotive Innovation, the auto industry’s most prominent lobbyist, which has petitioned the U.S. Court of Appeals in Washington, D.C. to uphold the rules. The group’s president argues that the regulation is imperative for maintaining American electric vehicle competitiveness. The American Lung Association, 22 states, and automakers such as GM, Ford, and Stellantis all publicly support the regulation.

Company Spotlight

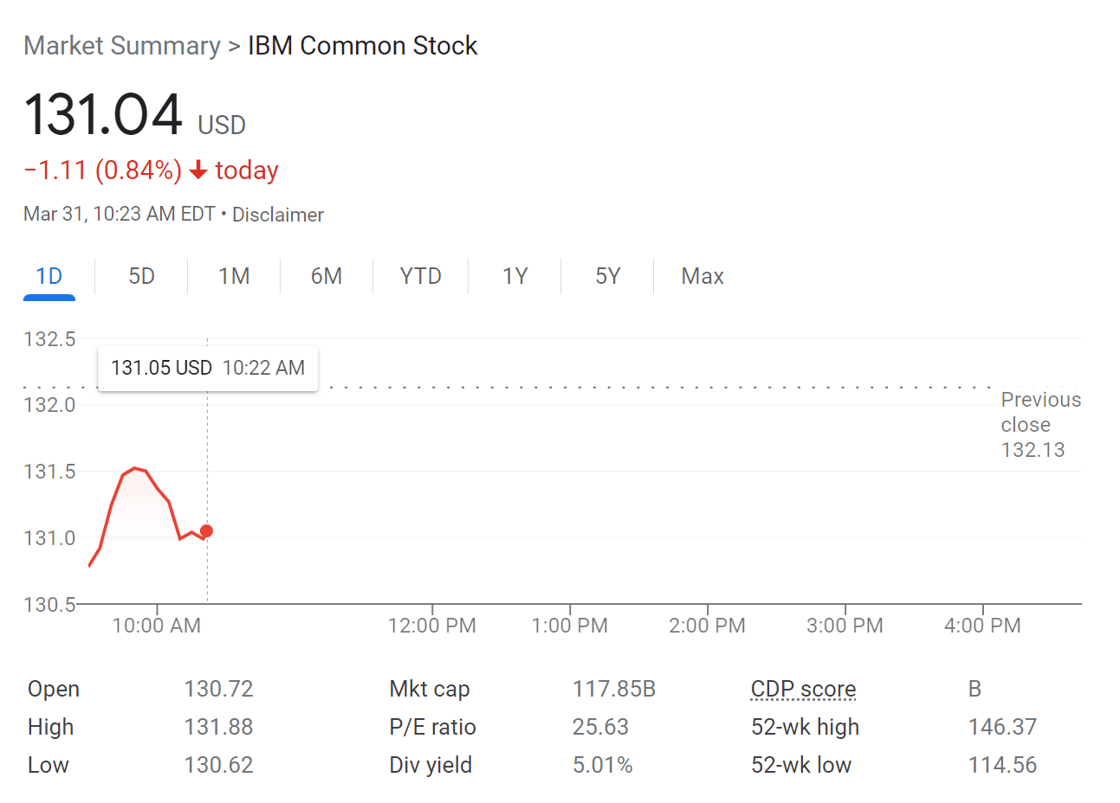

Google Adds CDP Scores to Stocks’ Financial Highlights

Have you Googled your stock recently? Google search results for some stocks will now host a CDP score alongside traditional financial metrics like market cap and price to earnings ratio. The score listed is based on the company’s climate change questionnaire response, though search results do not specify this. Google joins Yahoo Finance—which includes risk ratings metrics from Sustainalytics—as one of the few popular financial data providers to also display ESG metrics.

Companies Feeling the Heat

Apple, Meta Discord, Snap Release User Data to Hackers Pretending to Be Law Enforcement

Apple, Meta, Discord, and other popular social media platforms were duped into giving hackers access to user data including customers’ addresses, phone numbers, and IP addresses. The hackers masqueraded as law enforcement and presented the companies with forged emergency data requests. The forgeries were a type of request for data that does not require a warrant or subpoena and is used when there is reason to believe that the matter involves imminent risk of serious physical injury or death. The companies completed the requests, despite internal controls used by the companies to validate such inquiries. Apple and Meta receive thousands of similar requests each year from a wide variety of law enforcement agencies, making their legitimacy difficult to verify.

Featured Article: Why ESG Deserves Space in Your IR Presentation

Nowadays, ESG plays a key role in investors’ decision making. In an EY survey of over 320 institutional investors, 78% said they conduct a structured, methodical evaluation of the environmental and social aspects of a company’s performance, compared to 32% in 2018. Investors have been increasingly demanding more ESG-related information from companies. Further, ESG has become a common part of the due diligence and screening process for investors as they consider positions in potential investments and manage current holdings. To learn about the 2 approaches to incorporate ESG within your investor presentation, read more here.

More to Know…

Google, Netflix, and LinkedIn refused to sign a climate change ad in the New York Times.

The current demands faced by corporate boards signify CFOs may need more than deep audit expertise to secure a Director role moving forward.

The EU’s proposed rule cracks down on consumer products to address their environmental impacts by making products more repairable, reusable, and recyclable, and by properly informing consumers.

News Bites

- Biden Invokes Defense Production Act to Shore up Raw Materials for Clean Energy

- Bonuses, net zero and Ukraine: what to expect in AGM season

- EPA Would See Highest Funding Ever Under Biden Budget Plan

- ESG Fund Assets Soared in 2021. They Still Have Room to Run.

- Shopify Puts Up Cash for Rooftop Carbon-Capture Machines, Tree-Planting Drones

- Auditors Assess Complex New Climate Disclosures

- What Companies Should Know Now About the SEC’s Proposed Rule on Mandatory Climate Disclosures—and How to Plan Ahead