Investors Take the ESG Hot Seat (Newsletter 9/3)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

Asset Managers on High Alert After DWS Greenwashing

The recent probe into DWS for issuing misleading information on its ESG integration has given fund managers a wake-up call. Asset managers are under the same level of pressure as companies – to disclose more operationally on ESG, with the SEC closely watching if they go over their skis. Peter Uhlenbruch, Head of Investor Standards at ShareAction said asset managers need to be “very careful when making bold claims about ESG integration.” This week, the Chairman of the SEC Gary Gensler confirmed that the SEC is diving into potential disclosure requirements pertaining to the ESG data and metrics funds use to select companies.

Climate Funds Failing to Reach Paris Agreement Goals

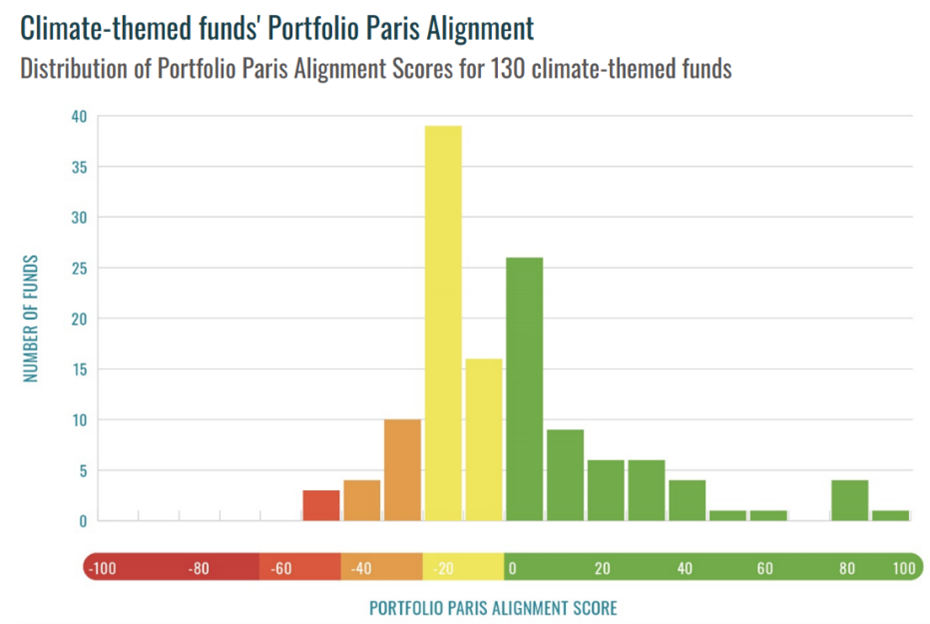

InfluenceMap, an international climate-focused think tank, published a report illustrating that over 50% of climate-themed funds are not aligned to the Paris Agreement goals. The report assessed a total of 723 funds – 593 of which were classified as general ESG funds and 130 of which were tagged as climate-themed. Only 58 of the 130 climate-themed funds had at least a 50% chance of aligning to a scenario limiting global warming to at least 1.75°C, shown in the graph below as funds with scores of 0 or higher.

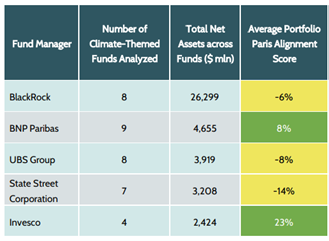

InfluenceMap also found that when looking at the five asset managers with the largest amount of net assets in climate funds, State Street was least aligned with the Paris Agreement goals, then UBS Group, followed by BlackRock.

UBS & MSCI Launch Sustainable Small-Cap ETF

The new UBS ETF (IE) MSCI World Small Cap Socially Responsible UCITS ETF will increase exposure to companies with strong sustainability profiles from the MSCI World Small Cap SRI Low Carbon Select 5% Issuer Capped universe. The screening will cover norms-based exclusions, for example, companies violating the UN Global Compact, value-based exclusions, as in tobacco and weapons, and climate-related exclusions, such as oil & gas and large emitters.

Goldman Sachs Acquires NN Investment Partners

In Goldman Sachs’ announcement to acquire NN Investment Partners from NN Group, Goldman Sachs emphasized the firm’s ranking as a top ESG manager in Europe, known for its strong ESG integration with over 75% of its assets considered ESG integrated. CEO of NN Group confirmed the approach on ESG will remain as is since Goldman Sachs has a similar commitment to responsible investing. The deal is expected to close at the end of the first quarter of 2022.

CalSTRS Commits to a Net Zero Portfolio by 2050

This week, CalSTRS Board announced it has committed to achieving net zero emissions across its portfolio by 2050 or sooner. It aligned with the science-based targets of the Paris Agreement and implemented a framework to meet the goal. As part of the plan, CalSTRS will increase investments in low-carbon solutions and engage with companies currently in its portfolio to promote a transition to net zero.

Company Spotlight

KPMG CEO Outlook Highlights

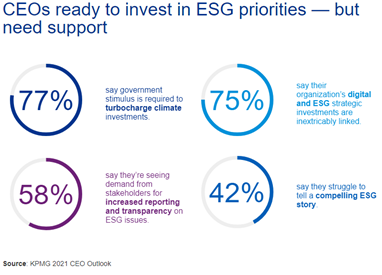

KPMG‘s 2021 CEO Outlook study utilized data from more than 1,300 CEOs globally to assess business leaders’ strategies and perspectives about the next three years. Key ESG findings from the study include:

- CEOs named supply chain, cyber security, and climate change as top risks to growth in the next three years

- 71% of surveyed CEOs believe CEOs will be held more responsible personally for making progress in on social issues

- 56% believe that they will struggle to measure up to DEI expectations, given the rapidly mounting societal, investor, and government expectations

- 30% of surveyed CEOs are planning to invest more than 10% of their revenues toward becoming more sustainable

- 75% say at COP26, international leaders need to create a sense of urgency for the climate agenda

AT&T to Aid Businesses in Reducing 1 Billion Metric Tons of GHG Emissions by 2035

With the launch of its Connected Climate Initiative, AT&T has set a goal to help companies reduce 1 billion metric tons of GHG emissions by 2035, which is the equivalent of about 15% of US GHG emissions in 2020. As part of its Connected Climate Initiative, AT&T is collaborating with Equinix, Microsoft, and Duke Energy as well as a variety of universities and organizations to provide broadband-enabled climate solutions internationally.

ADM Paves the Way for Carbon Neutral Flour

ADM, an American multinational food processing company, has achieved carbon neutrality for its U.S. flour milling operations by using its commercial carbon capture and storage facility to sequester carbon dioxide, improving energy efficiency, and purchasing renewable energy certificates. ADM is the first in its industry to have carbon-neutral milling operations and is timely considering last week Climate Action 100+ published released recommendations for investor engagements and expectations for the Food and Beverage industry.

Nike Dives into Carbon-Negative Sustainable Material

Nike is partnering with Newlight Technologies to consider the use of AirCarbon, a carbon-negative biomaterial produced by microorganisms in the ocean, in a range of applications. Ultimately, this partnership and move toward AirCarbon as a material align with Nike’s move toward zero carbon and zero waste and Nike’s 2025 Targets.

ESG Ratings & Reporting

MSCI’s Net Zero Hub

With the recent influx of news on upcoming regulatory movements related to ESG reporting, it’s tough to keep track of what will be enforced where and when. MSCI’s Net Zero Hub outlines the updates from all countries, sharing an organized table summarizing the climate-related regulatory and sustainability initiatives by location.

News Bites

- Iron Ore Giant Plans Carbon Targets for Customers in Green Pivot

- The Blind Spot: How ESG Matters Can Affect Current Accounting and Financial Reporting

- Cathie Wood’s Planned ETF Bets ‘Transparency’ Buzzier Than ESG

- Elevating ESG: Now is the time for fund managers to step up their reporting

- Solar Farm Financed by Corporate Carbon Offsets Breaks Ground

- Regulators Intensify ESG Scrutiny as Greenwashing Explodes