Investor-Backed ESG Frameworks You Need to Know About (Newsletter 8/27)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

A Rise in Shareholder Proposal Activity Related to Environmental Topics

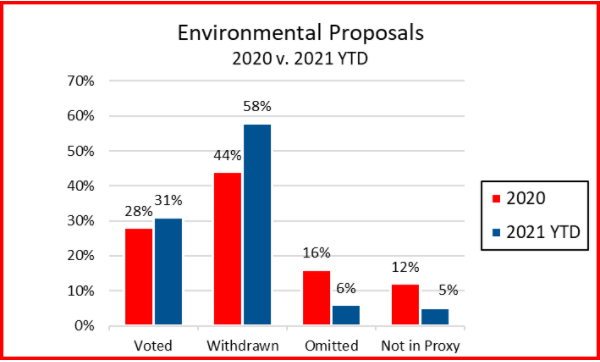

Harvard Law conducted a review of environmental shareholder proposals from the 2021 proxy season. The research found that 58% of environmental proposals submitted were withdrawn in 2021, an increase from 44% in 2020. The pullback occurred after companies engaged with shareholders over their concerns as many companies may have preferred to engage with the shareholder versus take the proposal to a vote. As You Sow withdrew 21 of the 41 environmental proposals submitted, and New York City Comptroller withdrew proposals at 5 companies. In total, 12 environmental proposals passed this year, 11 of which were climate-related, showing a jump from the 5 passed in 2020. This year, ISS supported 64% of environmental proposals, similar to the previous year. Excluding anti-ESP (environmental, social, and political) proposals, ISS supported proposals averaged 55% support, while proposals without ISS support only received 15% of votes.

Climate Action 100+ Makes Food & Beverage its Latest Focus

Climate Action 100+, a climate change-focused investor initiative representing 600+ investors with over $55 trillion in assets, has released recommendations for investor engagements and expectations for the Food and Beverage industry. These recommendations outline actions that are crucial for the industry to take in order to speed the transition to a net zero economy. The report recommends that investors expect corporations to:

- Integrate supply chain climate action into corporate decision-making processes and procurement policies

- Incentivize and support agricultural producers to reduce the climate impact of crop and livestock production and enhance agricultural carbon sequestration

- Align capital expenditures, product development, and R&D with a 1.5-degree scenario

- Transition to more efficient and renewable energy use and transportation across operations, distribution, and supply chains

- Improve processing, manufacturing, and packaging practices to reduce emissions and food loss

- Partner with peers, suppliers, and policymakers to drive transformations across the sector

Deutsche Bank’s DWS Probed over ESG Efforts

Following previous allegations from the former Chief Sustainability Officer, U.S. authorities are looking into DWS’ sustainability claims. In its annual report, DWS said over half of its $900 billion assets were invested by using ESG integration, however, an internal review a month prior revealed only a fraction of the investments underwent the process. The probe shows the SEC’s interest in institutions’ ESG practices, a sign that may indicate looming regulation on ESG disclosures not only for corporate issuers, but also for investors, especially related to ESG integration processes impacting investment decisions.

Morningstar’s CEO Welcomes ESG Regulation with Open Arms

In an interview with Financial Times, Kunal Kapoor, CEO of Morningstar, which owns Sustainalytics, discussed the upcoming changes to ESG reporting. He said every year disclosures are increasing as investors are demanding it and companies are responding and improving internal programs. Based on Morningstar’s data, he shared companies in the U.S. are only reporting two-thirds of their material ESG issues, and he believes SASB and TCFD will be the starting point for mandatory disclosures. When asked about potential regulations on ratings, his response was positive noting that even if the costs go up, the additional attention to the space is better in the long term. As for next steps, Morningstar is looking to expand its climate data offerings.

Moody’s Launches SDG Screening Tool

Yesterday, Moody’s ESG Solutions announced the release of its new data solution that allows investors to align investing strategies with the UN Sustainable Development Goals (SDGs). The tool gives investors the data needed to apply the SDGs to risk management and reporting frameworks. In the screening process, investors can see the SDG contributions a company makes through its products and services as well as the company’s impact on the SDGs through management and stakeholder relations. Currently, the solution covers 5,000 companies with over 300 data points.

Company Spotlight

The Industries Adopting ESG Metrics

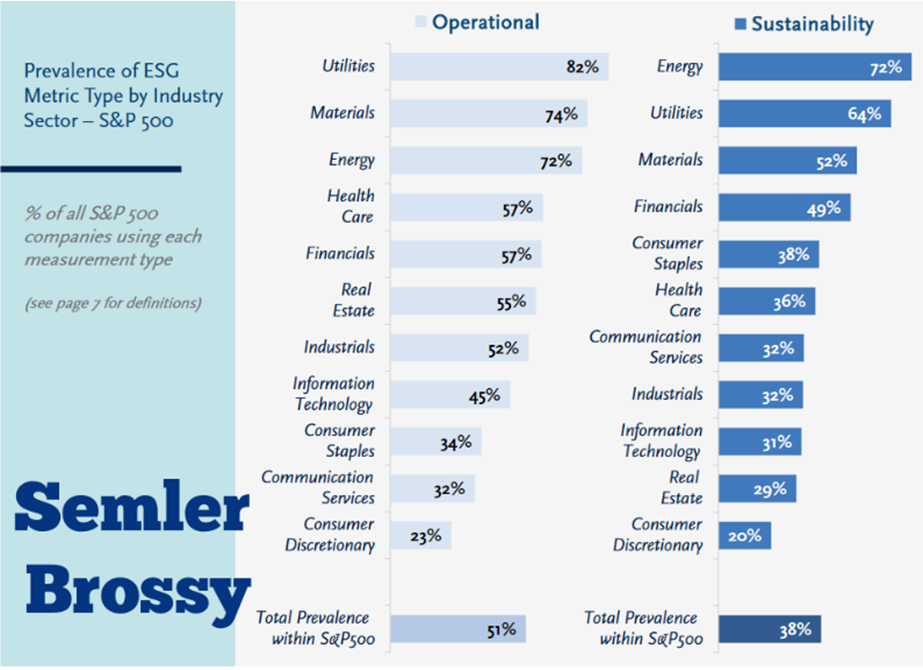

In the ESG + Incentives Report, Semler Brossy dove into the S&P 500 companies using ESG metrics in compensation. The report focused on operational metrics, such as safety, customer satisfaction, and talent, and sustainability metrics, including environmental topics and diversity & inclusion. The study found that 51% of the companies in the S&P 500 include operational metrics in executive incentive programs and 38% include sustainability metrics. Of particular interest, Energy, Utilities, and Materials companies had the highest prevalence of ESG metrics. Environmental metrics, which are less common, were most prominent in these three industries. Diversity & Inclusion was the most common metric across the board, showing up in the top three metrics for 9 out of the 11 industries.

Sanderson Farms Opens Up About SASB Alignment

Sanderson Farms is the first company to report in alignment with the Meat, Poultry & Dairy SASB Standards. In a Q&A with the Value Reporting Foundation, Lee Southwell, Manager of External Financial Reporting at Sanderson Farms, discussed the decision to report aligned with SASB, getting internal buy-in, and investor feedback. The primary driver of adopting SASB was engagement with top shareholders, namely, BlackRock and Vanguard, and the internal push came from the C-suite. Since reporting, the agriculture company has received positive feedback from investors.

Lululemon Leverages Partnership for Sustainable Material Sourcing

Lululemon is partnering with Genomatica, a biotechnology company specializing in sustainable materials. Together, the two will develop a plant-based nylon that has a lesser environmental impact and will replace the conventional nylon currently used in lululemon’s products. This collaboration and investment in Genomatica demonstrates lululemon’s commitment to accomplish its Impact Agenda, including the company’s goal for 100% of its products to include end-of-use solutions and sustainable materials by 2030.

Apple Announces 15 Black- and Brown-Owned Businesses Participating in its Impact Accelerator

Apple’s Impact Accelerator, which is focused on supporting Black- and Brown-owned businesses that are working on climate solutions, has welcomed its first class of businesses. These businesses focus on topics ranging from energy efficiency to green chemistry and, as part of the Impact Accelerator, have direct access to partnership opportunities with Apple and customized training, among other resources. Not only is the Impact Accelerator part of Apple’s $100 million Racial Equity and Justice Initiative, but it will allow these companies to be considered as suppliers for Apple and aid Apple in becoming carbon neutral across its products and supply chain by 2030.

Google Launches 24/7 Carbon-Free Energy Compact

Google, in partnership with the international organization Sustainable Energy for all (SeeforALL), is creating the 24/7 Carbon-free Energy Compact, which aims to bring together an international coalition of businesses, governments, and stakeholders to collaborate and take the actions necessary for full decarbonization. In line with this compact, by 2030, Google aims to operate all of its offices and data centers globally on carbon-free energy.

ESG Ratings & Reporting

Nasdaq’s Board Diversity Disclosure FAQ

Since releasing the Board Diversity Requirements for listing companies, Nasdaq has received questions from issuers. Within the Listing Center, Nasdaq has provided a growing FAQ in response to the large volume of inquiries from companies. The questions have been related to timing, double-dipping diversity objectives from a single director, exemptions for newly listed companies, and seeking more details related to the rule.

Featured Article: Worried About New TCFD-Reporting Mandates? Here’s Everything You Need to Know Now

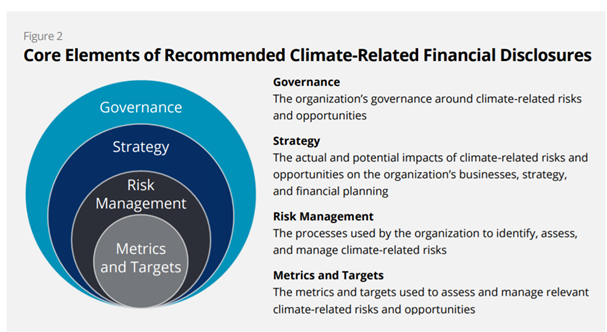

The Task Force on Climate-related Financial Disclosures—better known as TCFD—is an old framework with a new mandate. Or, more accurately, several new mandates. The Task Force was formed back in 2015 and TCFD-recommend disclosures first became public in 2017. But the topic is getting more attention today than ever before and is now frequently found at the top of board agendas, due in large part to regulatory momentum and global investor pressures.

If you’re giving TCFD some serious consideration for the first time—or even if you’re elbow-deep in the process—you’ve no doubt got questions. What exactly is TCFD? How is it different from or aligned with other ESG frameworks? Who endorses it? And, perhaps most importantly, how do you get started?

Click here to continue reading and learn more about TCFD reporting and what investors and regulators are saying about the framework.

News Bites

- Gas Producer’s Net Zero Pledge Challenged in Court by Activist

- SEC Weighs Requiring Companies to Give More Details on Workers

- ESG Reporting: 5 Climate Disclosure Considerations

- Singapore Exchange Plans Mandatory Climate-Related Disclosures

- How companies can future-proof materiality assessments

- Where to Start When Considering a Climate Pledge