How Many Companies Use SASB? (Newsletter 3/26)

Sign up for The ESG Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

BlackRock Gives More Direction on Sustainability Reporting

Based on Larry Fink’s January 2021 public letter, nothing in its 2021 Engagement Priorities document is much of a surprise (think board oversight and diversity, SASB alignment, etc.) However, we admit that the ask for KPI’s around how effectively a company integrates sustainability risks and opportunities into its long-term strategy and financial resilience commentary did raise an eyebrow. BlackRock cites that companies with a clearly articulated purpose that is reflected in the long-term strategy are more likely to have engaged employees, loyal customers, and support from other key stakeholders, thus giving a competitive advantage and a stronger foundation for generating superior financial returns.

BlackRock also released further guidance on Natural Capital and Human Rights. Specific additions for each are outlined below.

- Human rights: Asks companies to provide evidence of board oversight, due diligence, and remediation of adverse impacts to people arising from their business practices. BlackRock is prioritizing engagement with companies whose business practices have breached international norms set forth by UN Guiding Principles on Business and Human Rights and OECD Guidelines for Multinational Enterprises.

- Natural capital: Encourages companies to disclose how their business practices are consistent with sustainable use and management of natural capital, including natural resources such as air, water, land, minerals, and forests, and companies’ impact in communities in which they operate. For companies with material dependencies or impacts on natural habitats, the institution requests “no-deforestation” policies and strategies on biodiversity.

Finally, BlackRock shared expectations around ESG metrics in compensation. Notably, the institution is pushing companies to disclose how incentive plans coincide with strategy and include performance metrics, both on a short-term and long-term basis.

Investors Are Behind on Decarbonization

Robeco released results from the 2021 Global Climate Survey about how investors are approaching opportunities and risks associated with climate change. The respondents covered 300 of the world’s largest institutional and wholesale investors representing around $23.4 trillion in AUM. Almost three-quarters of investors said climate change is already a significant factor in investment policies. Only 17% of investors surveyed have already set a net zero target, but in North America and Europe more than 60% of investors expect to adopt a zero-carbon target within next 5 years. However, 45% of the North American investors cited lack of data and internal expertise on decarbonization as the biggest hurdles.

Company Spotlight

Q&A with 3M

This week, Sustainable Brands interviewed 3M’s VP and Chief Sustainability Officer Gary Schueller on setting sustainability goals. As the company recently shared climate goals including carbon neutrality by 2050, Schueller explained the company sets environmental goals based on science, confirming the company would not set goals that it does not believe are achievable. 3M conducts materiality assessments every two years to identify what stakeholders view are the company’s highest risk areas. Lastly, Schueller spoke 3M’s heightened efforts around DEI, including the release of an inaugural Global Diversity, Equity, & Inclusion Report.

Proposal Seeks Climate-Lobbying Report

As You Sow, Calvert Research and Management, and Illinois State Treasurer Michael Frerichs filed a proposal seeking a climate-lobbying report from Sempra Energy. The shareholders are requesting to know if Sempra’s lobbying activities align with the Paris Agreement, and if not, what the company is doing to mitigate the risks. They note Sempra lags peers in terms of sustainability commitments and invests in GHG-intensive natural gas assets, posing a risk to the company, and also adds volatility to investor portfolios. The SEC denied Sempra’s request for no-action relief.

Featured CSR: Forward Air

Forward Air published a solid “starter” report, with 26 pages total. At the beginning of the report, it announces revisions to the Corporate Governance & Nominating Committee Charter to include oversight of ESG matters, risks, and opportunities. On page 6, the company mentions it conducted a materiality assessment, using SASB standards as a guide. While Forward Air falls under the Airfreight and Logistics industry, the company decided to incorporate Road Transportation industry topics as well. As a result of the assessment, Forward Air identified its 10 ESG priority areas. Although the report does not show alignment with any frameworks, it calls out CDP, SASB, and GRI and notes it plans to incorporate metrics from the frameworks in the future.

Getting Graphic in CSRs

Investors care about E and S related KPIs and quantitative targets, yet simply providing this information without considering its presentation is not enough. E and S information contained in CSR reports, press releases, or ESG websites should not just be part of an unending sea of words. To catch investors’ attention and adequately alert them to your company’s ESG progress, consider using fresh, visually appealing graphics. Graphs, charts, and illustrations not only to ensure that your ESG achievements are noticed, but that investors can easily understand the data and see your company’s progress. Below are a few examples that have grabbed our attention.

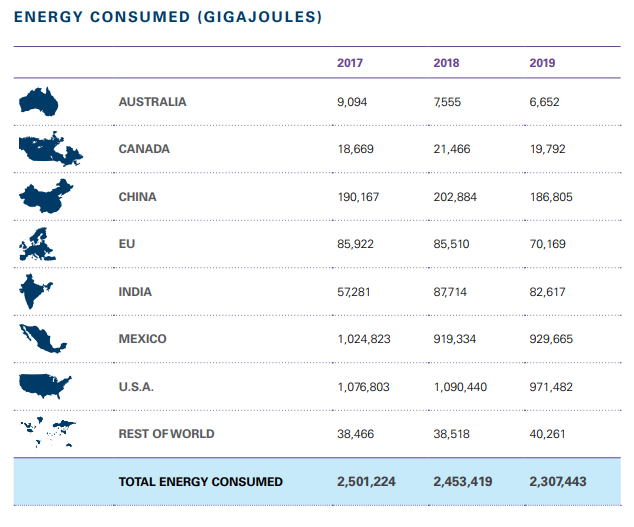

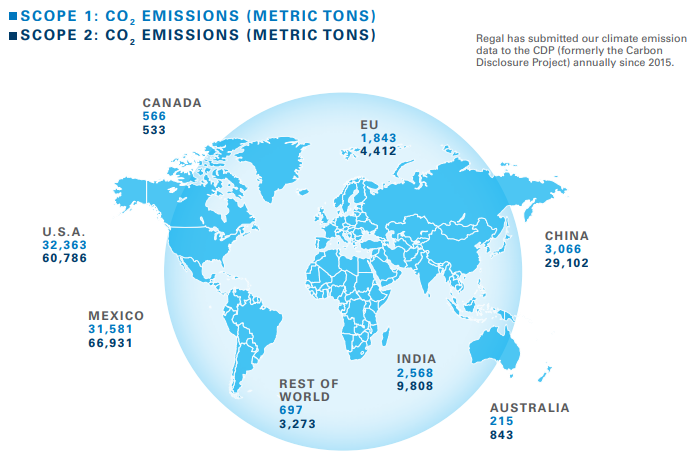

Regal Beloit utilizes engaging graphics to make its energy and consumption data, which spans multiple years and different countries, easy to grasp and interesting to look at. (See pages 33-34)

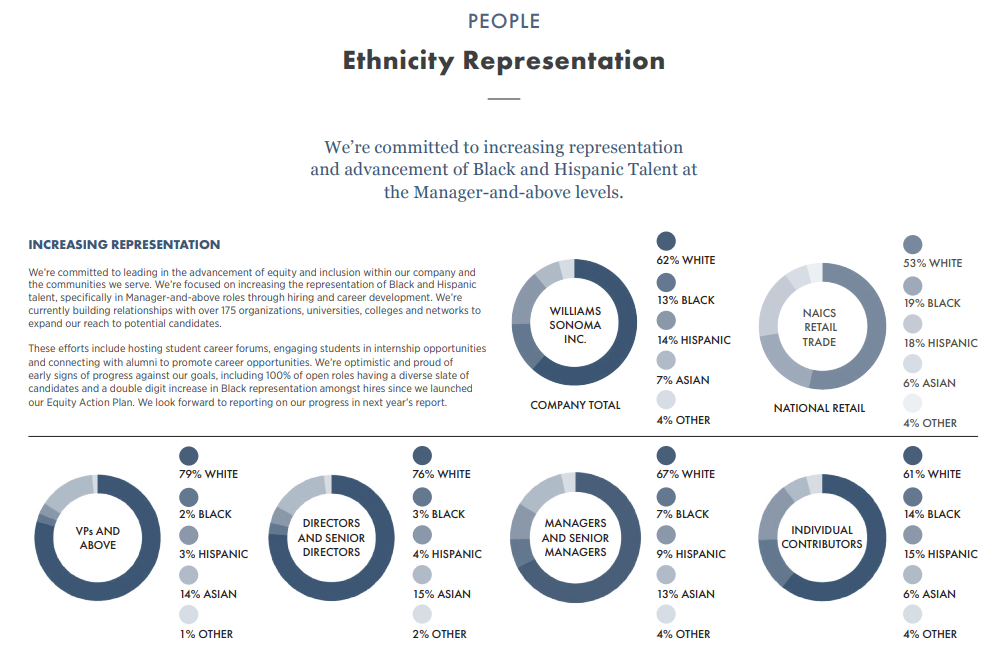

Williams-Sonoma dedicates ample space in its Corporate Responsibility Scorecard to disclose ethnic and gender diversity in a way that is visually appealing and easy to understand, yet still detailed. (See page 28)

For more examples, read the blog post here.

Regulatory News

The SEC’s New ESG Webpage

Citing an increase in demand for information, the SEC has launched a new ESG investing resource on its homepage and included easy access to add your company’s voice to the ongoing comment period on climate change reporting changes.

Ratings & Frameworks

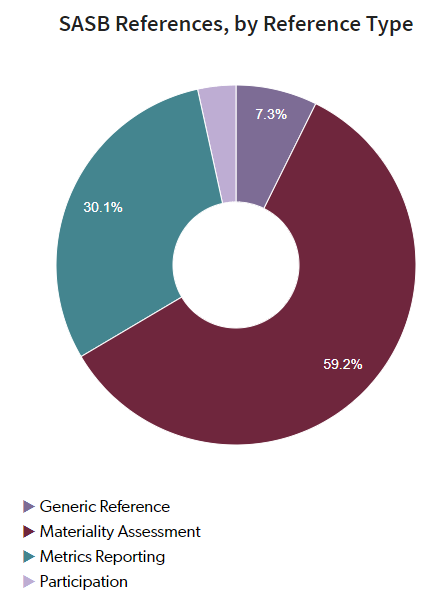

SASB Implemented Globally

More than one half of all public companies in the U.S. either reported aligned with, or in reference to, SASB standards. This is almost a tenfold increase from 2017 when there were roughly the same number of public companies. This, plus Larry Fink and BlackRock’s continuing endorsement of SASB as a “starter framework” makes it tough to understand companies that remain silent on the framework. While the U.S. accounts for about 55% of the SASB reporters, Canada makes up 10% and the rest are spread among Asia, Europe, Latin America, the Middle East, and the UK.

Referencing SASB versus reporting aligned with the standards is most commonly done in conjunction with materiality assessments. Companies use the SASB standards as a starting point for material topics to include in the assessment. Using SASB standards for materiality assessments beats the actual adoption of the standards by almost 30%.

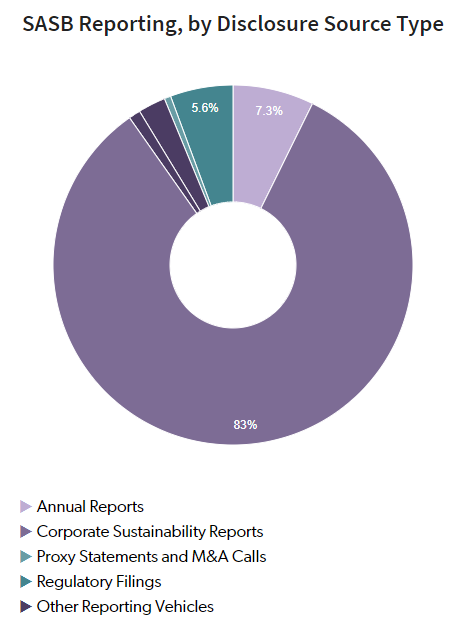

For companies that do fully adopt the standards, the overwhelming majority are disclosing their SASB index within a CSR.

News Bites

- Why Sustainable Investors Should Keep an Eye on the SEC

- Powerful investor group finds net zero pledges distant and hollow

- IFRS Launches Sustainability Reporting Working Group with Leading Standards Bodies

- Chevron Reinforces Plan to Deliver Higher Returns, Lower Carbon

- GRI Looks to Improve Human Rights Transparency in Sustainability Reporting Standards

- Climate Action 100+ Releases Net Zero Benchmark, Reveals Significant Work Ahead for Major Emitters

- Mastercard ties top executives’ compensation to ESG goals