ESG Shareholder Proposals Are Up 22% This Year (Newsletter 3/18/22)

Sign up for The Infinite Minute to receive the top news impacting corporate ESG reporting.

Proxy Season Briefing

Carbon Neutrality Isn’t Enough: Investors Want Science-Based Targets

Concerned about the rise in UPS’ delivered emissions and the company’s lack of transparency around its carbon neutrality goal, Trillium Asset Management, Green Century, and Zevin Asset Management have filed a shareholder proposal encouraging UPS to establish science-based targets. UPS currently has a goal to be carbon neutral by 2050 and includes interim deadlines for achieving this goal, however, investors expect a greater level of detail and transparency than UPS has provided.

U.S. Oil & Gas Companies Face New Proposals to Reduce Emissions

Activist group Follow This has proposed a shareholder resolution that would require major oil and gas companies set goals consistent with the 2015 Paris Agreement, obligating them to reduce emissions 50% by 2030. Past proposals by the group to “substantially reduce greenhouse gas emissions” saw strong support from shareholders of Chevron, ConocoPhillips, and Phillips 66. The new proposals will be a test of shareholder support for climate initiatives amid rising oil prices and calls for greater energy security.

Investors Urge Starbucks to Adopt Neutral Stance on Unionization

A group of 75 investors are urging Starbucks to take a neutral stance on its employees’ attempts to unionize. The group, representing $3.4 trillion in assets and $1.2 billion in Starbucks stock, cites the potential for reputational damage if the company opposes employees’ efforts to organize. The group is specifically concerned about the alleged retaliatory measures taken against employees after unionizing at 5 locations in Buffalo, NY. The group wrote in a letter to Starbucks that the benefits of supporting worker’s rights “may include lower turnover, more resilient and risk-tolerant operations, more effective feedback loops, higher employee satisfaction and productivity.”

Investor Updates

Investors Publish Standard for Corporate Lobbying

This week, a group of investors representing over $130 trillion launched the Global Standard on Responsible Climate Lobbying. The 14-point plan encourages companies to commit to responsible climate lobbying and support the goals of the Paris Agreement. The WSJ reported that so far this year, U.S. shareholders have filed 46 proposals related to lobbying, with almost half requesting proof that the company’s climate lobbying was in alignment with the Paris Agreement, according to research from Ceres. BNP Paribas Asset Management and the Church of England Pensions Board participated in developing the standards.

ESG Ratings & Reporting

Most Companies Don’t Have Adequate Resources to Report ESG Data

Deloitte conducted a survey on ESG preparedness, disclosures, and reporting. The respondents were comprised of 300 finance, accounting, sustainability, and legal executives at U.S. public companies. Highlights from the survey are as follows:

- Only 21% of respondents have an ESG council in place, while 57% are actively in process of establishing one

- 82% of respondents think they will need additional resources to generate ESG disclosures that meet the needs of critical stakeholders

- 92% of respondents said their organization needs to invest more in technology to address demand for consistent and reliable measurement, reporting, and disclosures

- About 75% of respondents plan to obtain assurance over ESG disclosures in the next reporting cycle

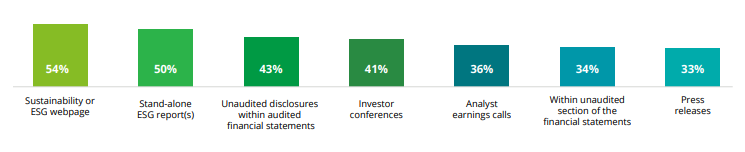

- Most respondents (54%) report ESG through ESG webpages followed by ESG reports (50%)

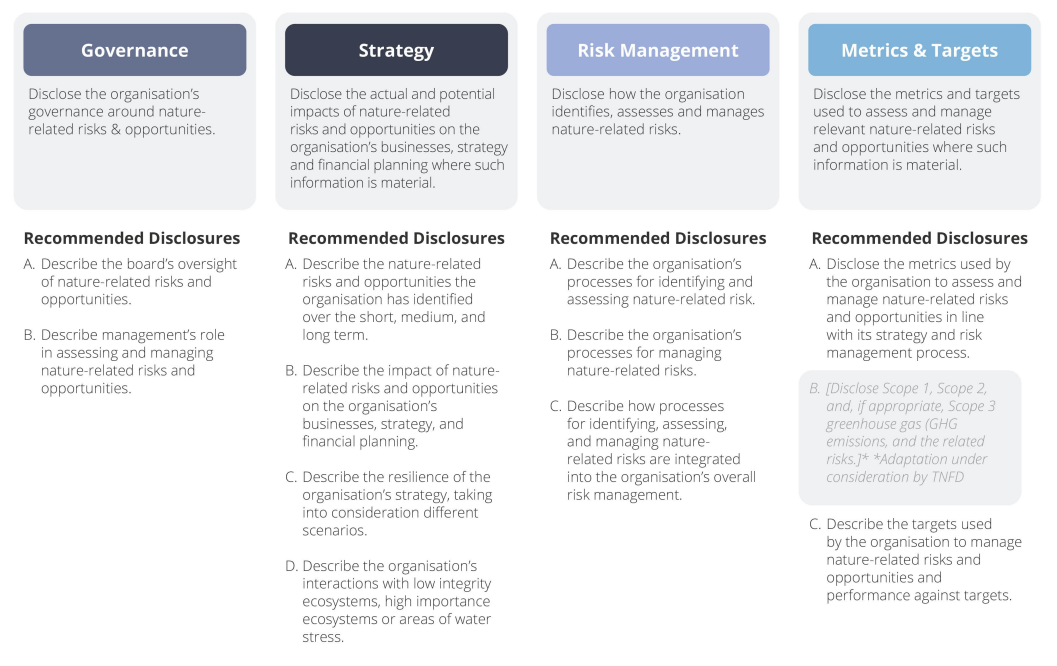

TNFD Releases Beta Framework

The Taskforce on Nature-Related Financial Disclosures (TNFD) released the first version of its reporting framework issuing guidance for identifying risks and opportunities for biodiversity. The goal of the TNFD is to integrate the requested nature-related disclosures with other environmental disclosures. It was modeled after TCFD, adopting the same pillars, and is designed to also align with the International Sustainability Standards Board (ISSB) framework, which is expected to release in June. The recommended disclosures are shown below.

Company Spotlight

Aviation Sector Encouraged to Reduce Emissions Versus Offsets

Climate Action 100+, a climate change-focused investor engagement initiative, published a report detailing how the aviation industry can align with a 1.5°C scenario and how investors can advance the industry’s net zero transition. According to the report, alignment with a 1.5°C pathway would require scaling up sustainable aviation fuel (SAF) usage rapidly, curbing increases in air travel, and diverting demand to high-speed rail infrastructure as much as possible. Another key focus of airlines should be working to reduce their own emissions rather than utilizing carbon offsets to achieve their goals. Investors can help facilitate this change by encouraging airlines to set aggressive short-, medium-, and long-term targets related to their SAF usage and disclose how their lobbying relates to policies that would reduce the industry’s emissions.

Target Unveils New Solar-Powered Store

Target is testing a new type of store that produces more energy than it uses. The prototype store has solar panels installed across the entire roof, uses natural carbon dioxide refrigeration, and has eliminated the use of natural gas for heating. The location is expected to generate a 10% annual energy surplus which can be sold back to the power grid. With its new experimental store, Target is demonstrating how operational changes can dually benefit the climate and the bottom line.

Regulatory Updates

DOL Proposes Amendment to Fiduciary Duties to Allow ESG Investing

The U.S. Department of Labor is investigating the effect of climate risk on retirement savings. Current fiduciary rules require Employee Retirement Income Security Act of 1974 (ERISA) retirement plans to only consider ESG when it is material to an investment and may not make investments on thematic or political grounds. A proposed rule regarding “Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights” may ease these restrictions on ERISA fiduciaries, allowing them to consider broader ESG factors when making investment decisions.

More to Know…

SEC Commissioner Allison Herren Lee is stepping down in June.

Reuters reported that shareholders have filed a whopping 529 resolutions related to ESG issues so far this year, up 22% from the same time last year.

GRI releases its Sector Standard for Coal, the second sector-specific standard released by the organization.

An email with BlackRock and a Texas oil and gas regulator leaked, revealing BlackRock may have backpedaled on its climate commitments.

Ready for the cybersecurity disclosure rules? Here’s how you can start preparing.

News Bites

- GE Cuts Larry Culp’s 2022 Pay After Shareholder Protest

- Biden’s Greenhouse Gas Climate-Cost Rules Restored, for Now

- Climate Group Prepares Legal Action Against Shell Directors

- Most Middle-Market CFOs Believe ESG Strategy Will Improve Financial Growth

- Corporate Venture Investors Boost Climate-Tech Spending

- Billionaire Investor Predicts Energy Crisis Will Spur Green Spending Boom