ESG Mutual Fund Inflows Tick Back Up (Newsletter 7/9)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

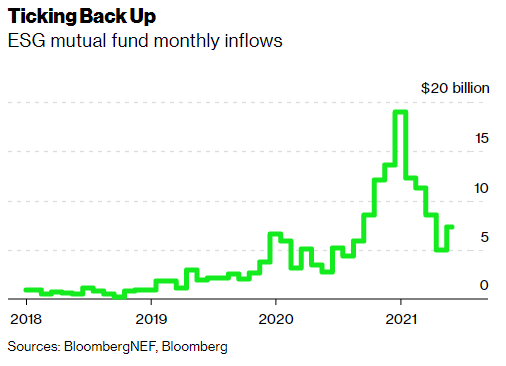

ESG Mutual Fund Inflows Rise

According to Bloomberg, in June ESG mutual funds saw the first uptick of inflows this year. The inflows for the first six months of 2021 were over $63 billion, and total assets for responsible investment funds in the U.S. were up to $1.007 trillion at the end of March (Refinitiv).

Asset Managers Committed to Net Zero Surpasses $40 Trillion AUM

Earlier this week, 41 new signatories joined the Net Zero Asset Managers initiative. After launching in December of 2020, the initiative now has 128 signatories totaling over $43 trillion in AUM. New signatories include Amundi, Brandywine, ClearBridge, Franklin Templeton, GAM Investments, HSBC, MFS Investment Management, and Willis Towers Watson, among others. Does this mean investors are about to go on a divesting spree? Not necessarily. As part of becoming a signatory, investors commit to engagement and stewardship as key components of their decarbonization strategy in alignment with the net zero goals they have set. However, this commitment may lead to decisions against allocating capital to high carbon investments.

ESG Labeled a Critical Factor in Investing & M&A

In a survey conducted by Acuis and Baker Tilly, ESG was found to be a critical factor in investment or M&A opportunities, as noted by 65% of dealmakers surveyed. Additionally, 60% of respondents said they have walked away from a deal because the target did not perform well enough in ESG assessments. As both companies and investors are increasingly interested in improving ESG performance, this trend is likely to persevere, especially since 52% of participants responded saying their ESG investment strategy positively impacted returns.

In another survey, Schroders Institutional Investor Study, of the North American investors that participated, 41% said COVID-19 has significantly impacted the role of sustainable investing within their organization. While more investors are seeking ESG-related information, many find it challenging to decipher true green investments as almost 60% of global investors surveyed responded they are worried about greenwashing.

Banks Join Forces for Sustainable Nutrition Fund

Credit Suisse and JPMorgan are developing a sustainable fund that will invest in public companies that address nutrition, healthy, biodiversity, and climate and focus on nutrition from a societal and environmental viewpoint. The fund is expected to launch by the end of the year. The banks note the new investment strategy will strive to deliver financial and purpose-driven outcomes while building lasting portfolio value. Earlier this year, Credit Suisse was in talks with BlackRock to develop another line of sustainable investment products.

AMG Acquires Parnassus

Affiliated Managers Group (AMG) bought a majority interest in Parnassus Investments, a leader in sustainable investing with about $47 billion AUM. AMG’s stock surged at the news, rising about 7% on July 6th. Following the investment, AMG’s ESG-dedicated assets come to about $80 billion, while assets incorporating ESG will total $600 billion. The release notes that Parnassus’ investment process will not change.

Regulatory Updates

SEC: More Diversity & Inclusion Disclosure for Asset Managers

Pending further approval, a rule change recommended to the SEC by an advisory subcommittee would require asset managers and fund boards to disclose gender and racial diversity information on the workforce, officers, and owners. According to Gilbert Garcia, the subcommittee chair, specific disclosure requirements have not been recommended, rather the subcommittee believes that more data, in general, should facilitate greater diversity. Gensler asked the staff to consider disclosure to improve diversity and inclusion in the asset management industry.

Additionally, Gensler said he would potentially set sustainable fund disclosure requirements, particularly the criteria and data used. He stated the possible new rules for funds would complement the climate change risk disclosure requirements for public companies, which will likely be released in October.

Company Spotlight

Retailers Support Race to Zero

This week, big name companies including H&M, Ingka Group (IKEA), Kingfisher plc, and Walmart partnered to launch the Race to Zero Breakthroughs: Retail Campaign. The companies committed to speeding up changes within the retail industry and encouraging more companies to set reduction targets in alignment with the Paris Agreement. Retailers can join the campaign by setting science-based targets that will halve greenhouse gas emissions by 2030 and reach net zero by 2050. The campaign was launched in partnership with COP26 High Level Climate Action Champions and World Business Council for Sustainable Development.

Pepsi Co Emphasizes Progress in Achieving Sustainable Food System

Pepsi’s Goals & Progress webpage covers the company’s key issue areas – agriculture, water, product, packaging, climate, and people, and shares a pop-up window with updates on the goals and metrics, by date, and progress for each, including SDGs tied to the topic. In the Sustainability Metrics Performance report, Pepsi provides performance metrics and progress towards previous goals, as well as sets new goals for 2025 and 2030, including:

- Design 100% of packaging to be recyclable, compostable, or biodegradable by 2025

- Improve water-use efficiency by 15% in the agricultural supply chain in high water-risk areas by 2025

- Reduce Scope 1 and 2 absolute GHG emissions by 75% by 2030

- Reduce Scope 3 absolute GHG emissions by 40% by 2030

- Achieve gender parity by 2025 in management roles

Steel Dynamics Announces 2050 Carbon Neutrality Goal

For its electric arc furnace (EAF) steel mill operations, Steel Dynamics now aims to be carbon neutral by 2050. For interim reductions across its EAF steel mills, Steel Dynamics is targeting a 20% Scope 1 and Scope 2 combined GHG emissions intensity reduction by 2025 and a 50% reduction by 2030, from a 2018 baseline. As well, Steel Dynamics intends to increase its renewable electrical energy use for EAF steel mills to 10% by 2025 and 30% by 2030.

News Bites