ESG Is Now Boards’ Top Priority (Newsletter 11/12)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

COP26

Not Everyone Is on Board with Cutting Car Emissions

The Glasgow Declaration on Zero Emission Cars and Vans was unveiled at the COP26 climate summit amid criticism from some global automakers. The proposal would eliminate new car emissions by 2040. The proposal was signed by two of the largest U.S. car manufacturers, Ford and General Motors. Other notable signatories include Volvo, Mercedes-Benz, Jaguar Land Rover, Germany’s Daimler, China’s BYD, India’s Tata Motors, as well as Uber. While these commitments represent a sizeable portion of the global auto market, still, holdouts remain. The largest automakers in the world, Toyota and Volkswagen, as well as other notable OEMs like BMW, Stellantis, Honda, and Nissan remain on the sidelines.

The two largest car markets in the world, the U.S. and China, also did not sign the proposal. Yet, according to data from the International Energy Agency showed, about a quarter of global emissions come from transportation, mostly from road vehicles. The lack of commitment now calls into question the timeline for global auto emissions reductions and could jeopardize broader climate goals.

ESG Ratings & Reporting

ISS Initiates Open Comment Period for 2022 Policy Changes

Last week, ISS proposed a set of new policy changes for the upcoming 2022 proxy season. The open comment period is held through November 16th, 2021 at 5:00pm EST. For a summary of the changes proposed by ISS, click here.

Moody’s Shares Sector-Level Positioning Towards Net Zero Emissions

Moody’s released an update on the unevenness of the decarbonization landscape, calling out differing levels of preparedness among industries. While the global race to achieve net zero is accelerating, many critical sectors lag in their efforts to reduce emissions. Roughly half of companies scored by Moody’s are not well-positioned for a rapid transition to a low-carbon economy. The automotive and utilities sectors show promise while the oil and gas and metals and materials industries are the biggest laggards. Moody’s cites reduced default risk and increased industrial competitiveness as benefits to those companies that take aggressive climate action, while delayed action could cause the most exposed sectors to face probabilities of default well above their highest recorded values in over 30 years.

Common Themes within U.S. Sustainability Reports

Harvard Law reviewed over 200 sustainability reports from 11 different sectors to identify trends and best practices for sustainability disclosures. They found inconsistency in all aspects of sustainability reporting, from naming conventions to the data that is included in each report. However, themes from the reports are as follows:

- The average report length was 70 pages, out of a range of 12-243 pages

- Nearly 100% of reports had a letter from the CEO indicating oversight of sustainability issues at the executive level

- Nearly all reports had employee demographic data

- Roughly 1 in 4 had highlights and recent achievements at the beginning of the report

- 3 in 4 reports contained a data table somewhere in the report

The article concludes that all sustainability reports should align with a framework like TCFD or SASB, should use consistent language, should include accurate data and metrics, and should describe the mechanisms for ESG oversight within the company.

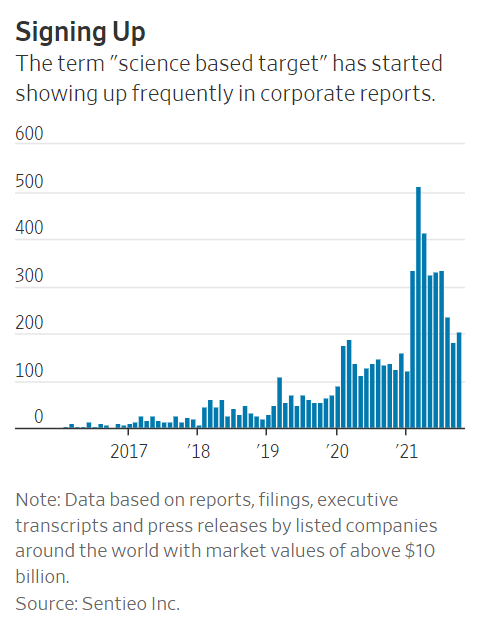

SBTi Can’t Keep up with Demand

The Science Based Targets initiative (SBTi) has received higher demand from companies seeking SBTi-approved emissions targets, which add credibility to corporate climate commitments. It formed in 2014 when environmental groups including the World Resources Institute, the World Wide Fund for Nature, CDP, and the UN Global Compact joined together to add structure to corporate carbon emissions targets. Last week, SBTi raised $37 million which will be attributed to expanding the organization’s capacity and potentially developing software that will allow companies to track progress. SBTi has approved targets of 1,006 companies and has 1,116 companies in the pipeline. In January, the organization said companies with approved targets reduced emissions by 25% since 2015, ahead of the pace needed to align with the Paris Agreement. SBTi charges $9,500 in an effort to be widely accessible.

| Source: The Wall Street Journal |

Company Spotlight

ESG Permeates the Boardrooms of the S&P 500

The U.S. Spencer Stuart Board Index 2021 report discusses the most recent trends in board composition, board organization and process, and board director compensation for S&P 500 companies. Notably, almost a quarter of the S&P 500 expanded their board size to meet the increased demand for more diverse boards. A few highlights on improvements in diversity at the board-level are as follows:

- 30% of all S&P 500 directors are women, although only 8% serve as board chairs or lead directors

- Only 4% of the S&P 500 have just one woman on the board

- 92% of the S&P 500 have at least one racial/ethnically diverse director

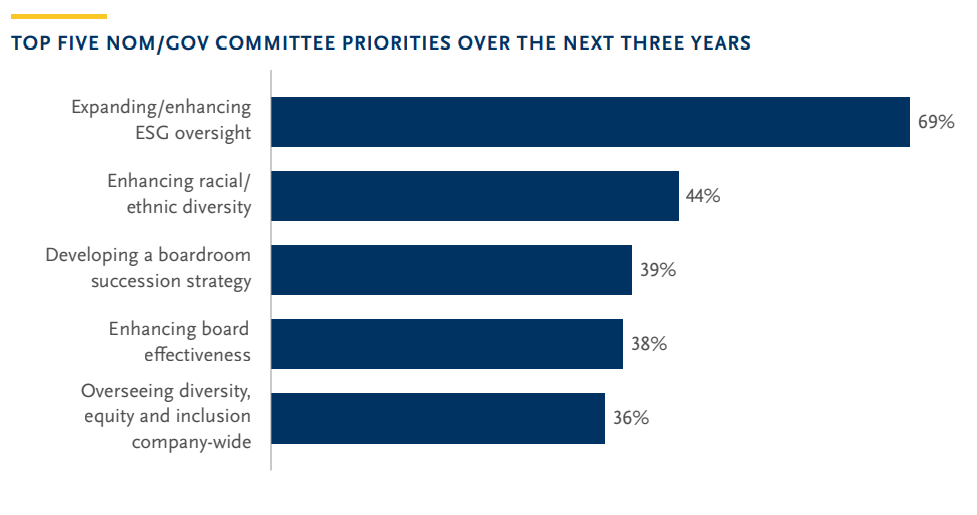

The report also includes a survey of nominating/governance committee members that reveals the top priorities over the next three years for boards, which are listed in order below:

- Oversight of ESG initiatives

- Racial/ethnic diversity

- Succession planning

- Enhancing board effectiveness

- Diversity equity, and inclusion (DEI) oversight

Further, recruiting is another priority for the nominating/governance committee members, and the priorities in order are as follows:

- Underrepresented groups

- Global perspective and experience

- Technology experience

- Financial experience

- Operational experience

Ralph Lauren Announces Support for U.S. Climate Action

Ralph Lauren has published a statement on climate change that calls for action far beyond its own operations. The statement includes Ralph Lauren’s own initiatives to achieve net zero GHG emissions across its value chain by 2040 and recognizes the need for action from governments, companies, and consumers around the world. The company supports investments towards a lower-carbon economy through the establishment of a clean electricity standard and placing a price on carbon emissions.

Medtronic Shares Decarbonization Roadmap to Net Zero by 2045

Corresponding with COP26, Medtronic has released an updated commitment to achieving zero carbon emissions which now covers its entire value chain. Medtronic’s previous commitment was ambitious—zero emissions from operations by 2030—but now includes all aspects of the business. In accordance with the SBTi, the new policy commits to net zero carbon emissions across the entire value chain by 2045. The new proposal commits to reductions in Scope 1, 2, and 3 emissions, with Scope 1 and 2 to be cut first. Medtronic’s Decarbonization Roadmap cites renewable energy use, logistical improvements, and sustainable sourcing as the primary instruments for emissions reductions.

Investor Update

BNPP AM Expands Sustainability Team

BNP Paribas Asset Management (BNPP AM) made 5 new hires to its “Sustainability Centre,” boosting its ESG capabilities. Jane Ambachtsheer, global head of sustainability at BNPP AM said the expansion of the team supports the institution’s goals to accelerate thematic investing and continue to be a leading sustainable investor. Rachel Crossley, newly appointed head of stewardship, is based in London and will report to Michael Herskovich, global head of stewardship. The rest of the hires listed below will report to Alex Bernhardt, global head of sustainability research.

- Malika Takhtayeva – sustainable fixed income lead, based in London

- Thibaud Clisson – climate change lead, based in Paris

- Robert-Alexandre Poujade – biodiversity lead, based in Paris

- Delphine Riou – inclusive growth lead, based in Paris

Featured Article: Defining Scope 1, 2, and 3 Emissions

Certain asset managers, such as BlackRock and State Street, expect portfolio companies to report in alignment with TCFD and other ESG frameworks, including disclosing GHG emissions. Despite this, only 36% are tracking emissions-related data, according to TCFD’s most recent status update on its three-year analysis of these firms. All ESG rating agencies and ESG frameworks use the Greenhouse Gas Protocol (GHG Protocol) as the global standard for corporate inventory and reporting of scope 1 and scope 2 emissions, and it encourages companies to track and report scope 3 emissions.

So, what exactly are scope 1, 2, and 3 emissions? For easy-to-understand descriptions, click here.

News Bites

- ESG Governance: Board and Management Roles & Responsibilities

- China and U.S. promise more climate cooperation at COP26 talks

- Largest firms deem climate change a financial risk

- Allbirds dropped ‘sustainable’ claim from IPO after SEC objection

- ICC proposes first global rules on sustainable trade finance

- Volvo sets carbon price to assess sustainability of new projects

- COP26: Climate campaigners to target banks after Shell court ruling