ESG Hot Topics in 2022 (Newsletter 1/7/22)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Company Spotlight

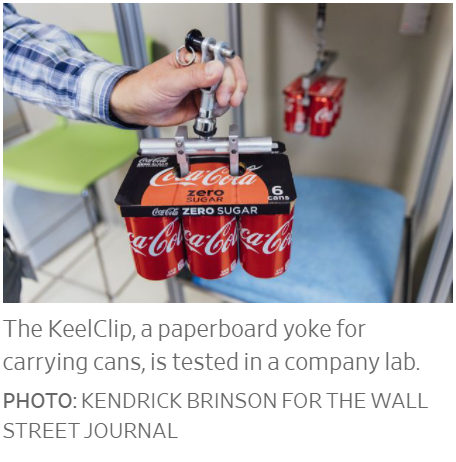

Graphic Packaging’s Bet on Paper

Graphic Packaging is trying to make packaging greener by reducing plastic and alternatively using paper. Why? Graphic Packaging’s customers, consumer goods companies, are increasingly focused on diminishing the environmental impact caused by their supply chains. Pressures from stakeholders like investors and customers are mounting. While potentially more expensive, paper packaging versus plastic packaging can lead to lower emissions and less plastic waste.

JetBlue Launches Sustainability Program for Corporate Travel

JetBlue has announced its JetBlue Sustainable Travel Partners program, a host of new offerings enabling corporations to minimize their emissions from business travel and achieve their sustainability goals. Biogen, Deloitte, ICF, and Salesforce will be the first customers to use this new service. The program will allow corporate partners to:

- Reduce business travel emissions by buying sustainable aviation fuel (SAF) certificates, which help cover the cost premium of SAF and signal greater demand for SAF in the market

- Ensure carbon offsetting of all domestic flights

- Accurately track travel and emissions data on a granular level

- Consult with JetBlue representatives on business travel emissions reduction strategies

Walmart’s Open Discussion on Climate Change

In a recent ESG webinar hosted by Chief Sustainability Officer Kathleen McLaughlin, Walmart elaborated on its two-pronged approach to climate change: emissions abatement and climate resiliency. The first facet is focused on minimizing Walmart’s climate-related impacts by using science-based targets to reduce its Scope 1 & 2 emissions to zero by 2040, and by aiding suppliers and customers in reducing their own emissions.

The second facet is focused on preparing for climate-related risks such as damage to facilities from severe weather and disruptions to supply chains from reduced product quality and yield, especially in coffee and cotton. Walmart reported progress towards these goals, achieving a reduction in carbon emissions of 17.4% from 2015-2020 and 36% renewable energy use in 2020. Walmart also reported initiatives to protect its operations from the impacts of climate change, including evaluating the resiliency of its real estate and rerouting supply chains away from vulnerable areas. For its efforts to mitigate climate change, Walmart received a CDP Climate Change score of A-.

CIOs See Sustainability as Ripe for Technological Disruption

Nearly half of CIOs in a recent IBM survey cited sustainability as the biggest opportunity for disruption by technology. Some top-of-mind goals include decreasing paper use, reducing energy use at data centers—which account for roughly 1% of global emissions—and increasing use of cloud computing to improve energy efficiency through economies of scale. In addition, prominent cloud computing providers have committed to the use of renewable energy, allowing customers to indirectly use these sources of energy by offloading processing to the cloud.

Investor Updates

NYSTRS Creates Climate Action Plan

The New York State Teachers’ Retirement System (NYSTRS) Retirement Board recently adopted a climate change action plan that directs the system to:

- Divest from directly held public equity thermal coal holdings with over 10% of revenue coming from thermal coal-related activities;

- Establish a restricted list that prohibits further investment in specific carbon-intensive fossil fuel holdings; and

- Engage with companies on the restricted list to encourage the establishment of climate transition plans.

According to NYSTRS, this will help mitigate climate change risks to its portfolio by reducing exposure to the fossil fuel industry. The plan aims to ensure NYSTRS’ long-term financial sustainability and enable NYSTRS to be part of a “climate-conscious future.”

Domini Impact Investments’ Strategy

In an interview with Barron’s, Amy Domini, founder of Domini Impact Investments, discusses her firm’s strategy. She previously launched the Domini 400 Social Index, which is now owned by MSCI. In line with most investors, she yearns for better access to nonfinancial data and hopes for more standardization. Although, with the nonfinancial information available, she says you can learn a lot about management teams. The Domini Impact Equity fund is primarily driven by the environmental and social profiles of companies. The fund is modeled by the S&P 500, has a thematic sleeve, and excludes sin stocks and traditional energy stocks. Her team puts companies into 5 categories ranging from companies providing a social benefit to companies that are “good enough” from an ESG perspective. The ESG analysts spend 20% of their time engaging with companies and then identify companies to include in the fund twice a year.

ESG Ratings & Reporting

HBR’s 10 Questions Every Company Should Answer

Harvard Business Review (HBR) compiled the top 10 questions companies should be considering when developing their ESG strategy. Here are the most commonly asked questions from the list:

- Is ESG undermining your competitiveness?

- Strong ESG performance is viewed as both a competitive advantage and also a risk for missing out on growth opportunities if not executed properly. The more prominent risk is not focusing enough on ESG, potentially falling behind in the market, and losing support from employees, customers, and investors.

- How do you vet company performance of ESG?

- Currently, there are no consistent standards or metrics required for companies and no mandate for third-party verification of ESG reporting. However, at this time, independent external auditing is the highest level of compliance a company can attach to ESG reports.

- How should companies navigate the ever-changing landscape of ESG?

- Business leaders should maintain ongoing communications with regulators and policymakers to keep tabs on how ESG regulations may play out. In the meantime, companies should compare performance across time, peers, and other industries.

Companies Feeling the Heat

Tesla Opens a Dealership in Xinjiang, Seen as a Controversial Move

Tesla has opened a new dealership in Xinjiang, a Chinese province mired in controversy over the detainment of hundreds of thousands of Muslim Uyghurs. The province is notorious for the use of forced labor and the cover up of what many deem to be cultural genocide. Human rights activists and politicians on both sides of the aisle have accused Tesla of ignoring atrocities in order to appease the Chinese government and gain a foothold in the world’s largest car market.

Featured Article: MSCI’s Top 10 Trends to Watch in 2022

Each year, MSCI releases a set of emerging topics companies and investors should have on their radar in the coming year. This year, there is an emphasis on climate change issues, which have become front and center around the world. Climate initiatives have become a priority for many major companies and this trend is not expected to go away. See the top 10 ESG trends here.

News Bites

- Larry Fink Wants to Save the World and Make Money Doing It

- New EU Rules Spark Fight Over What Is ‘Green’ Energy

- These 10 Retail Stocks Are Set for 2022’s Biggest Trends. Here’s Why.

- Aramark Rolls Out Cool Food Meals On Residential Dining Menus, Identifies 350 Lower Carbon Footprint Dishes

- That’s a wrap: French plastic packaging ban for fruit and veg begins

- Midwest Holding Announces Launch of S&P 500 ESG Index for the Fixed Annuity Space

- Expect ESG to Be a Market Driver in 2022