ESG Expectations from the World’s Largest Investor (Newsletter 1/21/22)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

BlackRock’s Letter to CEOs 2022: Stakeholder Capitalism

This week, BlackRock released its annual Letter to CEOs by Larry Fink. As the largest investor in the world, BlackRock’s influence on companies, the SEC, and other financial institutions – both because of its massive active base and its outspoken CEO – cannot be understated. In this year’s letter, Fink focused on the phrase stakeholder capitalism, which refers to the relationship between a company and its employees, customers, suppliers, and communities, and how it can drive long-term value for shareholders by aligning the priorities of all stakeholder groups. Three big topics that will impact companies’ ESG strategy include:

- TCFD reporting

- Increasing employee engagement and minimizing turnover

- Regularly communicating your ESG progress and engaging with a broader investor audience

Continue reading about the letter and how to proactively implement the key takeaways here.

Vanguard Signals the Importance of Board Diversity and Climate Risk

The release of Vanguard’s 2022 proxy voting guidelines has seen the passive fund manager expand its guidance on diversity and climate risk oversight. More specifically, Vanguard makes the following updates:

- Vanguard will generally vote against the nominating committee chair if the board has made insufficient progress related to its diversity, whereas in the past Vanguard had looked at this issue on a case-by-case basis.

- Vanguard expects boards to at least reflect diversity in terms of gender, ethnicity, and race and signals the importance of the following disclosures:

- Nominating committee statements on board diversity strategy, detailing expectations for year-over-year progress,

- Policies facilitating increased board diversity, and

- Current attributes of the board.

- Vanguard specifies that oversight failures include climate risk oversight and gives its criteria around whether a climate risk oversight failure merits action against the board, which includes the materiality of the risk, among other considerations.

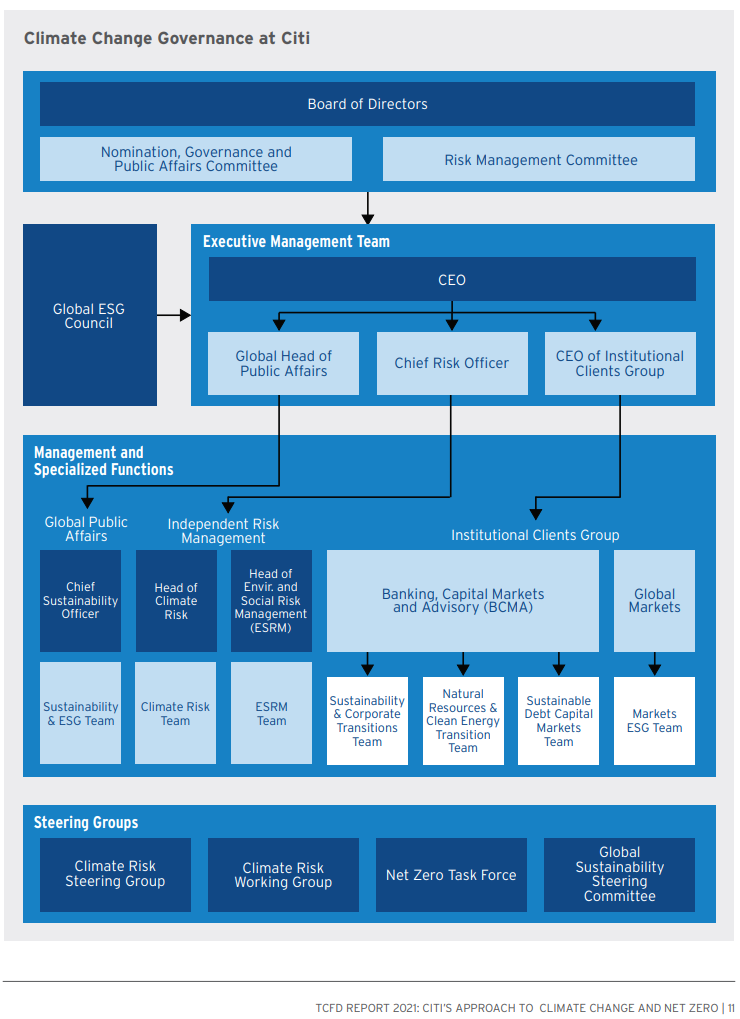

Citi Releases TCFD Report with 2030 Emissions Targets & 2050 Net Zero Commitment

Citigroup has released its 2021 TCFD report and a new net zero commitment. The report, which is supported by management and reviewed by the Board, includes an assessment of risks and opportunities by sector and short- and long-term emissions targets. To achieve net zero by 2050, Citi will engage with companies on decarbonization and reduce financed emissions across its investments. Notably, Citi will decrease financed emissions from the energy sector by 29% by 2030.

Further backing Citi’s commitments, a letter by CEO Jane Fraser describes the bank’s approach to net zero. Similar to BlackRock, Citi will not rely on divestment in fossil fuel intensive companies, and instead will engage with companies and encourage a transition to alternative resources. Citi also supports the TCFD framework.

Company Spotlight

Big Brands Call for Global Pact to Cut Plastic Production

Some of the world’s largest retailers and food and beverage companies are pushing for an agreement to cut global plastic production. The agreement comes ahead of a United Nations Environment Assembly conference to discuss solutions to the world’s growing plastic waste crisis. Cutting plastic production and switching to more sustainable packaging methods will be the basis of the agreement. Less than 10% of all plastic produced has been recycled, making reuse another key component of plastic waste reduction. Some of the 70 companies that support the agreement include Coca Cola, PepsiCo, Unilever, Nestle, and Walmart.

Exxon Mobil Gives in to Net Zero by 2050 Goal

Exxon Mobil has announced its goal of achieving net zero across its operations by 2050. While this commitment does not include scope 3 emissions, the emissions from the fuel Exxon sells, it is a notable turn in the company’s strategy and comes within a year of Exxon’s proxy fight with Engine No. 1, during which the supermajor lost three seats on its board. Exxon was the last of the major western oil companies to make such a commitment—Shell and BP did so in 2020 and Chevron in late 2021—and Exxon’s commitment is the only one lacking accountability for the end-use of its products.

ESG Ratings & Reporting

CDP Campaign Encourages Companies to Respond to Investor Requests

In 2021, 168 investors and financial institutions asked 1,317 companies to disclose CDP. Each year, CDP hosts a Non-Disclosure Campaign designed to increase engagement with companies that received a CDP disclosure request on behalf of investors but failed to respond. The 2021 campaign saw a 56% rise in the number of financial institutions signed up compared to the previous year. Of the companies engaged by the campaign, 25% completed one of the three questionnaires issued by CDP. The climate change questionnaire remained the most popular, but all three—including water and forests—had increased response rates. Signups for the 2022 campaign run from February to March and results will be published at the end of the year.

Credit Suisse’s Varying ESG Scores Prove Discrepancies in Ratings

The Wall Street Journal reports that Credit Suisse has received widely varying scores across ESG ratings agencies due to the different criteria used by each assessor. Credit Suisse’s management team has been involved in a number of recent controversies that have resulted in significant differences in governance scores depending on the rating methodology. Some agencies include controversies in scores directly, while others separate them from overall score, as they are often one-time issues. These discrepancies highlight the need for investors to understand the criteria that each ratings agency uses to gain context for overall scores and exemplify why investors use multiple ratings when evaluating companies.

Dow Jones Launches Sustainability Data Platform for Investors

Dow Jones has launched a new SASB-aligned ESG performance rating platform. The platform hosts data for over 6,000 companies scored across 26 sustainability categories. Scores are calculated using data disclosed by companies as well as news from outside sources. The goal of the platform is to inform investors on each company’s performance and to help financial institutions provide greater transparency regarding sustainability risks and integration of ESG in their investment process.

News Bites

- Franklin Templeton Appoints Anne Simpson as Global Head of Sustainability

- Invesco Expands its Canadian ETF Line-up with Eight New ESG ETFs

- SSGA & Vanguard Release Proxy Voting Strategies for ESG Issues

- Video: The Future of The ESG Craze

- Meijer Commits to 50 Percent Carbon Emission Reduction Goal by 2025