ESG Becomes Firms’ Top Strategic Priority in 2022 (Newsletter 2/18/22)

Sign up for The Infinite Minute to receive the top news impacting corporate ESG reporting.

Regulatory News

The Government Announces Actions to “Clean” the Industrial Sector

The Biden administration announced a series of actions to support clean manufacturing. The initiative covers lower-carbon production processes for steel and aluminum for EVs, wind turbines, and solar panels, along with “clean concrete”. A big part of the initiative is to expand the use of clean hydrogen in the industrial sector. Additionally, the federal government is launching a “Buy Clean Task Force” to support procurement of materials with lower emissions and pollutants. The fact sheet details further plans to support the advancement of greener technologies to promote the decarbonization of industrial activities.

Investor Updates

Morningstar Cuts 1,200 Funds from Its List of Sustainable Investments

In November 2021, Morningstar published a paper stating the European sustainable fund universe had expanded to over 6,000 ESG-focused funds, a 65% increase over the trailing 6 months. However, Morningstar revised that figure this week, removing 1,200 funds representing $1.4 trillion from the list. The research firm eliminated these funds for ambiguous legal language and overstated claims on the integration of sustainability in their investment process. The revised AUM for sustainable funds in the Morningstar universe dropped to $2.03 trillion from $3.4 trillion following the adjustment.

Banks and Institutional Investors in the Hot Seat for Coal Financing

A report by climate NGOs Urgewald and Reclaim Finance details the funding that is keeping coal afloat. According to this report, international banks and institutional investors spent $1.5 trillion and $1.2 trillion, respectively, financing coal projects in the last three years. At the top of the naughty list in terms of coal funding were Mizuho Financial, Mitsubishi UFJ Financial, SMBC Group, Barclays, and Citigroup. Notably, all five of these banks are members of the Net Zero Banking Alliance, a group of banks committed to reaching net zero greenhouse gas emissions by 2050. The report also highlights BlackRock and Vanguard, which are both members of the Net Zero Asset Manager Initiative, as having an outsized role in funding coal. According to the report, BlackRock has more than $34 billion of investments in companies developing new coal plants.

Amundi U.S. Expands Lineup of Global Sustainable Equity Funds

Amundi’s U.S. arm is rebranding its main global equity fund from Pioneer Global Equity Fund to Pioneer Global Sustainable Equity Fund, highlighting its new ESG focus. The change was made because Amundi is “seeing growing investor interest in exposure to sustainable investments.” Amundi states that they integrate ESG into the investment process for all funds and that ESG integration will drive the long-term performance of their investments. The Pioneer Global Sustainable Equity Fund will prioritize companies with a “sustainable business model” defined as those with durable competitive and financial positions and that offer products and services through sound business practices and the responsible use of resources. The fund will also exclude companies from industries such as weapons manufacturing, tobacco, and coal mining.

Goldman Sachs Launches New Clean Energy ETF

Goldman Sachs launched its newest ESG fund, the Goldman Sachs Bloomberg Clean Energy Equity ETF. The fund will focus on equities from companies that invest in and produce renewable energy. The move comes as interest in sustainability is skyrocketing, but renewable energy stocks are falling—in 2021 the sector has lost over a third of its value. Goldman says these factors combine to make an attractive entry point for new investments in the space. The fund will help investors capitalize on an energy transition that will have “the scale of the industrial revolution and the speed of the digital revolution,” according to Katie Koch, a Partner at Goldman Sachs.

Proxy Season Briefing

Icahn Preps Proxy Fight at McDonald’s Over Treatment of Pigs

Activist investor Carl Icahn said he’s prepared to nominate directors at McDonald’s if the fast-food chain continues to use suppliers that house pregnant pigs in small crates, a practice he argues is inhumane. The issue dates back to 2012 when McDonald’s announced that it would require its U.S. pork suppliers to outline their plans to phase out the use of so-called sow gestation stalls by 2022. The changes were never made, however, leading Icahn to prepare for a proxy fight over the issue. Icahn says his proposed slate of board members is 90% complete and will move forward unless McDonald’s changes their animal rights practices immediately.

Fewer Shareholder Proposals to Be Excluded This Year

Back in November, the SEC overturned a few items that had previously aided companies in pushing down shareholder proposals. Companies’ arguments that certain issues are categorized as “micromanagement” and “transcending normal business activities” may no longer see the support from the SEC that the agency previously granted. It is likely that the SEC will accept fewer exclusionary requests, but this proxy season we will see to what extent. It already looks as though some companies are not contesting proposals that they would have fought in the past.

Company Spotlight

Coca-Cola Ties Some Executive Compensation to E&S Issues

This week, Coca-Cola’s Talent and Compensation Committee approved new performance measures for executives that include social and environmental goals. 10% of executives’ 2022 compensation will be tied to measures that promote employee diversity, equity, and inclusion. The other 90% of their annual incentives will be tied to traditional financial metrics.

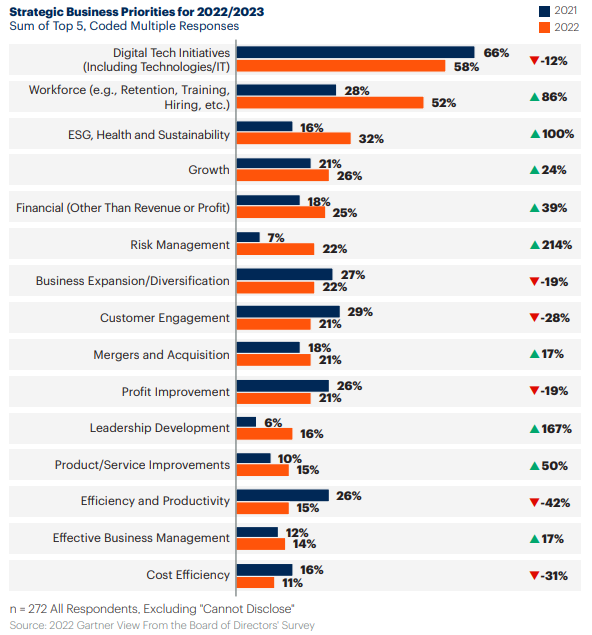

ESG Steps up to Become a Top Strategic Priority for 2022 and 2023

According to Gartner’s Business Quarterly for Q4 2021, ESG has jumped ahead of growth and financials for corporate directors’ top strategic business priorities for the next two years. Employee retention, training, and hiring has also risen from third to second place in the ranking and the top spot has been stolen yet again by digital technology initiatives, which continue to be a key focus area. Notably, both ESG and employee retention, training, and hiring have more or less doubled in terms of the percentage of board members prioritizing them as key strategic priorities for 2022 and 2023.

More to Know…

Gary Gensler drops a twitter thread on the SEC’s climate disclosures, specifically mentioning the 10-K.

The New York State Common Fund adds strict diversity rules for portfolio companies, already filing diversity-related shareholder proposals.

The ICCR releases its 2022 Proxy Resolutions and Voting Guide.

News Bites

- Texas sues Meta for collecting facial recognition data – CNN

- We Need Universal ESG Accounting Standards – Harvard Business Review

- Climate Disclosure Poses Thorny Questions for SEC as Rules Weighed

- BP CEO says oil and gas giant is a ‘greening company,’ refutes greenwashing accusations – CNBC

- Do ESG Funds Live Up to Their Marketing Promises? ESMA Takes Another Look – Bloomberg

- Pilot Company Diversifies Leadership Team as Part of 2022 Growth Strategy (prnewswire.com)

- Coca-Cola, Criticized for Plastic Pollution, Pledges 25% Reusable Packaging