BlackRock Gives Proxy Voting Power to Its Shareholders (Newsletter 10/8)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

BlackRock to Give Investors Proxy Voting Rights

BlackRock told its larger customers, including pension funds, that they will have the right to cast their own proxy votes beginning next year. Asset managers typically vote on behalf of shareholders, but with recent pressures from shareholders to vote certain ways on environmental and social matters, BlackRock has decided to give the voting power back to shareholders, allowing them to vote based on their own values. According to BlackRock, about 40% of its $4.8 trillion index-tracking equity assets will be eligible. The stewardship team at BlackRock will still vote on proxies for clients that choose to have the asset manager vote.

IRO Study Shows an Increase in Investors’ Focus on Carbon Neutrality

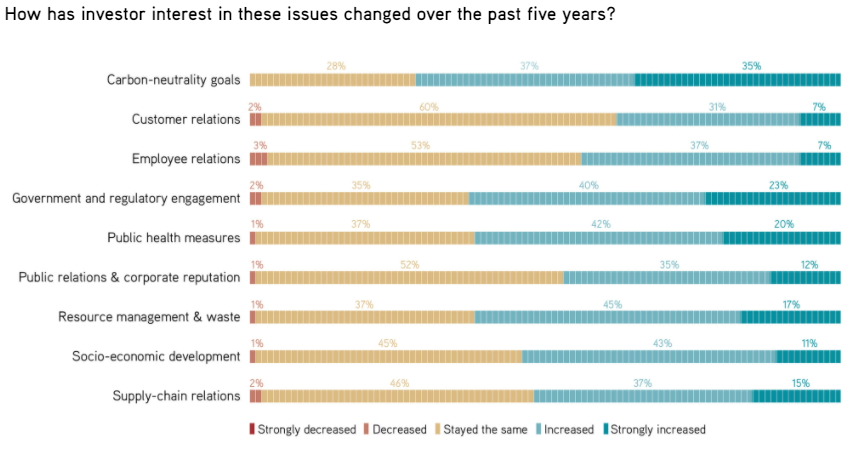

IR Magazine has released a study exploring investor interest in and company focus on 9 stakeholder issues, including carbon neutrality, employee relations, and government engagement, among others. The study contains responses from 441 IROs across the globe and noteworthy insights include:

- A majority of companies have upped their focus on all 9 stakeholder topics

- Employee relations is the most common stakeholder issue to be included in the annual report

- IROs believe investors are most worried about government and regulatory engagement

- In the past five years, investor interest has increased the most around carbon neutrality

Materiality’s Impact on Investment Decisions

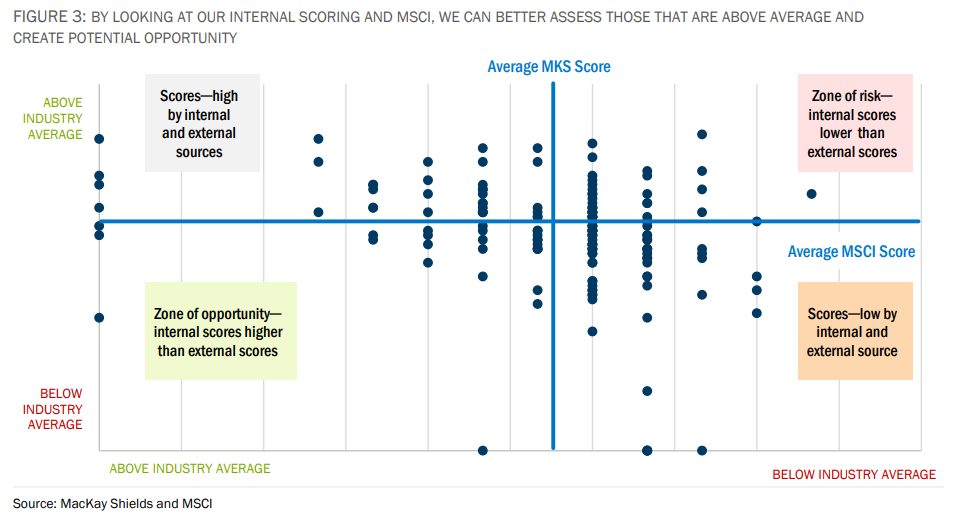

When looking at companies, MacKay Shields, a subsidiary of New York Life Management Holdings, highly considers material factors most relevant to a given industry, and how companies perform on the material issues compared to industry cohorts. It issues an internal score based on its fundamental research, and then focuses on the factors that the market is missing. Next, it compares its internal scores to external scores, such as MSCI. As shown in the image below, if the internal scores are above the external scores and it deems the company’s price as attractive, then it may increase its position in the company. Second, if the firm identifies a material issue that a company does not perform well on compared to peers, it will engage with the company on the topic. Further, if the company improves its performance related to that issue, it may increase its position in the company, especially if it deems the pricing is attractive.

Hedge Funds Cash in on Oil & Gas

As institutional investors undergo a shift toward more ESG-friendly investments and increasingly divest from oil and gas companies, hedge funds have seen this as an opportunity to buy up unwanted shares. According to Goldman Sach’s brokerage division, recent net buying of energy stocks by hedge funds has reached its highest level since February 2021 as hedge funds capitalize on elevated energy prices.

ESG Ratings & Reporting

ISS Global Survey Results

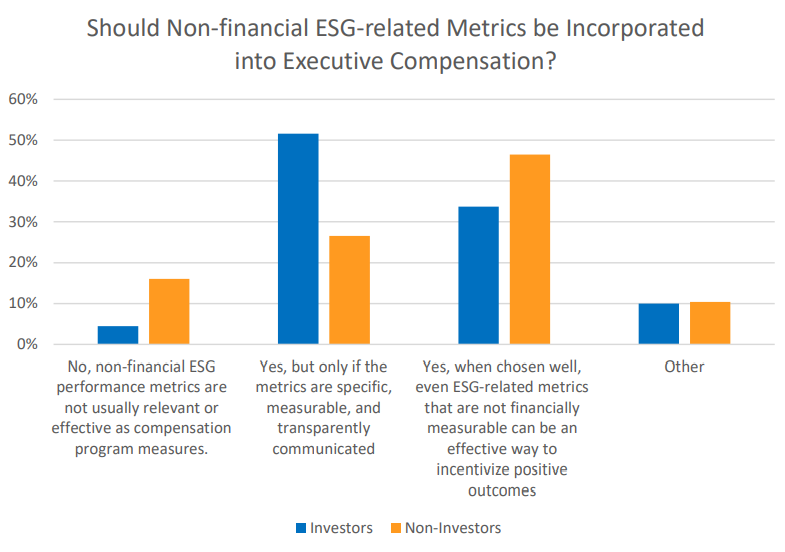

ISS released the results of its 2021 Global Benchmark Policy Survey and its 2021 Climate Survey, which include responses from around 160 investors and over 150 companies and corporate-affiliates. These surveys are conducted as part of ISS’ annual policy development process. In October, ISS will release draft policy updates and launch a public comment period. These two surveys cover topics ranging from ESG metrics in executive compensation and racial equity audits to climate-related disclosure and oversight. Key findings of the surveys include:

- 88% of investors and 75% of companies and corporate affiliates surveyed believe companies that are strong contributors to climate change should have detailed, clear climate disclosures, such as TCFD reporting.

- 72% of investors surveyed believe companies that are strong contributors to climate change should have declared a long-term ambition to align to the Paris Agreement goals.

- Over 80% of investors said that ESG-related metrics should be incorporated into executive compensation.

- Of these investors, 81% said that both short and long-term incentives could be appropriate places for ESG-related metrics, depending on the circumstances.

GRI Updates Standards & Introduces Sector Standards

On Tuesday, GRI released the first round of updates to its standards since the organization launched in 2016. It announced revised Universal Standards, added required human rights disclosures, and is issuing new sector-level standards, starting with oil & gas. About 40 sector standards will be released over the next year. GRI gave a timeline, requesting companies transition GRI disclosures to the updated standards by January of 2023.

MSCI Launches Platform for Investors to Manager Climate Risks & Goals

MSCI announced the release of MSCI Climate Lab, an application that allows investors to conduct enterprise-level monitoring and management of climate and financial risks their portfolios. Additionally, the application gives investors access to data across asset classes, MSCI’s temperature rise and target scorecard data, and the ability to assess and manage portfolios with the Paris Agreement and to forecast future climate data. Ultimately, the tool will allow investors to transition existing investment strategies to net zero.

Regulatory Updates

Fed Says Banks Need a Push on Managing Climate Risks

On Thursday, Lael Brainard, a Federal Reserve governor, said that the Fed is developing climate-related risk scenarios to build into bank stress tests as well as performing a climate risk analysis on the broader financial system to better understand the potential financial risks associated with climate change. Brainard worries climate change could have major consequences on economic activity.

Company Spotlight

Airline Industry Pushes for Net Zero CO2 by 2050

As part of the International Air Transport Association (Iata), airlines globally have agreed to work toward achieving net zero carbon emissions by 2050. This will be a considerable challenge, given that there is not currently a defined short-term solution. The industry road map depends on sustainable aviation fuel use for 65% of emission reductions, though this type of fuel does not currently have a large supply relative to demand. Given that the pathway is not yet defined, as mentioned by JetBlue CEO Robin Hayes, airlines will turn decreasing pollution into a competition, which could fuel the achievement of this goal sooner.

CFOs Increase Spending on Carbon Offsets

While facing pressures from investors, customers, and regulators, companies are spending more on carbon offsets. In the first eight months of 2021, companies spent over $107 million on carbon offsets compared to $72 million in 2020. The increased spend is in an effort to meet sustainability targets and improve appeal to stakeholders. For example, ServiceNow is using carbon offsets to achieve net zero by 2030 targets, while AAR Corp. will offer carbon offsets to customers purchasing certain used engine parts.

GM to Double Revenue by 2030 with EVs

General Motors announced on Wednesday that it plans to more than double revenue by 2030 and increase margins, boosted by new battery-electric car models and auto services. BrightDrop, a new GM business, is building a connected and electrified ecosystem, which launched an electric van and will add a smaller sized electric vehicle in 2023. The auto company has made the push for an electric future the core of its go-forward strategy.

Nucor Introduces Net Zero Steel Products

Nucor has announced the launch of Econiq, the company’s net zero carbon steel product line, with General Motors serving as the first Econiq customer, with a start date of Q1 2022. Econiq will be net zero across Scope 1 and 2 emissions, with the product being made with 100% renewable energy and Scope 1 emissions being eliminated through carbon offsets.

Mars Sets SBTi Goals and Links Executive Pay to Emissions Reduction

Mars has committed to net zero GHG emissions across its value chain by 2050 and to reach its goal will:

- Reduce absolute emissions across the company’s whole GHG footprint, including all scope 3 emissions

- Eliminate deforestation in the company’s supply chain

- Tie executive compensation to GHG value chain emission reductions

- Urge 20,000+ suppliers in its value chain to commit to meaningful targets

News Bites

- VanEck launches new ESG fund MOTE

- Poor ESG Standards Hold Back Funds’ Ability to Do Good

- AllBirds Walks Back ‘Sustainable IPO’ Claims

- What will the transition to the new economy mean for investors?

- SEC Continues to Drive ESG — Climate Change Disclosure Takes the Wheel

- Sweden’s AB Volvo wins its largest electric truck order so far