Biden’s Roadmap to Address Climate Change & the Sectors Most Affected (Newsletter 10/15)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Regulatory News

Biden Proposes Roadmap to Address Climate Change

This morning, the White House released a report outlining a roadmap to build resiliency against climate change impacts. Within the report, the administration touches on its goals to force financial firms and insurance companies to address climate change risks, support the SEC’s upcoming ruling on mandating climate disclosures from public companies, and to reverse the Trump-era ruling which would now allow for ESG standards to be included in U.S. workers’ retirement savings plans. The report also revealed an agenda to adjust federal procurement regulations to review greenhouse gas (GHG) emissions when considering bids, look at climate-related financial risks within federal budgeting, lending, and underwriting, and to build more resilient infrastructure.

SEC Looks Into How Advisors Market ESG Investing

The SEC is looking into how advisory firms advertise ESG investment strategies. Kristin Snyder, deputy director of the SEC’s Divisions of Examination, noted the staff is monitoring how advisors are stating investment strategies categorized as impact, socially responsible, or ESG-conscious and what risk factors or values they use. She says the SEC will look at compliance programs, portfolio management, and marketing and advertising.

Regulatory News

TCFD Releases Guidance for Reporting

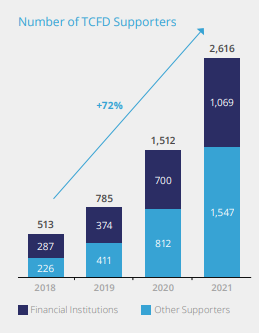

TCFD released its 2021 Status Report, sharing that the number of companies disclosing in alignment with TCFD jumped 9% in 2020, hitting over 50% of companies reviewed, or almost 1,700 companies globally. Further, the support for the standards has jumped to 1,069 financial institutions. The growth in support for TCFD was driven by regulators, endorsement from investors, and reporting recommendations or requirements in select countries. Additional insights from the report include:

- Materials and Buildings companies lead on TCFD disclosures with an average level of disclosure across the 11 recommended disclosures at 38% in 2020 for the sector.

- The Insurance industry increased disclosures, and leads all groups in risk management disclosures by at least 15 percentage points.

- The governance recommendation is addressed the least by companies.

TCFD also released new guidance on how to apply the recommendations as companies transition to a net zero economy. The updates highlight 7 categories of metrics for assessing financial impact – Scope 1, 2, and 3 emissions, metrics on climate-related transition and physical risks and opportunities, capital deployment, internal carbon price, and renumeration. Additionally, the Guidance on Metrics, Targets, and Transition Plans released is directed to help those that prepare financial statements to clearly show the financial impacts affecting investments, lending, and underwriting activities and measure progress on net zero commitments. For more information, see the 2021 TCFD Implementation Recommendations.

Glass Lewis Releases 2021 Proxy Season Review

Glass Lewis‘ latest U.S. Proxy Season Review highlights key ESG trends and statistics. The disruptions caused since early 2020 are still impacting how investors vote during annual general meetings, from increased scrutiny on executive compensation in a scenario of a shortage of workers, to a growing concern by shareholders regarding the health and safety of employees. The following are the key takeaways from the report:

- Board Elections: 2021 saw a 25% increase in directors failing to get majority shareholder approval in the U.S. The main drivers of votes against directors were compensation-related concerns, especially pay and performance misalignment, and overboarding.

- Executive Compensation: The number of Say-on-Pay proposals failing to get majority shareholder approval doubled among S&P 500 companies. Covid-19 increased shareholder scrutiny of CEO pay, due to massive disruptions caused in the labor market. The main drivers of shareholder opposition to executive compensation were remuneration not tied to performance metrics, discretionary payments, and failure to respond to shareholders’ previously raised concerns on pay.

- Diversity: 74% of S&P 500 companies disclosed the percentage of ethnic/gender diverse members on their boards, compared to 29% in 2020. 25% of seats on boards of Russell 3000 companies are now occupied by women.

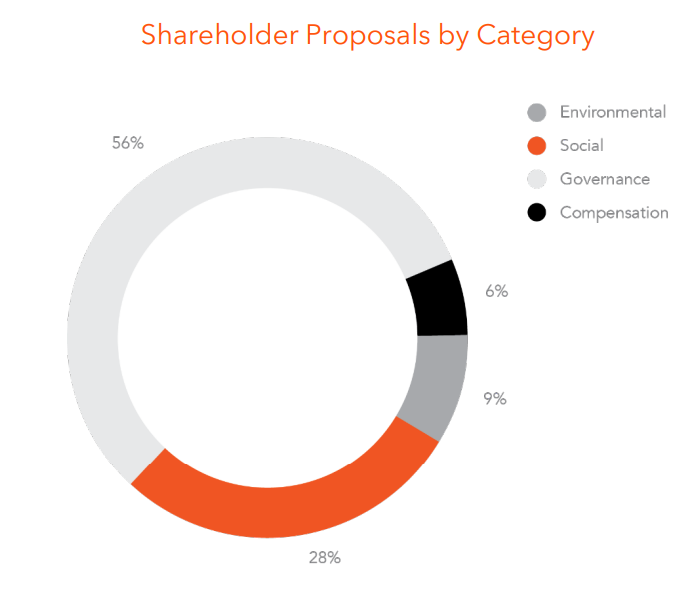

- Shareholder Proposals: 28% of shareholder proposals in 2021 were social-related, which was strikingly higher than compensation proposals at 6%. In total, 37% of shareholder proposals in 2021 were related to environmental and social topics compared to 62% related to governance topics. This shows a significant shift in the rise of E&S shareholder proposals.

The Critical Aspects of Net Zero Targets

In an interview with the WSJ, Taylor Francis, co-founder of Watershed Technology Inc. – a software provider that helps companies develop a climate program to reduce their carbon footprint, discussed setting net zero goals. Similar to a recent article by the Financial Times, Francis pointed to the CEO as responsible for achieving those goals, which hinges on whether or not the leader feels like his or her job is on the line if the necessary progress is not made during his or her term. He mentions that a net zero goal by 2030 is much sooner than it sounds to drastically cut emissions. While the climate commitments are heading in the right direction, Francis emphasizes the important announcement should be how the company will get to net zero.

Investor Updates

Aegon Expands Its Responsible Investment Team

Aegon Asset Management announced three new hires on its responsible investment team led by Brunno Maradei, bringing the total to 17 specialists.

- Andy Woods, responsible investment manager, will take on voting activities across Aegon’s portfolio.

- Curtis Zappala, responsible investment associate, will focus on ESG integration and support the firm’s fixed income platform.

- Jamie McAloon, responsible investment associate, will support equities and multi-asset platforms, sustainable products, and evaluate current and potential holdings.

Investors Call on G20 Leaders to Support Mobilization of Capital for Climate

As the COP26 Climate Summit creeps closer, Glasgow Financial Alliance for Net Zero (GFANZ), a climate-focused alliance representing over 295 investment firms with over 90 trillion dollars in assets, has published The GFANZ Call to Action, asking G20 leaders to implement a set of policies which will aid in mobilizing capital to address climate change. The GFANZ Call to Action challenges policymakers to:

- Set net zero targets for 2050 or earlier that are economy-wide

- Green the international and multilateral financial structure

- Agree to price carbon emissions’ externalities

- Develop incentives that aid communities, individuals, and companies in going green as part of pandemic recovery

Hedge Fund Manager Pushes Regulators to Make Climate Reforms

Chris Hohn, co-founder of The Children’s Investment Fund Foundation and a key player in Say on Climate initiatives, has been speaking out against the banking industry for financing of fossil fuel projects as well as regulators for enabling climate risk to occur across the financial system. In an effort to step up his campaign, Hohn sent letters proposing reforms to the U.S. Financial Stability Oversight Council, the Bank of England, and the European Central Bank, among others. His proposals would require that lenders disclose emissions related to their underwriting businesses and loan books and create emissions reduction plans that are five years out.

Company Spotlight

JetBlue Advances ESG Strategy with Impressive TCFD-Based Disclosures

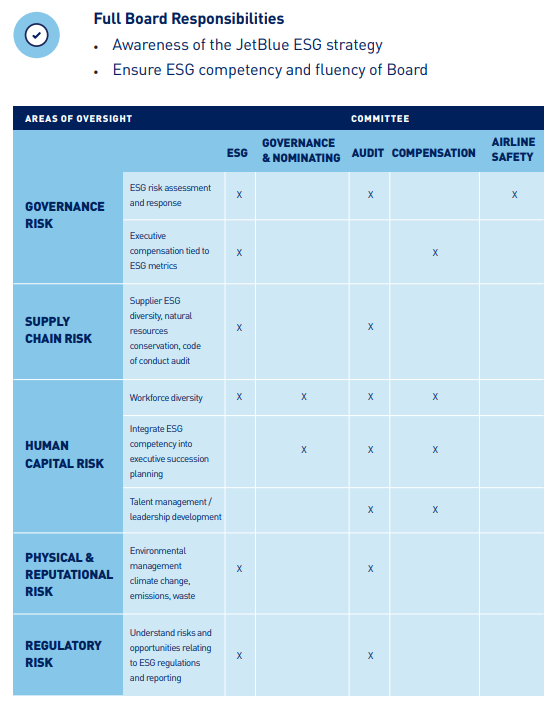

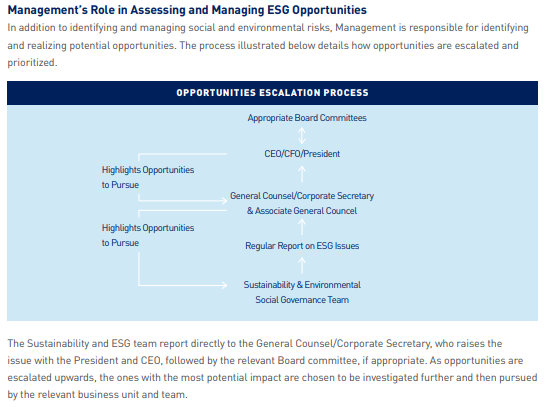

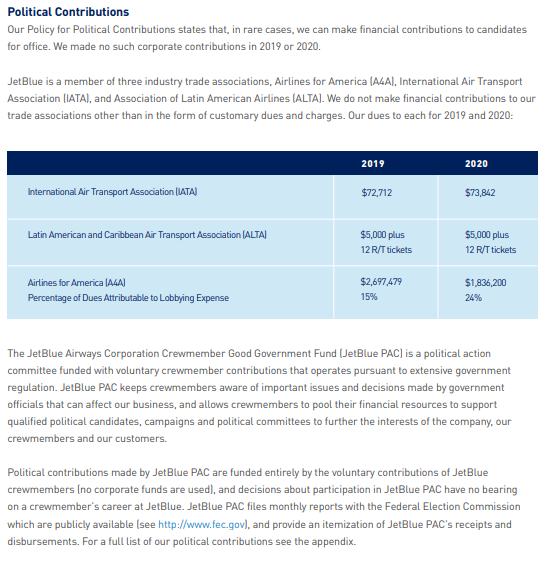

JetBlue’s 2019-2020 ESG Report, released this week, integrates TCFD and SASB recommendations across all ESG areas, going above and beyond what TCFD, a climate-focused disclosure framework asks for. The forward-thinking nature of this report make the company’s disclosures something public companies across diverse industries could learn from. Highlights of this report include an in-depth discussion of the Board’s oversight of ESG, including mapping which committees have responsibility for the various risks;

An outline of the process for assessing ESG opportunities and management’s role; and

A clear description of JetBlue’s advocacy efforts and contributions.

Featured Article: ESG Takes a Village: Here’s Who Should Be a Part of It

ESG is, in a word, big. On one dimension, the topics and issues that fall under this umbrella easily range in the hundreds. But more importantly, the impact of these issues is vast. How well you address them affects everything from consumer sentiment to employee relations, to your success attracting and retaining investors, and, ultimately, to your ability to operate your company sustainably long-term. While somebody needs to lead the charge on ESG for your organization – and the head of IR is probably the best person for the job – he or she can’t, nor should, do the work alone.

To learn about who should be on your ESG steering committee and how the team should set priorities, continue reading here.

News Bites

- BI tracker navigates clean-energy bubble as theme ETFs rebalance

- ESG 2.0 Is in the Making

- The Stock Market’s CO2 Footprint Is Much Bigger Than Feared

- Aviva, Tesco Want U.K. to Mandate Corporate Net-Zero Plans

- Carbon Capture and Storage Gathers Momentum in Response to Rising Climate Ambition

- Morningstar Investment Management and PAi Announce First ESG Pooled Employer Plan

- Prince Harry, Meghan Join ESG Boom as ‘Impact Partners’ in Fund