Berkshire Hathaway Immune to ESG? Think Again… (Newsletter 8/13)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

UN Climate Report Increases Urgency for Green Investment Funds

On Monday, August 9, the United Nations released a new climate report that signaled major alarms regarding current climate change trends. The report indicated that even drastic carbon emissions reductions are unlikely to prevent the global climate from reaching potentially catastrophic levels. This increases an already significant need for green investment funds, which allow investors to pour money into companies that are, in theory, making the right business decisions for the sake of the environment.

U.S. Institutions Increase Commitment to ESG

A report from Coalition Greenwich finds that 72% of asset owners have incorporated sustainability into their investment process—up from 52% in 2016. Turning to the future, more than 80% expect to have made the adoption of sustainability criteria by 2026. Coalition Greenwich’s Head of Client Relationships, Davis Walmsley, points to stakeholders as being the most significant driving force behind this shift toward sustainability. “Going forward…asset owners and their managers will come under mounting pressure from both internal and external stakeholders to document the positive impact of their investments,” Walmsley said.

How Sustainable Are Sovereign Wealth Funds?

Because sovereign wealth funds (SWFs) are among the longest holders in the investment world, many expect them to be leaders in ESG and climate-related investing. Yet, SWFs have invested more than three times the assets under management into oil and gas than they have into renewable energy since 2015. One significant reason for this is a sizable portion of SWFs are based in the middle east, which is also home to the world’s most oil-dependent economies. Sustainable investing advocates look to SWFs to set a new standard with regard to green investing, in hopes that they will clean up their portfolios and prioritize environmentalism.

ESG Ratings & Reporting

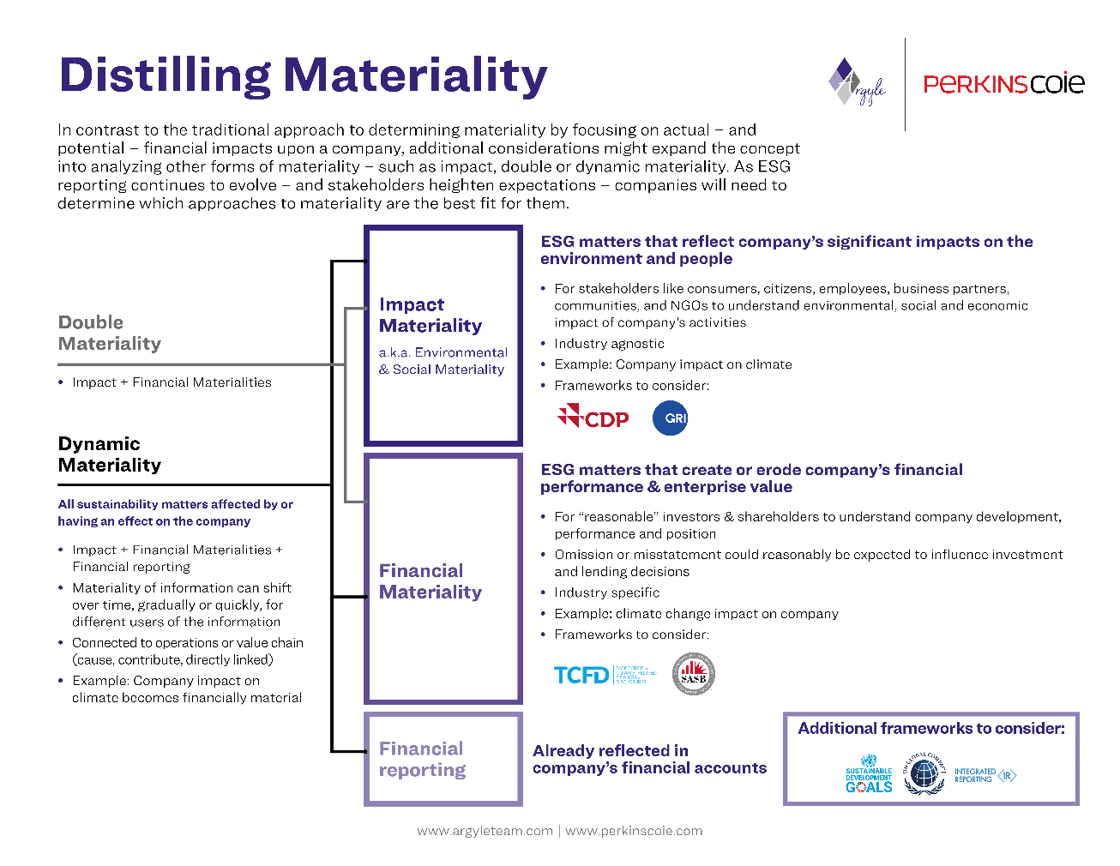

You Asked for It! An ESG Materiality GraphicIn a recent webcast hosted by Perkins Coie, an audience member asked for a graphic to help explain the terminology surrounding “materiality” in relation to ESG issues. Perkins Coie partnered with Argyle to create the following graphic.

Company Spotlight

ESG Disclosure is a Must – Berkshire Hathaway as a Case Study

Berkshire Hathaway‘s impressive track record of consistently delivering strong financial performance made it a model of how to run a public company in the 20th century. Yet, the rise of ESG and a shift toward stakeholder capitalism has, by some standards, seen Berkshire failing to adapt. In particular, Buffet has attracted criticism for his statement that personal belief in climate change does not oblige management to make decisions based on shareholder apprehensions around climate change. Ultimately, the main challenge Berkshire will need to confront going forward is not necessarily a need for greater ESG action but rather greater transparency about its current plans and actions.

A New Microsoft Solar Project Shows How Climate and Racial Equity are Getting Connected

In July, Microsoft announced a solar energy partnership with Volt Energy, a black-owned solar energy development firm. This deal, which is part of Microsoft’s pledge to use 100% renewable energy by 2025, is unique in two ways. First, it is Microsoft’s first utility-scale solar power agreement with a black-owned company, but more importantly, the contract pledges to deploy a portion of profits to develop renewable energy in underserved communities. Microsoft has repeatedly demonstrated an interest and willingness to do what it takes to remain at the forefront of environmental sustainability. With this deal, it begins incorporating critical social elements into its sustainability résumé as well.

Entergy Helps Seed Success One Tree at a Time

Entergy, an integrated energy utility company based in New Orleans, has been committed to supporting local communities for many years. And in 2015, it began a partnership with NOLA Tree Project to help restore an estimated 100,000 trees that were lost due to Hurricane Katrina in 2005. Recently, the two organizations planted their 60,000th tree, marking a significant milestone toward the long-term goal. Entergy has also contributed more than $10 million in economic impact to the city of New Orleans through volunteerism since 2006. Collectively, these efforts are driving positive environmental impacts and fostering support for local communities in a city that is still rebuilding nearly 20 years later.

Regulatory Updates

SEC Approves NASDAQ’s Proposed Diversity Rule Changes

The SEC has approved NASDAQ’s Board Diversity Proposal, which was filed in December 2020. These rules require NASDAQ-listed companies to publicly disclose consistent diversity statistics for their board of directors and to have at least two diverse directors. More specifically, the mandate calls for one director who self-identifies as female and another who self-identifies as being from an underrepresented minority group or LGBTQ. Companies that do not have at least two diverse directors will be asked to explain why they do not meet this minimum in a formal statement to Nasdaq.

Featured Article: It’s Official: New Climate Risk Disclosure Rules Are Coming From the SEC

The U.S. has largely lagged behind European regulators when it comes to detailed mandatory climate change reporting. But a bevy of recent activity indicates that the U.S. is quickly making up ground. Last week, SEC Chairman Gary Gensler drew a clear line in the sand, reaffirming his commitment to the issue and noting in public remarks that SEC staff has been asked to develop a mandatory climate risk disclosure proposed rule by year end.

Most notably, Chairman Gensler signaled that the forthcoming climate disclosure regime should be inspired by—but separate from—the Task Force on Climate-related Financial Disclosures (TCFD) reporting framework. Based on his comments, we anticipate that the SEC will build upon its 2010 guidance, which broadly outlined ways in which climate change may trigger disclosure obligations, and soon require specific qualitative and quantitative disclosures to support investment decisions, ultimately giving both companies and investors “clear rules of the road.”

Click here to continue reading and learn the three keys to being prepared for the SEC’s impending rules related to climate risk disclosure.

News Bites

- ESG Discussions on the Rise at Corporate Events

- Do ESG Stocks Outperform?

- Proxy Season Findings: Increasing Investor Support for E&S Proposals and Greater Issuer ESG Disclosure

- IPCC Calls for Greater Emissions Reductions

- Sustainability-linked Bonds Help Put ESG Into Practice

- Greentech is On the Rise and Crowdfunding Platform Indiegogo is Leading the Charge