86% of Investors Say Companies Exaggerate ESG (Newsletter 11/19)

Sign up for The Infinite Minute and receive a quick recap of the week’s ESG news highlights every Friday.

Investor Updates

Emphasis on the E

ESG-denoted funds that focus on the environment are wildly more popular than those centered on social or governance issues. According to Morningstar, funds with the attributes “low carbon/fossil-fuel-free,” and “environmental” had inflows of $28.33 billion and $13.53 billion, respectively, from January through October, as opposed to funds with the attributes “community development,” “other impact themes,” and “gender and diversity,” which attracted $7.53 billion, $5.99 billion, and $5.12 billion, respectively, within the same 10 months. This divide is in part because there are more environment-focused funds to choose from, but also because social and governance themes are harder to align portfolios with. Social topics, such as diversity, are attracting more attention and dollars from investors, while good governance remains the most difficult ESG theme to invest around.

95% of Insurers Believe Climate Risk Is Investment Risk

In a survey conducted by BlackRock, 95% of insurance executives agreed that climate risk will have a significant impact on portfolio construction over the next two years. Half of respondents in the study indicated their reason for reallocating existing assets to sustainable investments is the ability of these investments to generate better risk adjusted performance. One third indicated that environmental risk is now considered a serious threat to their firm’s investment strategy. Digitization is playing an important role in combating these threats – over 40% of respondents confirmed they are looking to increase investment in technology that integrates climate data into risk calculations, a clear sign that analytics for “transition-ready” investments are a priority for insurers over the years ahead.

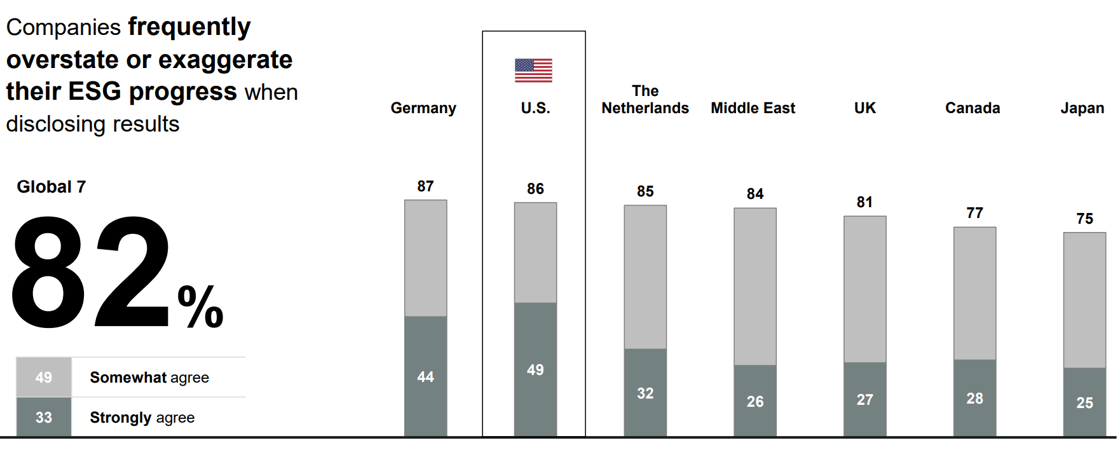

Investors Don’t Trust ESG Commitments

According to the 2021 Edelman Trust Barometer Survey, investors are not sold on companies’ ESG commitments. As investors have pushed companies to be more transparent on ESG initiatives, investors question the reporting. The following responses are based on U.S. investors surveyed.

- 86% of investors believe companies exaggerate their ESG progress in reporting

- 62% said they do not believe companies will meet their ESG commitments

- 94% of investors said they expect companies to share net zero emissions plans and 93% said companies with net zero plans deserve premiums, however, 92% of investors doubt companies will meet the net zero targets

- Over 75% of investors said they intend to engage with companies on environmental issues, and 81% plan to engage on board structure

S&P DJI Launches Equal Weight Index

The S&P Dow Jones Indices launched the S&P 500 Equal Weight Leaders Select Index, which allocates a fixed weight of 0.2% to each company within the ESG-focused index. The index starts with the constituents of the S&P 500 index and excludes companies in certain businesses, for instance, oil & gas and gambling, and screens out companies that are within the bottom 25% of S&P DJI ESG scores by GICS code, have poor UN Global Compact scores, or have major ESG controversies. The index ends up with 23% higher exposure to companies that report quantitative environmental indicators, 13% higher exposure to companies with emissions reductions targets and initiatives, and 21% higher exposure to companies that disclose female representation across the enterprise. Following the announcement, Invesco launched the Invesco S&P 500® Equal Weight ETF linked to this index.

Regulatory News

Biden Signs $1.2tn Bipartisan Infrastructure Investment and Jobs Act

President Joe Biden signed his $1.2 trillion Infrastructure Investment and Jobs Act into law. The goal of the new legislation is to revitalize the transportation of people, energy, and data in the U.S., as well as prepare the country for a changing climate. The majority of the bill’s funding will go towards the renewal of roads, bridges, rail lines, and airports, while roughly one fifth is dedicated to overhauling water and energy infrastructure and combatting impacts from climate change. This includes measures to build high efficiency powerlines, develop new sources of clean energy, reclaim polluted land, mitigate floods and fires, and purchase electric buses and charging stations.

New COP26 Rules Aim to Establish International Carbon Credit Market

New rules from the UN climate summit outline a framework for global carbon credit trading. The credits, which can be bought and sold, represent one ton of carbon that has been removed from the atmosphere. This market is expected create a boom in projects that generate credits, such as tree planting and carbon capture systems, which are bought by those looking to compensate for emissions. The new framework will be comprised of two parts: a centralized system open to the public and private sectors and a separate bilateral system that will allow countries to trade credits that they can use to help meet their decarbonization targets.

ESG Ratings & Reporting

Glass Lewis Releases 2022 Proxy Voting Policy Updates

Proxy Advisor Glass Lewis released its 2022 Policy Guidelines and 2022 Policy Guidelines on ESG Initiatives. The updates this year focus on trending topics including board diversity, a summary of the highlights names the top items to know below:

- Recommend voting against the nominating committee chair if the board has less than two gender diverse directors or voting against the committee if the board has zero gender diverse directors, adjusted from “female directors.” In 2023 this will change to a percentage-based approach, with the recommendation to vote against the nominating committee chair if the board is not at least 30% gender diverse for Russell 3000 companies.

- Recommend voting against the governance committee chair at S&P 500 companies that do not provide sufficient diversity disclosures and/or do not give board-level oversight of environmental and social issues.

- If E&S metrics are used in the incentive program, companies are expected to issue strong disclosures on the metrics used, performance targets, and how payout opportunities are determined.

- Continue to generally oppose shareholder Say-on-Climate proposals and evaluate management say-on-climate proposals on a case-by-case basis.

ESG Reporting Is Led by Compliance Teams

Navex surveyed executives across the U.S. and Europe and found that 89% of respondents include ESG reporting as part of their organization’s compliance program. This highlights the incredible speed at which ESG reporting is being adopted. However, the survey also found significant variability in ESG reporting across frameworks and countries, with international companies’ alignments evenly distributed between GRI, SASB, TCFD, and CDP frameworks. In the U.S., there is a clear frontrunner, SASB, with over 60% of respondents indicating alignment.

Company Spotlight

Companies Push Suppliers to Disclose Emissions Data, or Else…

Corporate pledges to reduce emissions often omit one of the largest sources of pollution – their supply chain. This is because companies have limited visibility into their Scope 3 emissions, making them difficult to track. However, U.S. securities regulators are expected to mandate disclosure of climate-related information to investors soon, making emissions monitoring compulsory. In order to meet this mandate, as well as self-prescribed net zero commitments, companies are demanding more accountability from suppliers regarding emissions. Many companies are asking suppliers to reduce their carbon footprint and improve non-financial disclosure, with some ultimately threatening to order elsewhere if progress is not made.

Are Amazon’s Bets on Electrification too Forward Looking?

Amazon hopes to have 10,000 of Rivian’s electric vans on the road as early as next year, and 100,000 by 2030. Those goals are largely at odds with Amazon’s current reality, considering Rivian has yet to make a commercially viable vehicle. Amazon has also poured money into electric plane startups with the hope that these will someday reduce emissions from Amazon’s fleet of planes. These investments are a step in the right direction, but are also largely meaningless until electric vehicles are actively integrated into Amazon’s logistics network.

Featured Article: Time to Commit: Set Science-Based Emissions Reduction and Lead the Way to in Combatting Climate Change

Recent global events such as the COP26 UN Climate Change Conference have made it crystal clear that the time for talking about climate change solutions has passed, and the time for action is right now. Climate change has been one of the biggest topics in ESG for some time and investors are pushing the agenda, demanding that companies start measuring and reducing their greenhouse gas (GHG) emissions, and sooner than later.

Science Based Targets initiative (SBTi) recently released a new global standard for corporate net-zero target setting, creating a credible and achievable way to set carbon reduction goals. To see what the standard is and what it means for you, click here to read on.

News Bites

- Advisers begin excluding specific sectors in

- New York Regulator DFS Wants Insurers to Disclose Climate Risks

- Net inflows into UBS ETFs this year have been only to ESG funds

- Clients Embed ESG Principles into Collateral Management Leveraging BNY Mellon ESG Data Analytics

- American Express Releases its Inaugural Diversity, Equity, and Inclusion Report